Tariff wars are a recurring characteristic within the world buying and selling system, and tensions between China and Canada have been ongoing for years. These tariff wars are largely pushed by geopolitical tensions.

In 2019, for example, China banned Canadian meat imports following the detention of Huawei’s chief government officer, Meng Wanzhou. Though China cited the usage of banned feed components in Canadian meat as the explanation, many considered it as a diplomatic response to the rift between Ottawa and Beijing.

Now, China is threatening to research Canada for potential dumping of canola into its market. In worldwide commerce, dumping is a sort of worth discrimination the place a product is offered at completely different costs in home and export markets. Basically, it entails promoting a product in a overseas market at a worth decrease than its regular worth within the house nation.

This determination got here after Canada imposed a 100 per cent tariff on electrical automobiles and a 25 per cent tariff on metal and aluminum from China efficient Oct. 1, 2024. It’s clear this transfer by China is a direct retaliation for the tariffs on electrical automobiles.

Commerce tensions between nations can severely disrupt worldwide commerce. My earlier analysis demonstrated how commerce tensions between Canada and america throughout Donald Trump’s presidency negatively impacted commerce between the 2 nations, significantly within the agri-food sector.

The mere menace of an anti-dumping responsibility can discourage imports, making anti-dumping legal guidelines a type of non-tariff barrier, even when the responsibility isn’t truly imposed. Though China has solely introduced a dumping investigation, the costs of canola oil futures are already being impacted.

THE CANADIAN PRESS/Jeff McIntosh

Anti-dumping procedures

As members of the World Commerce Group (WTO), each Canada and China are required to make sure their commerce insurance policies adjust to its rules.

Underneath the WTO framework, members can take motion towards dumping to guard their home markets. Nevertheless, such actions should observe the established WTO protocols, together with submitting complaints by means of the group’s dispute settlement mechanism.

The WTO’s Anti-Dumping Settlement outlines how nations can reply to dumping. On this case, China would want to show that Canada is dumping canola, quantify the extent of the dumping and show that it’s inflicting or threatening hurt to Chinese language canola farmers.

If China’s investigation uncovers proof of dumping, it has the appropriate to impose anti-dumping duties. These duties are utilized when dumping is confirmed and proven to have harmed the home trade.

The menace or imposition of such duties may considerably disrupt Canada’s canola exports to China, which might have severe implications for Canadian farmers who rely closely on world markets to promote their merchandise.

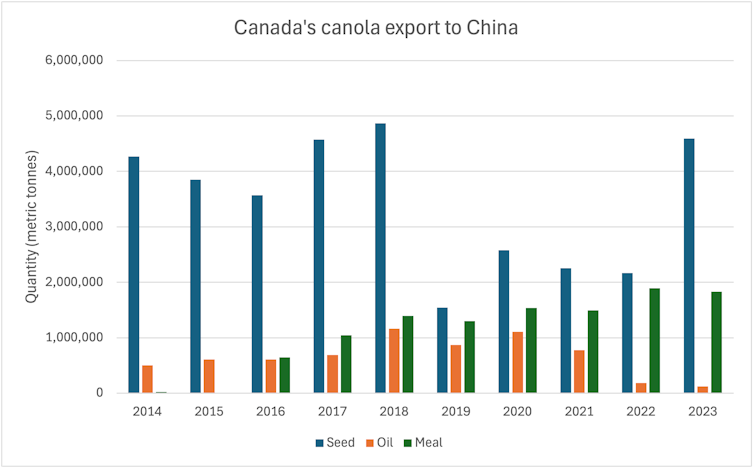

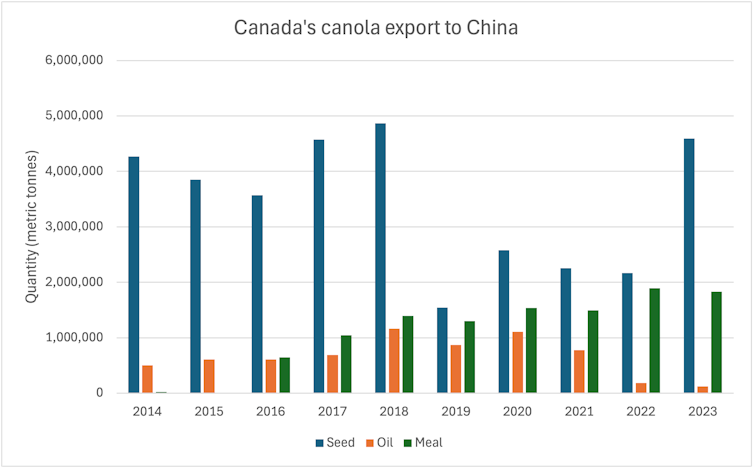

Canada’s canola export to China

Canada exports 90 per cent of its whole canola manufacturing, with exports of canola seed, oil and meal amounting to $15.8 billion in 2023. China is Canada’s second-largest importer of canola, after the U.S., with imports totalling $5 billion in 2023.

