I’m involved about tariff coverage impacting the economic system. Often fiscal, govt and commerce coverage selections wouldn’t result in a right away recession, however these tariffs are an enormous blunder. There have been different unforced errors – like chopping fundamental analysis spending – however that’s extra of a long-term situation.

As an apart: Think about a tech firm saying they had been going to chop spending by eliminating R&D. Their inventory would plummet. That’s what the U.S. has executed with among the DOGE cuts.

To recap, nowcasts and monitoring forecasts are down for Q1:

Determine 1: GDP (black), GDPNow of 4/1 (crimson triangle), GDPNow adjusted for gold imports (pink sq.), NY Fed (blue sq.), Goldman Sachs (inverted inexperienced triangle), SPGMI (orange inverted triangle), Survey of Skilled Forecasters (mild blue), all in billion Ch.2017$ SAAR. Supply: BEA, Atlanta Fed, Philadelphia Fed, NY Fed, Goldman Sachs and authors calculations.

NBER BCDC indicators plus SPGMI’s month-to-month GDP (previously Macroeconomic Advisers’ month-to-month GDP):

Determine 2: Nonfarm Payroll incl benchmark revision employment from CES (daring blue), implied NFP from preliminary benchmark by December (skinny blue), civilian employment as reported (orange), industrial manufacturing (crimson), private revenue excluding present transfers in Ch.2017$ (daring mild inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Supply: BLS through FRED, Federal Reserve, BEA 2024Q4 third launch, S&P World Market Insights (nee Macroeconomic Advisers, IHS Markit) (4/1/2025 launch), and creator’s calculations.

Month-to-month GDP and civilian employment (which has excessive volatility) are primarily flat, whereas consumption is down relative to peak.

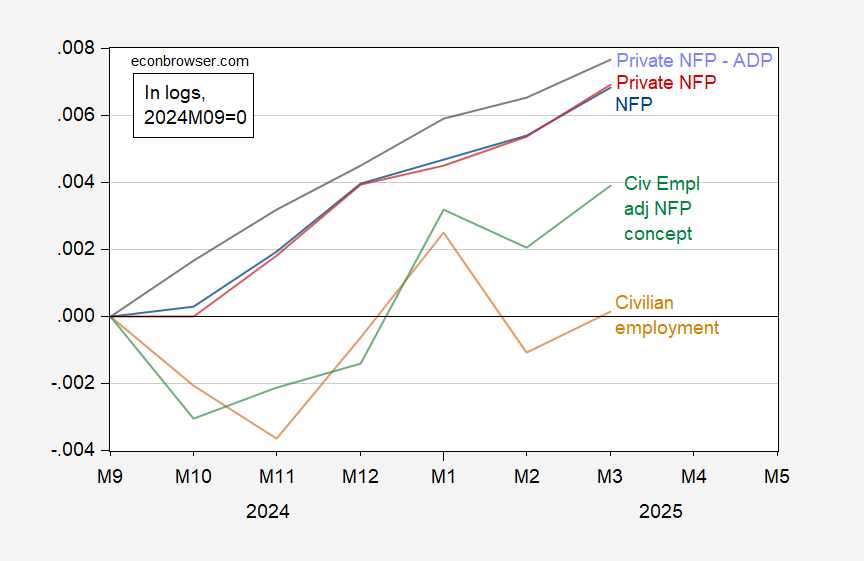

What about employment? Nonetheless rising strongly by most accounts.

Determine 3: Nonfarm payroll employment from BLS (blue), non-public NFP from BLS (crimson), non-public NFP from ADP (lilac), civilian employment adjusted to NFP idea, experimental sequence spliced to official (inexperienced), civilian employment, experimental sequence spliced to official (tan), all, s.a., in logs=2024M09=0. Supply: BLS, BLS and ADP through FRED, and creator’s calculations.

Except for civilian employment (which has a number of volatility), employment continues to be rising, albeit extra slowly.

Therefore, the nervousness is primarily based on “mushy knowledge”, of which many indicators are wanting *very* mushy.