(Please excuse all the various typos. It has been a protracted week and I’m fairly drained.)

Clearly no one is aware of something (TM Alan Beattie) on the subject of what Trump will do.

However I’m beginning to surprise if there’s a helpful rule of thumb growing for predicting how he may do it: “in probably the most simplistic, laziest method attainable.”

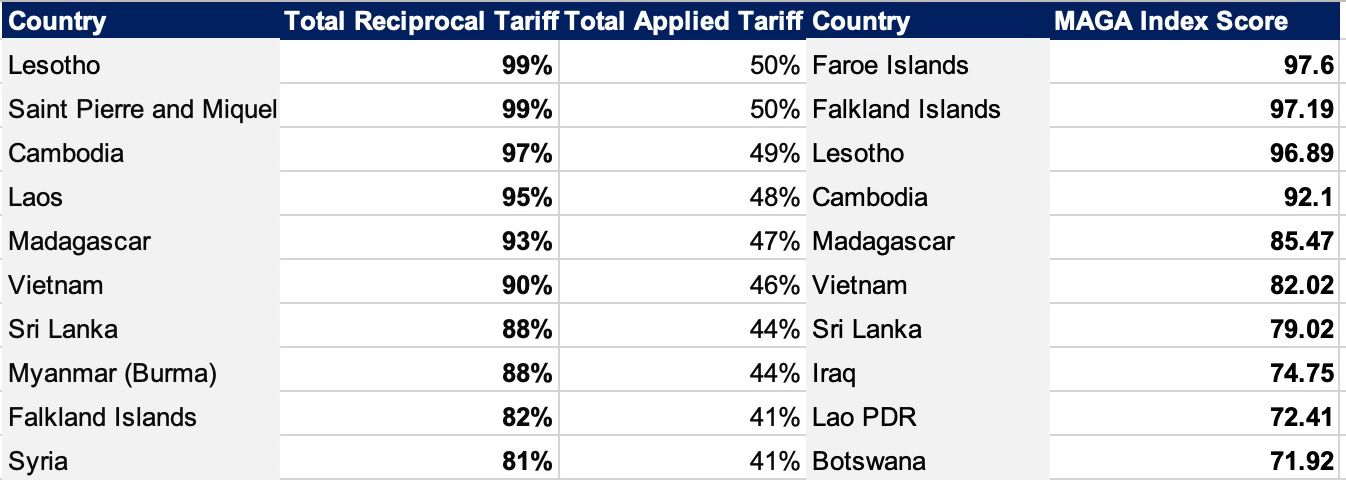

I say this as a result of, in November final 12 months, I created a hierarchy of nations Trump would need to tariff (primarily in order that I might name it the MAGA (Measure of American Items Benefit) index) in a piece printed by FT Alphaville.

To do that, I requested myself, what’s the most simplistic and lazy method to create such an index?

That is the equation I landed on:

-

US commerce stability, 2020-2022/complete commerce*100*-1

This was supposed to focus on which international locations run persistent commerce surpluses with the US and create a quantity between 100 and -100, the place 100 = Trump loves you and -100= Trump hates you.

The MAGA index is ridiculous as a result of it penalises locations just like the Falklands, which promote a lot of fish to the US however don’t purchase very a lot as a result of there aren’t many individuals dwelling there, and growing international locations that don’t purchase very a lot as a result of they’re poor, however do export some commodities.

Annnnnnd … it seems I overcomplicated issues.

As a result of when the President determined to impose reciprocal tariffs earlier this week, which ostensibly penalise international locations for treating US exporters unfairly, he didn’t hassle with 3-year averages or the like, he simply did the next:

-

US single-year commerce deficit/complete imports = deserved tariff.

-

He then divided this quantity by two as a result of he’s “form” to calculate the utilized tariff. (Observe: anybody with a quantity beneath 10 received a ten per cent tariff.)

And … lol.