This implies China accounted for practically one-third of Canada’s whole canola export worth that 12 months. Notably, China is the biggest marketplace for canola seed, whereas the U.S. is the biggest marketplace for canola oil and meal.

Canola is predominantly exported to China in its major kind (seed) quite than as processed merchandise (oil and meal). The info exhibits there have been secure exports to China from 2014 to 2018, however there was a pointy decline in canola seed exports beginning in 2019, which persevered till 2023.

(Canola Council of Canada)

This drop coincides with a interval of diplomatic pressure between Canada and China, suggesting that commerce disputes can have a big unfavourable impression on bilateral commerce. Thus, signalling the present commerce conflict may have devastating impact for canola farmers, particularly as China accounts for about 65 per cent of Canada’s canola seed export.

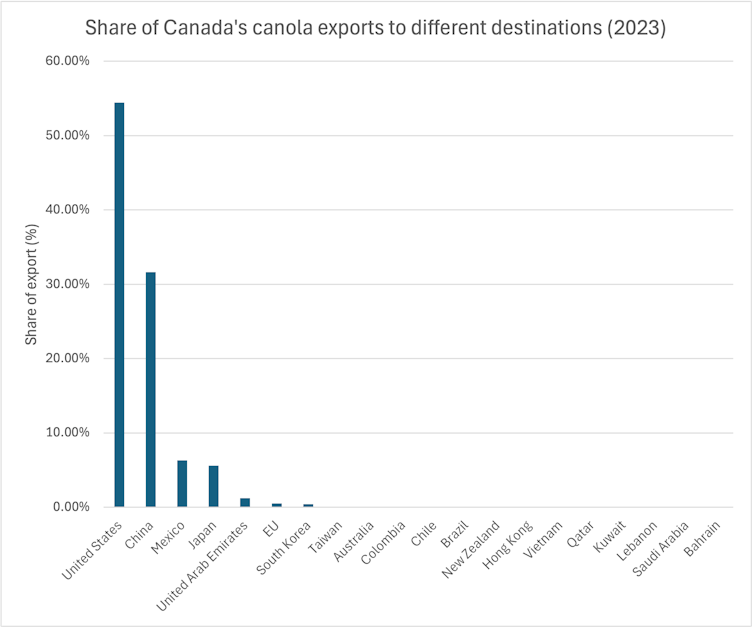

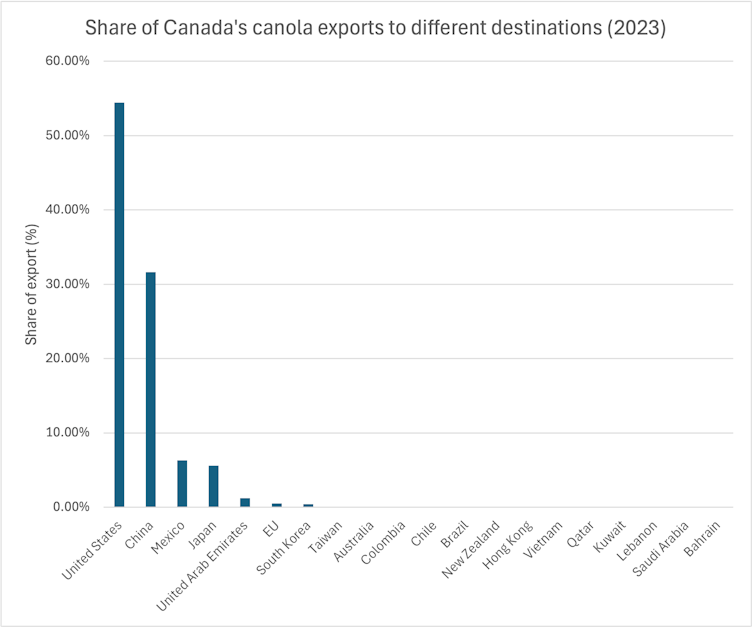

Moreover, Canada’s canola exports have proven restricted diversification, relying closely on simply 4 nations: the U.S., China, Mexico and Japan. Collectively, these nations accounted for 98 per cent of Canada’s whole export worth in 2023.

