[See update note at the very end of this post which means that some parts of this post – re 24/25 spending – need correcting and reframing]

In yesterday’s publish I attempted to current the Reserve Financial institution Funding Settlement for 2025-30, as authorized by the Minister of Finance and the Financial institution’s Board, within the context of the earlier settlement, and the variation to that settlement signed as much as by Grant Robertson a couple of weeks earlier than the final election (which vastly elevated the quantity obtainable for working expenditure). In opposition to that benchmark, yesterday’s settlement didn’t appear to show a lot restraint in any respect, even on the headline figures.

The Minister of Finance had sought to make a lot of (a) how a lot decrease the agreed numbers have been than the primary bid made by the Financial institution final September (a complete of $1.03bn over 5 years for each capital and working expenditure – capex being solely $50m in complete), and b) relative to a quantity we had by no means seen earlier than, what she described because the Financial institution’s working bills price range for 2024/25 of $200m. This latter was the premise for the much-publicised 25% reduce declare.

I used to be a bit dismissive of that presentation, and what appeared largely to be spin (not like the RB’s personal press launch).

So I’m now going to attempt to step by all of it pretty painstakingly and extra slowly/rigorously than I did yesterday.

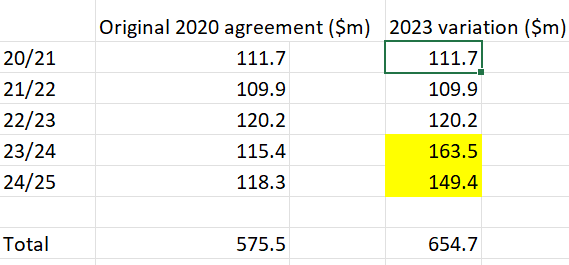

First, listed below are the working expenditure numbers for issues lined by the 2020 Funding Settlement, displaying each the unique settlement and the August 2023 variation.

There have been actually large will increase granted in that 2023 variation (way over, say, implied simply by the inflation shock). Be aware too that spending for 23/24 was allowed to be a lot increased than in 24/25. I’m fairly positive we by no means received a particular rationalization for that, nevertheless it most likely associated to some main new initiative.

By legislation, the funding agreements are required to specify most expenditure for every single 12 months (the Financial institution can’t simply decide and select, transferring cash from one 12 months to the textual content on a whim). Nevertheless, within the 2023 variation Grant Robertson explicitly allowed the Financial institution to deal with the final two years as a single mixture pool (apparently he had executed the identical for the final two years of the earlier settlement). In precept, I’ve no specific downside with that (though in fact most authorities businesses must come to Parliament and get a contemporary appropriation every year) nevertheless it opens up a lot of dangers.

And listed below are the outdated and new Funding Settlement opex numbers, expressed in fixed 2024/25 {dollars} (for every year I’ve used the extent of the CPI for the common of the related Dec and Mar quarters).

There are a variety of the way to have a look at that collection. A technique is to check spending in 29/30 with the common allowed (over the total 5 years) underneath the earlier Funding Settlement. These two numbers are nearly equivalent.

One other may be to check 29/30 with the authorized Funding Settlement stage for twenty-four/25. That suggests a reduce of about 6 per cent in actual phrases.

If we needed to be barely partisan about it (Willis can solely be held accountable for stuff that has occurred on her watch), authorized opex for 2029/30 will probably be just a little over 10 per cent increased in actual phrases that what was authorized for 22/23, the final full 12 months of the earlier authorities.

In every of these comparisons notice that the contemporary exclusions from what is roofed by the Funding Settlement imply that 2025-30 numbers are understated relative to the numbers for earlier years. It’s fairly unsatisfactory that neither the Financial institution nor the Minister (nor Treasury) has supplied any type of reconciliation desk to supply a clearer sense of magnitudes.

However all of these comparisons are between Funding Settlement authorized numbers for every year. What about comparisons with what the Financial institution has really executed, or deliberate to do, within the present (24/25 12 months).