However, our prime 10 worst offenders lists aren’t so totally different:

Anyway, I assume that what I’m saying is that by being simplistic and lazy, I used to be by accident one of many extra correct predictors (kinda) of Trump’s tariff hierarchy and ranges.

Perhaps there’s a lesson right here for these international locations attempting to barter a decrease tariff.

Given he appears to imagine that the extent to which a rustic sells extra to the US than it buys is a legitimate proxy for figuring out how unfairly one other nation treats US exports, what’s the most simplistic and laziest method to go about figuring out whose tariffs goes up and whose goes down?

One strategy that will match the invoice:

Yearly (quarter? month?), re-run the equation primarily based on the brand new commerce knowledge. If a rustic’s quantity goes up, its tariff goes up. If a rustic’s quantity goes down, it goes down. (Observe: except a rustic’s quantity is beneath 10, as a result of then you definately nonetheless get a ten per cent tariff.)

The issue with that is that maybe the quantity has solely gone down due to the Trump tariff, and if the tariff have been to be lowered the quantity may go up once more.

This makes me assume that there might be a second criterion: it’s a must to do some form of cope with Trump, which includes the discount of tariffs or removing of different irritants. For instance, possibly you scrap a digital companies tax or two, or take away your tariffs on US exports.

In and of itself, the deal isn’t sufficient. However in case you mix the 2 (deal plus the equation pumps out a decrease quantity), then … possibly.

And look, nobody is aware of something. However given that is so simplistic and lazy … it simply may work.

(Observe: none of this has any bearing on the way you may deal with the opposite sectoral tariffs on metal/aluminium and vehicles.)

Issues I wrote final week

In a brand new piece for FT Alphaville I introduced my art work to the unsuspecting lots, and made an argument that will likely be acquainted to readers of this article. (That non-preferential guidelines of origin are going to turn into an enormous deal now that the US is making use of country-specific tariffs.

Alongside my Flint colleague, Will Haworth, I wrote a bit for PoliticsHome explaining why there’s nonetheless fairly a little bit of uncertainty about how Trump tariffs will apply to exports from Northern Eire.

Issues different folks wrote final week

Fairly just a few folks assume that different international locations ought to coordinate their response to Trump to make sure most leverage and keep away from being picked off one after the other. I’m undecided that the incentives are fairly proper to make this work (coated right here), however folks disagree. Right here’s Ignacio Garcia Bercero (Bruegel) arguing that the EU and CPTPP members ought to launch a coalition of the keen towards Trump’s insurance policies and in favour of rules-based commerce. Right here’s Mona Paulsen (LSE Legislation) and Dan Ciuriak (C.D. Howe (Senior Fellow)) advocating a “small open economic system caucus (SOEC) be shaped throughout the World Commerce Group (WTO)”, which might prioritise a coordinated response to Trump’s commerce actions.

One of many different points arising from the Trump Govt Order on reciprocal tariff is yet one more sign that the US’s $800 de minimis threshold — which waives tariffs on imported low-value, business-to-consumer parcels — shouldn’t be lengthy for this world. Writing for EPC, Anna Jerzewska compares the US and EU efforts to take away their respective de minimis thresholds and explains why these efforts are creating a lot uncertainty for companies.

Marta Bengoa (Non-Resident Fellow at ORF America) write concerning the outsized impression the reciprocal tariffs may have on growing international locations. For instance:

Based mostly on 2023 commerce figures, the $5.9 billion in items Cambodia exports to the US would face $2.9 billion in tariff prices — a staggering 9.5% of its complete financial output. For a rustic the place the garment sector employs over 800,000 employees, predominantly ladies, these tariffs might set off widespread manufacturing facility closures and unemployment.