The U.S. led with imports price $8.6 billion, representing 54 per cent of Canada’s whole exports, adopted by China with $5 billion (32 per cent), Mexico with $1 billion (six per cent), and Japan with $883 million (5.6 per cent).

(Canola Council of Canada)

This heavy reliance on few markets heightens Canada’s vulnerability to commerce disruptions. If China imposes anti-dumping tariffs, this might make Canadian canola not aggressive within the Chinese language market, Canada may danger shedding 30 per cent of its canola export worth to different potential suppliers. The Canola Council of Canada has acknowledged China as an essential and valued marketplace for Canada’s canola.

What’s the best way ahead?

THE CANADIAN PRESS/Jeff McIntosh

Like many superior economies, Canada seeks to protect its home market from the inflow of low-cost Chinese language merchandise, corresponding to electrical automobiles. Nevertheless, Canada should train warning, significantly when adopting commerce insurance policies from bigger economies just like the U.S. and the European Union.

These bigger economies maintain larger leverage in worldwide commerce negotiations, not like Canada, a small open economic system that faces larger dangers in partaking in a commerce conflict with China.

Furthermore, to assist a swift transition to a inexperienced economic system and assist Canada meet its local weather goal of attaining 100 per cent zero-emission car gross sales by 2035, it’s important that electrical automobiles develop into extra inexpensive for the common Canadian.

As a substitute of escalating commerce tensions with China, Canada ought to discover various measures corresponding to safeguards or tariff price quotas on Chinese language electrical vehicles. These approaches may very well be mutually useful and fewer more likely to provoke a tit-for-tat retaliation.

Imposing a prohibitive tariff on electrical automobiles from China would come on the expense of different Canadian sectors that depend on Chinese language consumers. Canada should tread rigorously to keep away from sacrificing jobs within the agricultural sector whereas attempting to guard these within the car trade.

Canola farmers, particularly, would possible bear the price of Canada’s unilateral tariff on China. Quite a few different sectors is also focused, as China would possible retaliate by matching the impression by itself exports.

Canada should attempt to reduce diplomatic tensions and keep away from commerce wars with main world market gamers, as such conflicts have gotten more and more frequent. Current commerce disputes, together with these with the U.S. throughout the NAFTA renegotiation, Saudi Arabia over human rights points and China following the detention of a Huawei government, can considerably undermine Canada’s export competitiveness.

Tariff wars are a recurring characteristic within the world buying and selling system, and tensions between China and Canada have been ongoing for years. These tariff wars are largely pushed by geopolitical tensions.

In 2019, for example, China banned Canadian meat imports following the detention of Huawei’s chief government officer, Meng Wanzhou. Though China cited the usage of banned feed components in Canadian meat as the explanation, many considered it as a diplomatic response to the rift between Ottawa and Beijing.

Now, China is threatening to research Canada for potential dumping of canola into its market. In worldwide commerce, dumping is a sort of worth discrimination the place a product is offered at completely different costs in home and export markets. Basically, it entails promoting a product in a overseas market at a worth decrease than its regular worth within the house nation.

This determination got here after Canada imposed a 100 per cent tariff on electrical automobiles and a 25 per cent tariff on metal and aluminum from China efficient Oct. 1, 2024. It’s clear this transfer by China is a direct retaliation for the tariffs on electrical automobiles.

Commerce tensions between nations can severely disrupt worldwide commerce. My earlier analysis demonstrated how commerce tensions between Canada and america throughout Donald Trump’s presidency negatively impacted commerce between the 2 nations, significantly within the agri-food sector.

The mere menace of an anti-dumping responsibility can discourage imports, making anti-dumping legal guidelines a type of non-tariff barrier, even when the responsibility isn’t truly imposed. Though China has solely introduced a dumping investigation, the costs of canola oil futures are already being impacted.

THE CANADIAN PRESS/Jeff McIntosh

Anti-dumping procedures

As members of the World Commerce Group (WTO), each Canada and China are required to make sure their commerce insurance policies adjust to its rules.