Within the Financial institution’s Assertion of Efficiency Expectations, printed in the midst of final 12 months and absolutely adopted by the Board (signed by each Quigley and Orr), these have been the Financial institution’s monetary forecasts for the present 12 months.

Whole working bills have been forecast then to be $231 million. That was a rise from $186 million the earlier 12 months, and $105 million as not too long ago because the 12 months to June 2021.

Because it occurs, and shortly after the Assertion of Efficiency Expectations got here out I wrote a publish about some facets of their numbers

It was fairly breathtaking stuff. What I don’t suppose I’d seen by then was that the Minister of Finance had already, in April 2024, set out that is her annual Letter of Expectation to the Board.

That appeared fairly clear. $149.4 million was the baseline for what they have been allowed for (Funding Settlement lined) opex in 2024/25, the Minister gave the impression to be fairly clearly encouraging them to give attention to reprioritisation not bids for extra and but (a) the Board signed up to an enormous improve in opex for twenty-four/25 (properly forward of the Funding Settlement quantity for that particular 12 months) and b) then in September bid for a giant improve in actual opex spending allowances for the approaching 5 years (roughly a 25 per cent actual improve).

However how does that $231 million quantity examine to the $149.4 the Financial institution was allowed underneath the then Funding Settlement for twenty-four/25? There we get some trace from a useful desk within the Financial institution’s 2023/24 Annual Report

Now, this needs to be learn rigorously too. You’ll discover that the Funding settlement: annual allocation quantity ($177m for 2023/24) isn’t the identical because the Funding Settlement quantity within the first desk above. That’s as a result of within the 2020-25 Funding Settlement there’s a separate class for “direct web foreign money challenge bills” (foreign money is, in any case, a revenue centre for the Financial institution so there may be some logic in treating it individually). Within the 12 months to June 2024, $13.5m was allowed for that set of bills (subtract that from $177m and also you get the $163.5 within the desk above).

Additionally, you will discover that of the whole working bills ($186m that 12 months), $28m have been for gadgets not lined by the Funding Settlement in any respect (these exclusions matter, and as famous above they’re rising).

So lets return to that $231m price range for 2024/25 that the Board authorized in mid 2024. Of that, $14.5 may have been for these direct foreign money challenge bills (that was what was allowed within the Funding Settlement), however one other desk within the Annual Report means that in 2022/23 and 2023/24 precise web foreign money points bills had solely been $5-6 million each year, and the Minister’s Cupboard paper says that the most recent price range for foreign money points bills for twenty-four/25 is $9m. In absence of additional data, and with just a little extrapolation, we’ll permit $30m as having been for issues not lined by the Funding Settlement in any respect. Subtract these two gadgets and you might be left with $192 million, which is so much bigger quantity than the $149.4 million allowed for twenty-four/25 within the Funding Settlement (2023 variation).

Now, additionally, you will notice within the desk – penultimate line, though not clearly labelled – that in 2023/24 the Financial institution had underspent the Funding Settlement quantity by $19m (some mixture of foreign money and different opex), and so – per the Robertson settlement talked about above – they may in 2024/25 spent as much as $19m greater than what had been specified for that 12 months alone. That might take the permissible restrict to $168.4. Even that quantity continues to be a great distance wanting what the Financial institution was really budgeting for the 12 months (see earlier para), and it relied scope for one 12 months’s spending that shouldn’t have been prudently used for something apart from one-offs, since a brand new Funding Settlement was nearly to be negotiated, in a interval of straitened fiscal circumstances, and when the Minister had already warned them in regards to the future. And but they have been planning a 21 per cent improve in employees bills in a single 12 months – the ultimate 12 months of the outdated settlement.

As famous earlier, within the Minister’s Cupboard committee paper – and her press launch – she referred a number of instances to an (apparently revised) Reserve Financial institution working bills price range for 2024/25 of $200m. If we take off $30 million for spending not lined by the Funding Settlement and $9m for foreign money bills that might get us again to $161m, nonetheless considerably greater than the $149.4 allowed for that particular 12 months, though decrease than what would have been allowed in that 12 months from carrying ahead the earlier 12 months’s underspend.