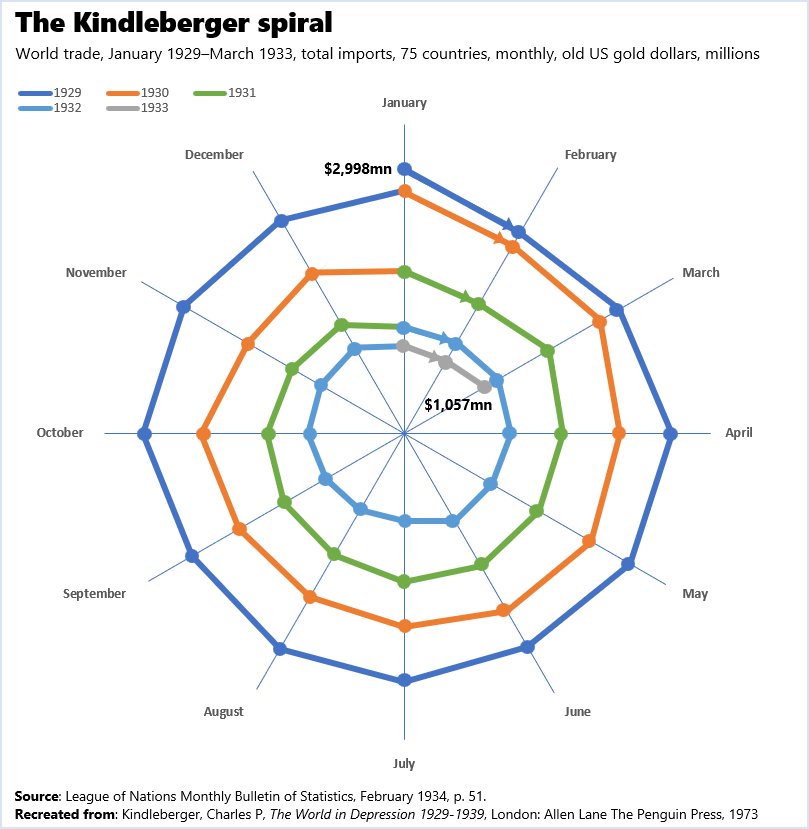

Lastly, Peter Ungphakorn has up to date his piece, discussing (amongst different issues) the relevance of the so-called Kindleberger spiral to at present’s debate.