Underneath the WTO framework, members can take motion towards dumping to guard their home markets. Nevertheless, such actions should observe the established WTO protocols, together with submitting complaints by means of the group’s dispute settlement mechanism.

The WTO’s Anti-Dumping Settlement outlines how nations can reply to dumping. On this case, China would want to show that Canada is dumping canola, quantify the extent of the dumping and show that it’s inflicting or threatening hurt to Chinese language canola farmers.

If China’s investigation uncovers proof of dumping, it has the appropriate to impose anti-dumping duties. These duties are utilized when dumping is confirmed and proven to have harmed the home trade.

The menace or imposition of such duties may considerably disrupt Canada’s canola exports to China, which might have severe implications for Canadian farmers who rely closely on world markets to promote their merchandise.

Canada’s canola export to China

Canada exports 90 per cent of its whole canola manufacturing, with exports of canola seed, oil and meal amounting to $15.8 billion in 2023. China is Canada’s second-largest importer of canola, after the U.S., with imports totalling $5 billion in 2023.

This implies China accounted for practically one-third of Canada’s whole canola export worth that 12 months. Notably, China is the biggest marketplace for canola seed, whereas the U.S. is the biggest marketplace for canola oil and meal.

Canola is predominantly exported to China in its major kind (seed) quite than as processed merchandise (oil and meal). The info exhibits there have been secure exports to China from 2014 to 2018, however there was a pointy decline in canola seed exports beginning in 2019, which persevered till 2023.

(Canola Council of Canada)

This drop coincides with a interval of diplomatic pressure between Canada and China, suggesting that commerce disputes can have a big unfavourable impression on bilateral commerce. Thus, signalling the present commerce conflict may have devastating impact for canola farmers, particularly as China accounts for about 65 per cent of Canada’s canola seed export.

Moreover, Canada’s canola exports have proven restricted diversification, relying closely on simply 4 nations: the U.S., China, Mexico and Japan. Collectively, these nations accounted for 98 per cent of Canada’s whole export worth in 2023.

The U.S. led with imports price $8.6 billion, representing 54 per cent of Canada’s whole exports, adopted by China with $5 billion (32 per cent), Mexico with $1 billion (six per cent), and Japan with $883 million (5.6 per cent).

(Canola Council of Canada)

This heavy reliance on few markets heightens Canada’s vulnerability to commerce disruptions. If China imposes anti-dumping tariffs, this might make Canadian canola not aggressive within the Chinese language market, Canada may danger shedding 30 per cent of its canola export worth to different potential suppliers. The Canola Council of Canada has acknowledged China as an essential and valued marketplace for Canada’s canola.

What’s the best way ahead?

THE CANADIAN PRESS/Jeff McIntosh

Like many superior economies, Canada seeks to protect its home market from the inflow of low-cost Chinese language merchandise, corresponding to electrical automobiles. Nevertheless, Canada should train warning, significantly when adopting commerce insurance policies from bigger economies just like the U.S. and the European Union.

These bigger economies maintain larger leverage in worldwide commerce negotiations, not like Canada, a small open economic system that faces larger dangers in partaking in a commerce conflict with China.

Furthermore, to assist a swift transition to a inexperienced economic system and assist Canada meet its local weather goal of attaining 100 per cent zero-emission car gross sales by 2035, it’s important that electrical automobiles develop into extra inexpensive for the common Canadian.

As a substitute of escalating commerce tensions with China, Canada ought to discover various measures corresponding to safeguards or tariff price quotas on Chinese language electrical vehicles. These approaches may very well be mutually useful and fewer more likely to provoke a tit-for-tat retaliation.

Imposing a prohibitive tariff on electrical automobiles from China would come on the expense of different Canadian sectors that depend on Chinese language consumers. Canada should tread rigorously to keep away from sacrificing jobs within the agricultural sector whereas attempting to guard these within the car trade.

Canola farmers, particularly, would possible bear the price of Canada’s unilateral tariff on China. Quite a few different sectors is also focused, as China would possible retaliate by matching the impression by itself exports.

Canada should attempt to reduce diplomatic tensions and keep away from commerce wars with main world market gamers, as such conflicts have gotten more and more frequent. Current commerce disputes, together with these with the U.S. throughout the NAFTA renegotiation, Saudi Arabia over human rights points and China following the detention of a Huawei government, can considerably undermine Canada’s export competitiveness.