You must surprise at what level the printed price range was revised so sharply (down 13 per cent for the total 12 months). Maybe Treasury had some enter when the noticed how far out of line the printed price range was?

It wasn’t as if this large improve in opex for 2024/25 appears to be like to have been all about one particular mission. In response to the desk within the Cupboard paper, in 2024/25 there’s a 40 per cent improve in spending on the core features (financial coverage, markets, and monetary stability), following a 48 per cent improve the earlier 12 months. And the assist features (now operating at greater than 4 instances the extent of spending in 2017/18) additionally see spending rise 17 per cent this (24/25) 12 months.

The Minister’s Cupboard paper, launched yesterday, informed us that complete employees numbers (FTE) had reached 660 by the tip of January. Final 12 months’s Annual Report tells us that as at 30 June final 12 months – solely 7 months beforehand – they’d had 601.3 FTEs. It’s staggering improve within the final 12 months of a 5 12 months Funding Settlement – relying for that 12 months’s Finances on a giant underspend the earlier 12 months, and regardless of the Minister’s warning of coming fiscal stringency.

It appears fairly clear that Orr, Quigley and the remainder of the Board have been engaged in a method designed, in impact, to attempt to bounce the Minister into agreeing to a brand new increased baseline spending quantity that (most likely) would have been even increased in actual phrases for the subsequent 5 years that what they have been spending in 2024/25. In that case, and it’s troublesome to learn what occurred every other manner (provided that we all know what the Financial institution bid for final September) it’s actually fairly inexcusable conduct all spherical (and albeit fairly poor behaviour vis-a-vis employees, because it was a dangerous high-wire act and if it didn’t come off it was prone to be employees who paid the worth.

All of the exclusions (and adjustments in exclusions – for instance, these web foreign money bills now have only a 5 yearly complete cap somewhat than annual provisions) imply it’s troublesome to know with any certainty how a lot the Financial institution is absolutely being reduce relative to this 12 months’s spending

Take that $200m price range for twenty-four/25, subtract $30m for spending excluded even within the earlier Funding Settlement and $10m for web foreign money bills and you might be again to $160m. The brand new Funding Settlement permits for spending in 2025/26 of $155m BUT there are new exclusions. There’s this one, which is no less than quantified

That may be $5m each year. As well as (and as talked about yesterday) spending across the CDBC mission can also be newly excluded and there are a selection of different gadgets. Subtract these of the $160m budgeted on Funding Settlement lined gadgets and also you get fairly near that $155m. Even permitting for a few per cent of inflation, there isn’t a lot signal of actual spending cuts – in an organisation that had massively elevated spending as not too long ago as, properly, this present 12 months.

For the interval past that there appears to be like to be considerably extra restraint imposed on the Financial institution however it’s nothing very dramatic, in an organisation the place spending and employees numbers have blown out lately, and stored doing so in 2024/25. (And as famous in yesterday’s publish, the Minister rejected Treasury’s push for decrease numbers.) Precise actual spending later within the Funding Settlement interval stays – per desk close to the beginning of the publish – properly above what was spent within the final full 12 months of the earlier authorities.

There are loads of numbers on this publish, and several other no less than are unsure. However the backside line appears to have been one the place the Financial institution’s Board and Governor tried it on, with their preposterous bid for a lot increased Funding Settlement operational expenditure. Fortunately that made no headway with the Minister. Nobody appears to emerge with a lot credit score, and should you have been inclined to make an allowance for The Treasury there may be the thriller of how that massive working bills price range ($231m) occurred within the first place. Certainly they have been conscious earlier than the factor noticed the sunshine of public day?

