Issues appear to be at a reasonably low ebb in and across the Reserve Financial institution. There was, particularly, the mysterious, sudden, and as-yet unexplained resignation of the Governor (we’ve had 4 Governors for the reason that Financial institution was given its operational autonomy 35 years in the past, and solely two have accomplished their phrases and left in a traditional approach, which have to be some form of undesirable superior nation report). Having slimmed down the bloated variety of Orr’s deputies by one final yr, one other of them quietly resigned and left final month on (apparently) brief discover and no particular job to go to. Of those that stay, two are (at greatest) ethically challenged and one is solely unqualified for the job she holds.

After which there’s the thriller as to why a brief Governor (particularly offered for within the Act) has not but been appointed, despite the fact that it’s now 4 weeks since Orr tossed his toys and walked out (formally ending on 31 March, however now not current). I wrote about this briefly on Monday morning when it emerged (in The Publish) that regardless of what the Minister and Financial institution had led us to imagine on the day Orr resigned (efficient 31 March), there wouldn’t be a brief Governor in place from 1 April. The Financial institution’s spokesperson, quoted within the Publish article on Monday so badly misinterpret the related provisions of the Act that the Financial institution appeared to really feel it essential to subject a launch yesterday, which added nothing however not less than didn’t muddy the water additional. The Financial institution’s Board has to (lastly) make a advice of an individual to function non permanent Governor by 28 April, however even as soon as she will get such a nomination the Minister of Finance can take as lengthy (or brief) as she likes to make an appointment (or, presumably, knock again a advice and ship the Board away to make one other).

Affordable folks would have assumed that inside a number of days of Orr saying his resignation (and storming off), the Board would have met and made a advice. With greater than three weeks discover (not less than on paper) having been given there was actually no excuse for not even having a advice on the Minister’s desk by the top of March. We’re left to marvel why. Maybe Hawkesby didn’t need the job? Maybe the Board doesn’t believe in him to do even the fill-in position? Maybe the Minister had indicated that she didn’t need him? We don’t know, and neither do worldwide markets who (like the remainder of us) have been taken off-guard by Orr’s resignation. It actually isn’t an excellent look. And if for some cause Hawkesby isn’t an possibility (and there are very slim pickings among the many different 2nd tier managers), maybe they may twist the arm of former Deputy Governor Grant Spencer and convey him again for a second stint filling in between Governors (solely it could be authorized this time)?

The unsatisfactory image was compounded just a bit in a while Monday morning when Hawkesby and the Board chair Neil Quigley fronted as much as the Finance and Expenditure Committee to announce that they have been in any case going to have a evaluation of financial institution capital necessities (their opening statements are right here). This had all been organized with the Minister of Finance, who put out a simultaneous assertion welcoming the evaluation, and confirmed by the Financial institution’s Board at a gathering final week (which the outgoing – however nonetheless in workplace, and thus nonetheless a Board member – Governor didn’t attend).

[UPDATE: Meant to mention that Hawkesby did himself no favours – if he aspires to be seen as anything other than Orr’s man – when he opened his FEC statement this way (emphasis added)

“I’d like to begin by acknowledging our Governor, Adrian Orr, who over 7 years would have attended FEC hearings more than 50 times and always been engaging. We are looking forward to continuing that relationship.”

Orr actively misled FEC repeatedly, and the frostiness of his encounters with any questioning FEC members has been repeatedly commented on. ]

Recall that, rightly or wrongly (I believe wrongly), Parliament has given policymaking powers on such issues to the Financial institution (and particularly to the underqualified Board). Recall too that only a few weeks in the past the Minister of Finance had indicated that she was looking for recommendation on methods to compel the Financial institution to vary coverage. Presumably the Board – and maybe administration – studying which approach the political winds have been blowing merely caved and organized Monday’s FEC look and announcement, slightly than threat dropping their powers. They have been, in any case, in a weak place: so far as we all know the Financial institution’s Funding Settlement for the subsequent 5 years has not but been authorised (the Minister has talked of coming cuts), there wasn’t a everlasting Governor in place, and even the appointment of a brief Governor gave the impression to be hanging in some form of limbo.

It’s at all times potential that the Financial institution itself (particularly now minus Orr – who final yr was vociferously defending present coverage and, as so usually, attacking any critics) thought {that a} evaluation was (substantively) well timed and acceptable, however it seems to be loads like bowing to political stress, at some extent of explicit weak spot. In an unbiased company. And, frankly, since I imagine that massive coverage calls needs to be made by elected politicians, I’d slightly the federal government had truly legislated to shift big-picture prudential policymaking powers again to the Minister of Finance, whereas retaining a significant position for a better-performing Reserve Financial institution to advise and to implement (primarily the mannequin in most different areas of presidency policymaking).