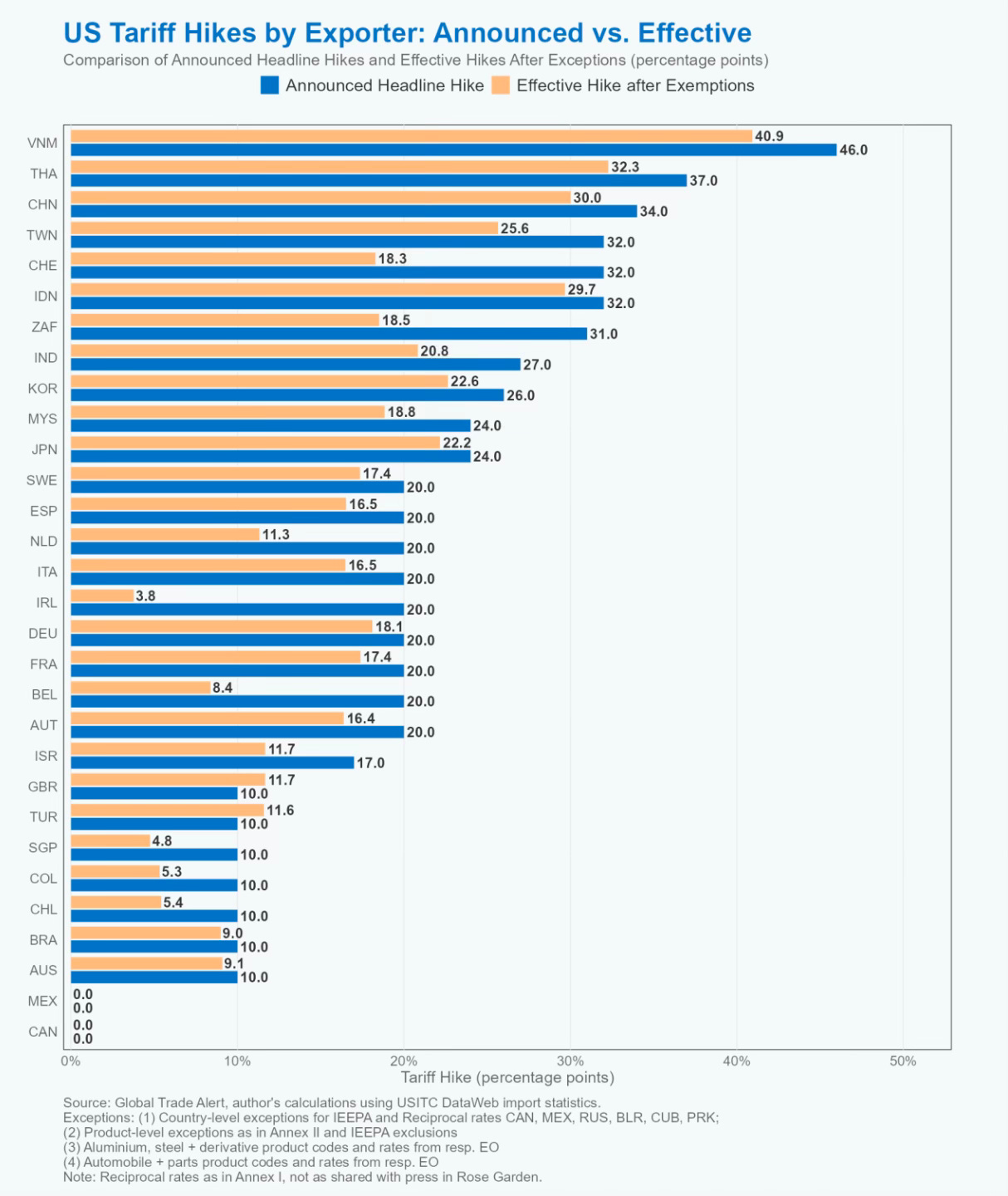

Chart of the week

From Johannes Fritz and the great people at World Commerce Alert:

Greatest needs,

Sam

(Please excuse all the various typos. It has been a protracted week and I’m fairly drained.)

Clearly no one is aware of something (TM Alan Beattie) on the subject of what Trump will do.

However I’m beginning to surprise if there’s a helpful rule of thumb growing for predicting how he may do it: “in probably the most simplistic, laziest method attainable.”

I say this as a result of, in November final 12 months, I created a hierarchy of nations Trump would need to tariff (primarily in order that I might name it the MAGA (Measure of American Items Benefit) index) in a piece printed by FT Alphaville.

To do that, I requested myself, what’s the most simplistic and lazy method to create such an index?

That is the equation I landed on:

-

US commerce stability, 2020-2022/complete commerce*100*-1

This was supposed to focus on which international locations run persistent commerce surpluses with the US and create a quantity between 100 and -100, the place 100 = Trump loves you and -100= Trump hates you.

The MAGA index is ridiculous as a result of it penalises locations just like the Falklands, which promote a lot of fish to the US however don’t purchase very a lot as a result of there aren’t many individuals dwelling there, and growing international locations that don’t purchase very a lot as a result of they’re poor, however do export some commodities.

Annnnnnd … it seems I overcomplicated issues.

As a result of when the President determined to impose reciprocal tariffs earlier this week, which ostensibly penalise international locations for treating US exporters unfairly, he didn’t hassle with 3-year averages or the like, he simply did the next:

-

US single-year commerce deficit/complete imports = deserved tariff.

-

He then divided this quantity by two as a result of he’s “form” to calculate the utilized tariff. (Observe: anybody with a quantity beneath 10 received a ten per cent tariff.)

And … lol.