As for the Minister of Finance, the try to say a 25 per cent discount relative to this 12 months’s price range appears to be like much more disreputable than I realised yesterday. A minimum of 20 per cent of that price range appears to be on gadgets that weren’t even lined by the (earlier) Funding Settlement.

The Minister of Finance appeared on RNZ this morning and from the ensuing story it seems that she needed to emphasize a message that “New Zealanders are doing it robust…..We anticipate you to indicate some restraint. Focus in your core statutory necessities”. Which is nice stuff as rhetoric, however the actuality appears to be one the place the funding the Minister has authorized will solely cease the Financial institution persevering with to develop additional (having already expanded for another 12 months than nearly all different authorities businesses), and do little or sufficient to make sure they’re targeted on the core stuff. That’s a disgrace, and I’m positive most New Zealanders would favor a couple of extra (say) kidney transplants than cementing-in very excessive ranges of spending – far far above pre-Orr ranges in actual phrases, and above even ranges late in Labour’s time period – on the central financial institution.

Maybe it’s just a few geeks and nerds who actually care in regards to the legislation being adopted in these obscure issues, however as a reminder

There’s nonetheless no signal of a price range (not to mention a pleasant to have like a correct reconciliation desk).

UPDATE:

Right here is one other method to attempt to have a look at it

The blue bars are precise (actual) working spending by the RB on issues lined by the Funding Settlement, with the 24/25 numbers being per the Financial institution’s price range disclosed within the Minister’s Cupboard paper. On the headline new Funding Settlement (and permitting for two per cent inflation) we get the purple bar. Permitting $7 million for the brand new exclusions – $5m for the Deposit Takers Act implementation (see above) and (considerably arbitrarily) simply $2m for the remaining – we get the yellow bar. If the yellow bar is roughly proper, actual spending (like for like) in 25/26 could be 4.4 per cent decrease than in 24/25 and barely decrease in any respect than the precise for 23/24 (greater than half of which 12 months was underneath the present authorities).

As a result of we have no idea the exact worth of recent exclusions, the yellow bar is illustrative solely, however the course is fairly clear. All the opposite numbers are from RB paperwork or the Minister’s Cupboard committee paper.

UPDATE 19/4: There’s a mistake on this publish, in deciphering the 2024/25 budgeted spend. A full publish, revising and amplifying the story, will observe on Tuesday.

[See update note at the very end of this post which means that some parts of this post – re 24/25 spending – need correcting and reframing]

In yesterday’s publish I attempted to current the Reserve Financial institution Funding Settlement for 2025-30, as authorized by the Minister of Finance and the Financial institution’s Board, within the context of the earlier settlement, and the variation to that settlement signed as much as by Grant Robertson a couple of weeks earlier than the final election (which vastly elevated the quantity obtainable for working expenditure). In opposition to that benchmark, yesterday’s settlement didn’t appear to show a lot restraint in any respect, even on the headline figures.

The Minister of Finance had sought to make a lot of (a) how a lot decrease the agreed numbers have been than the primary bid made by the Financial institution final September (a complete of $1.03bn over 5 years for each capital and working expenditure – capex being solely $50m in complete), and b) relative to a quantity we had by no means seen earlier than, what she described because the Financial institution’s working bills price range for 2024/25 of $200m. This latter was the premise for the much-publicised 25% reduce declare.

I used to be a bit dismissive of that presentation, and what appeared largely to be spin (not like the RB’s personal press launch).

So I’m now going to attempt to step by all of it pretty painstakingly and extra slowly/rigorously than I did yesterday.

First, listed below are the working expenditure numbers for issues lined by the 2020 Funding Settlement, displaying each the unique settlement and the August 2023 variation.

There have been actually large will increase granted in that 2023 variation (way over, say, implied simply by the inflation shock). Be aware too that spending for 23/24 was allowed to be a lot increased than in 24/25. I’m fairly positive we by no means received a particular rationalization for that, nevertheless it most likely associated to some main new initiative.

By legislation, the funding agreements are required to specify most expenditure for every single 12 months (the Financial institution can’t simply decide and select, transferring cash from one 12 months to the textual content on a whim). Nevertheless, within the 2023 variation Grant Robertson explicitly allowed the Financial institution to deal with the final two years as a single mixture pool (apparently he had executed the identical for the final two years of the earlier settlement). In precept, I’ve no specific downside with that (though in fact most authorities businesses must come to Parliament and get a contemporary appropriation every year) nevertheless it opens up a lot of dangers.

And listed below are the outdated and new Funding Settlement opex numbers, expressed in fixed 2024/25 {dollars} (for every year I’ve used the extent of the CPI for the common of the related Dec and Mar quarters).

There are a variety of the way to have a look at that collection. A technique is to check spending in 29/30 with the common allowed (over the total 5 years) underneath the earlier Funding Settlement. These two numbers are nearly equivalent.

One other may be to check 29/30 with the authorized Funding Settlement stage for twenty-four/25. That suggests a reduce of about 6 per cent in actual phrases.

If we needed to be barely partisan about it (Willis can solely be held accountable for stuff that has occurred on her watch), authorized opex for 2029/30 will probably be just a little over 10 per cent increased in actual phrases that what was authorized for 22/23, the final full 12 months of the earlier authorities.

In every of these comparisons notice that the contemporary exclusions from what is roofed by the Funding Settlement imply that 2025-30 numbers are understated relative to the numbers for earlier years. It’s fairly unsatisfactory that neither the Financial institution nor the Minister (nor Treasury) has supplied any type of reconciliation desk to supply a clearer sense of magnitudes.

However all of these comparisons are between Funding Settlement authorized numbers for every year. What about comparisons with what the Financial institution has really executed, or deliberate to do, within the present (24/25 12 months).

Within the Financial institution’s Assertion of Efficiency Expectations, printed in the midst of final 12 months and absolutely adopted by the Board (signed by each Quigley and Orr), these have been the Financial institution’s monetary forecasts for the present 12 months.

Whole working bills have been forecast then to be $231 million. That was a rise from $186 million the earlier 12 months, and $105 million as not too long ago because the 12 months to June 2021.

Because it occurs, and shortly after the Assertion of Efficiency Expectations got here out I wrote a publish about some facets of their numbers

It was fairly breathtaking stuff. What I don’t suppose I’d seen by then was that the Minister of Finance had already, in April 2024, set out that is her annual Letter of Expectation to the Board.

That appeared fairly clear. $149.4 million was the baseline for what they have been allowed for (Funding Settlement lined) opex in 2024/25, the Minister gave the impression to be fairly clearly encouraging them to give attention to reprioritisation not bids for extra and but (a) the Board signed up to an enormous improve in opex for twenty-four/25 (properly forward of the Funding Settlement quantity for that particular 12 months) and b) then in September bid for a giant improve in actual opex spending allowances for the approaching 5 years (roughly a 25 per cent actual improve).

However how does that $231 million quantity examine to the $149.4 the Financial institution was allowed underneath the then Funding Settlement for twenty-four/25? There we get some trace from a useful desk within the Financial institution’s 2023/24 Annual Report

Now, this needs to be learn rigorously too. You’ll discover that the Funding settlement: annual allocation quantity ($177m for 2023/24) isn’t the identical because the Funding Settlement quantity within the first desk above. That’s as a result of within the 2020-25 Funding Settlement there’s a separate class for “direct web foreign money challenge bills” (foreign money is, in any case, a revenue centre for the Financial institution so there may be some logic in treating it individually). Within the 12 months to June 2024, $13.5m was allowed for that set of bills (subtract that from $177m and also you get the $163.5 within the desk above).

Additionally, you will discover that of the whole working bills ($186m that 12 months), $28m have been for gadgets not lined by the Funding Settlement in any respect (these exclusions matter, and as famous above they’re rising).