However, our prime 10 worst offenders lists aren’t so totally different:

Anyway, I assume that what I’m saying is that by being simplistic and lazy, I used to be by accident one of many extra correct predictors (kinda) of Trump’s tariff hierarchy and ranges.

Perhaps there’s a lesson right here for these international locations attempting to barter a decrease tariff.

Given he appears to imagine that the extent to which a rustic sells extra to the US than it buys is a legitimate proxy for figuring out how unfairly one other nation treats US exports, what’s the most simplistic and laziest method to go about figuring out whose tariffs goes up and whose goes down?

One strategy that will match the invoice:

Yearly (quarter? month?), re-run the equation primarily based on the brand new commerce knowledge. If a rustic’s quantity goes up, its tariff goes up. If a rustic’s quantity goes down, it goes down. (Observe: except a rustic’s quantity is beneath 10, as a result of then you definately nonetheless get a ten per cent tariff.)

The issue with that is that maybe the quantity has solely gone down due to the Trump tariff, and if the tariff have been to be lowered the quantity may go up once more.

This makes me assume that there might be a second criterion: it’s a must to do some form of cope with Trump, which includes the discount of tariffs or removing of different irritants. For instance, possibly you scrap a digital companies tax or two, or take away your tariffs on US exports.

In and of itself, the deal isn’t sufficient. However in case you mix the 2 (deal plus the equation pumps out a decrease quantity), then … possibly.

And look, nobody is aware of something. However given that is so simplistic and lazy … it simply may work.

(Observe: none of this has any bearing on the way you may deal with the opposite sectoral tariffs on metal/aluminium and vehicles.)

Issues I wrote final week

In a brand new piece for FT Alphaville I introduced my art work to the unsuspecting lots, and made an argument that will likely be acquainted to readers of this article. (That non-preferential guidelines of origin are going to turn into an enormous deal now that the US is making use of country-specific tariffs.

Alongside my Flint colleague, Will Haworth, I wrote a bit for PoliticsHome explaining why there’s nonetheless fairly a little bit of uncertainty about how Trump tariffs will apply to exports from Northern Eire.

Issues different folks wrote final week

Fairly just a few folks assume that different international locations ought to coordinate their response to Trump to make sure most leverage and keep away from being picked off one after the other. I’m undecided that the incentives are fairly proper to make this work (coated right here), however folks disagree. Right here’s Ignacio Garcia Bercero (Bruegel) arguing that the EU and CPTPP members ought to launch a coalition of the keen towards Trump’s insurance policies and in favour of rules-based commerce. Right here’s Mona Paulsen (LSE Legislation) and Dan Ciuriak (C.D. Howe (Senior Fellow)) advocating a “small open economic system caucus (SOEC) be shaped throughout the World Commerce Group (WTO)”, which might prioritise a coordinated response to Trump’s commerce actions.

One of many different points arising from the Trump Govt Order on reciprocal tariff is yet one more sign that the US’s $800 de minimis threshold — which waives tariffs on imported low-value, business-to-consumer parcels — shouldn’t be lengthy for this world. Writing for EPC, Anna Jerzewska compares the US and EU efforts to take away their respective de minimis thresholds and explains why these efforts are creating a lot uncertainty for companies.

Marta Bengoa (Non-Resident Fellow at ORF America) write concerning the outsized impression the reciprocal tariffs may have on growing international locations. For instance:

Based mostly on 2023 commerce figures, the $5.9 billion in items Cambodia exports to the US would face $2.9 billion in tariff prices — a staggering 9.5% of its complete financial output. For a rustic the place the garment sector employs over 800,000 employees, predominantly ladies, these tariffs might set off widespread manufacturing facility closures and unemployment.

Lastly, Peter Ungphakorn has up to date his piece, discussing (amongst different issues) the relevance of the so-called Kindleberger spiral to at present’s debate.

Chart of the week

From Johannes Fritz and the great people at World Commerce Alert:

Greatest needs,

Sam