So lets return to that $231m price range for 2024/25 that the Board authorized in mid 2024. Of that, $14.5 may have been for these direct foreign money challenge bills (that was what was allowed within the Funding Settlement), however one other desk within the Annual Report means that in 2022/23 and 2023/24 precise web foreign money points bills had solely been $5-6 million each year, and the Minister’s Cupboard paper says that the most recent price range for foreign money points bills for twenty-four/25 is $9m. In absence of additional data, and with just a little extrapolation, we’ll permit $30m as having been for issues not lined by the Funding Settlement in any respect. Subtract these two gadgets and you might be left with $192 million, which is so much bigger quantity than the $149.4 million allowed for twenty-four/25 within the Funding Settlement (2023 variation).

Now, additionally, you will notice within the desk – penultimate line, though not clearly labelled – that in 2023/24 the Financial institution had underspent the Funding Settlement quantity by $19m (some mixture of foreign money and different opex), and so – per the Robertson settlement talked about above – they may in 2024/25 spent as much as $19m greater than what had been specified for that 12 months alone. That might take the permissible restrict to $168.4. Even that quantity continues to be a great distance wanting what the Financial institution was really budgeting for the 12 months (see earlier para), and it relied scope for one 12 months’s spending that shouldn’t have been prudently used for something apart from one-offs, since a brand new Funding Settlement was nearly to be negotiated, in a interval of straitened fiscal circumstances, and when the Minister had already warned them in regards to the future. And but they have been planning a 21 per cent improve in employees bills in a single 12 months – the ultimate 12 months of the outdated settlement.

As famous earlier, within the Minister’s Cupboard committee paper – and her press launch – she referred a number of instances to an (apparently revised) Reserve Financial institution working bills price range for 2024/25 of $200m. If we take off $30 million for spending not lined by the Funding Settlement and $9m for foreign money bills that might get us again to $161m, nonetheless considerably greater than the $149.4 allowed for that particular 12 months, though decrease than what would have been allowed in that 12 months from carrying ahead the earlier 12 months’s underspend.

You must surprise at what level the printed price range was revised so sharply (down 13 per cent for the total 12 months). Maybe Treasury had some enter when the noticed how far out of line the printed price range was?

It wasn’t as if this large improve in opex for 2024/25 appears to be like to have been all about one particular mission. In response to the desk within the Cupboard paper, in 2024/25 there’s a 40 per cent improve in spending on the core features (financial coverage, markets, and monetary stability), following a 48 per cent improve the earlier 12 months. And the assist features (now operating at greater than 4 instances the extent of spending in 2017/18) additionally see spending rise 17 per cent this (24/25) 12 months.

The Minister’s Cupboard paper, launched yesterday, informed us that complete employees numbers (FTE) had reached 660 by the tip of January. Final 12 months’s Annual Report tells us that as at 30 June final 12 months – solely 7 months beforehand – they’d had 601.3 FTEs. It’s staggering improve within the final 12 months of a 5 12 months Funding Settlement – relying for that 12 months’s Finances on a giant underspend the earlier 12 months, and regardless of the Minister’s warning of coming fiscal stringency.

It appears fairly clear that Orr, Quigley and the remainder of the Board have been engaged in a method designed, in impact, to attempt to bounce the Minister into agreeing to a brand new increased baseline spending quantity that (most likely) would have been even increased in actual phrases for the subsequent 5 years that what they have been spending in 2024/25. In that case, and it’s troublesome to learn what occurred every other manner (provided that we all know what the Financial institution bid for final September) it’s actually fairly inexcusable conduct all spherical (and albeit fairly poor behaviour vis-a-vis employees, because it was a dangerous high-wire act and if it didn’t come off it was prone to be employees who paid the worth.

All of the exclusions (and adjustments in exclusions – for instance, these web foreign money bills now have only a 5 yearly complete cap somewhat than annual provisions) imply it’s troublesome to know with any certainty how a lot the Financial institution is absolutely being reduce relative to this 12 months’s spending

Take that $200m price range for twenty-four/25, subtract $30m for spending excluded even within the earlier Funding Settlement and $10m for web foreign money bills and you might be again to $160m. The brand new Funding Settlement permits for spending in 2025/26 of $155m BUT there are new exclusions. There’s this one, which is no less than quantified

That may be $5m each year. As well as (and as talked about yesterday) spending across the CDBC mission can also be newly excluded and there are a selection of different gadgets. Subtract these of the $160m budgeted on Funding Settlement lined gadgets and also you get fairly near that $155m. Even permitting for a few per cent of inflation, there isn’t a lot signal of actual spending cuts – in an organisation that had massively elevated spending as not too long ago as, properly, this present 12 months.

For the interval past that there appears to be like to be considerably extra restraint imposed on the Financial institution however it’s nothing very dramatic, in an organisation the place spending and employees numbers have blown out lately, and stored doing so in 2024/25. (And as famous in yesterday’s publish, the Minister rejected Treasury’s push for decrease numbers.) Precise actual spending later within the Funding Settlement interval stays – per desk close to the beginning of the publish – properly above what was spent within the final full 12 months of the earlier authorities.

There are loads of numbers on this publish, and several other no less than are unsure. However the backside line appears to have been one the place the Financial institution’s Board and Governor tried it on, with their preposterous bid for a lot increased Funding Settlement operational expenditure. Fortunately that made no headway with the Minister. Nobody appears to emerge with a lot credit score, and should you have been inclined to make an allowance for The Treasury there may be the thriller of how that massive working bills price range ($231m) occurred within the first place. Certainly they have been conscious earlier than the factor noticed the sunshine of public day?

As for the Minister of Finance, the try to say a 25 per cent discount relative to this 12 months’s price range appears to be like much more disreputable than I realised yesterday. A minimum of 20 per cent of that price range appears to be on gadgets that weren’t even lined by the (earlier) Funding Settlement.

The Minister of Finance appeared on RNZ this morning and from the ensuing story it seems that she needed to emphasize a message that “New Zealanders are doing it robust…..We anticipate you to indicate some restraint. Focus in your core statutory necessities”. Which is nice stuff as rhetoric, however the actuality appears to be one the place the funding the Minister has authorized will solely cease the Financial institution persevering with to develop additional (having already expanded for another 12 months than nearly all different authorities businesses), and do little or sufficient to make sure they’re targeted on the core stuff. That’s a disgrace, and I’m positive most New Zealanders would favor a couple of extra (say) kidney transplants than cementing-in very excessive ranges of spending – far far above pre-Orr ranges in actual phrases, and above even ranges late in Labour’s time period – on the central financial institution.

Maybe it’s just a few geeks and nerds who actually care in regards to the legislation being adopted in these obscure issues, however as a reminder

There’s nonetheless no signal of a price range (not to mention a pleasant to have like a correct reconciliation desk).

UPDATE:

Right here is one other method to attempt to have a look at it

The blue bars are precise (actual) working spending by the RB on issues lined by the Funding Settlement, with the 24/25 numbers being per the Financial institution’s price range disclosed within the Minister’s Cupboard paper. On the headline new Funding Settlement (and permitting for two per cent inflation) we get the purple bar. Permitting $7 million for the brand new exclusions – $5m for the Deposit Takers Act implementation (see above) and (considerably arbitrarily) simply $2m for the remaining – we get the yellow bar. If the yellow bar is roughly proper, actual spending (like for like) in 25/26 could be 4.4 per cent decrease than in 24/25 and barely decrease in any respect than the precise for 23/24 (greater than half of which 12 months was underneath the present authorities).

As a result of we have no idea the exact worth of recent exclusions, the yellow bar is illustrative solely, however the course is fairly clear. All the opposite numbers are from RB paperwork or the Minister’s Cupboard committee paper.

UPDATE 19/4: There’s a mistake on this publish, in deciphering the 2024/25 budgeted spend. A full publish, revising and amplifying the story, will observe on Tuesday.