There are additionally numerous questions on the place to from right here with the evaluation. The suggestion from Quigley is that the evaluation might be accomplished by the top of the yr, however whereas choices are lastly a matter for the Financial institution’s Board, it does invite the query of what position (if any) the brand new everlasting Governor is to have (not less than whether it is anybody apart from Hawkesby). By regulation, the non permanent Governor can (finally) be appointed for six months, extendable for one more three. Even when the Board will get on and advertises for a everlasting Governor this month, at greatest it is going to be a number of months earlier than a brand new Governor is on board (eg there was roughly six months between Don Brash resigning and Alan Bollard beginning work). With a non-expert Board wouldn’t one usually anticipate the Governor to be taking the lead in formulating the recommendation on which the Board would lastly make choices? Or is the brand new particular person to be introduced with a fait accompli?

After which after all, there are questions concerning the nature of the evaluation itself. Is it purely look theatre (“we have to appear like we’re doing one thing”) or is it genuinely a case of an open-minded reassessment? There’s discuss of consulting banks earlier than any adjustments are made, however what concerning the wider group of specialists and commentators (a lot of whom submitted on the 2019 coverage proposals/choices)? And for all of the discuss of commissioning “worldwide specialists”, absolutely solely essentially the most naive would take that at face worth. You select your skilled in line with your pursuits (eg a distinct group if one wished folks seemingly largely to reaffirm your priors than for those who have been genuinely opening issues up). I reread yesterday my submit concerning the “worldwide specialists” Orr had commissioned in 2019, and the slightly restricted (and conveniently-supportive, having been chosen for a objective) contribution they made. These earlier specialists have been barred from speaking to anybody in New Zealand apart from the handful the Financial institution authorised. Will it’s any totally different this time?

And though again in 2019 the regulation was such that the selections have been nonetheless these of Orr alone (the Board then had a distinct position), Quigley was additionally the Board chair then and has had Orr’s again proper all through his time in workplace – apparently serving the Governor’s pursuits greater than the general public’s curiosity. His personal questionable relationship with the details on numerous events has additionally been documented right here on numerous events. Apparently Quigley introduced fairly properly at FEC on Monday, however so what? When he isn’t underneath stress – and FEC was extra attuned to welcome the evaluation than ask very looking questions – he’s a clean operator (when he’s underneath stress, properly…..see his press convention on the afternoon Orr resigned).

My very own view, again in 2019, was that even the ultimate Orr place – which pulled again from the preliminary proposals – went additional than was actually warranted. However one of many issues I’d be in search of as a part of the Financial institution’s evaluation this yr – and as a check of seriousness and openmindedness – is a rigorous and clear comparability of the New Zealand capital necessities (for giant and for small banks) with these of different nations. The Reserve Financial institution made no atttempt no matter to offer these types of comparisons in 2018/19.

One would possibly consider nations like Norway, Sweden, Denmark, Australia and Canada, however maybe additionally superior nations the place the majority of the banking system is made up of subsidiaries of much-larger overseas banks (for instance, the Baltics). To do that correctly isn’t a superficial train of evaluating headline capital ratios. One wants to take a look at issues just like the composition of stability sheets (in a fairly granular approach), threat weights on particular person kinds of exposures (standardised and IRB) and so forth. One would possibly, in precept, take the enterprise construction of a number of New Zealand banks and really apply the foundations in different nations to see how a lot capital they’d be required to have on these guidelines, relative to the foundations right here.

If the present Reserve Financial institution coverage, and scheduled additional will increase in minimal required capital, ended up just about within the pack, relative to the scenario in different superior nations, it is likely to be thought of the top of the matter. There won’t be something very optimum about what these different nations have chosen to do, however the case for any revision to the New Zealand guidelines could be that a lot tougher to maintain than if (for instance) the total New Zealand necessities imposed a lot greater capital necessities on a lot the identical form of portfolios. There isn’t a compelling cause to imagine that the publicity to essentially severe antagonistic shocks is any higher in New Zealand than in different superior economies, so absent a compelling argument that the remainder of the world is simply “too lax”, being someplace across the median of different nations is likely to be an inexpensive benchmark for New Zealand authorities (in a world of inevitable nice uncertainty). (By the way, there could be no level in having necessities decrease than these utilized by APRA, since their necessities would set a ground for the Australian banking teams as an entire – there was too little point out of the APRA group necessities within the latest New Zealand debate).

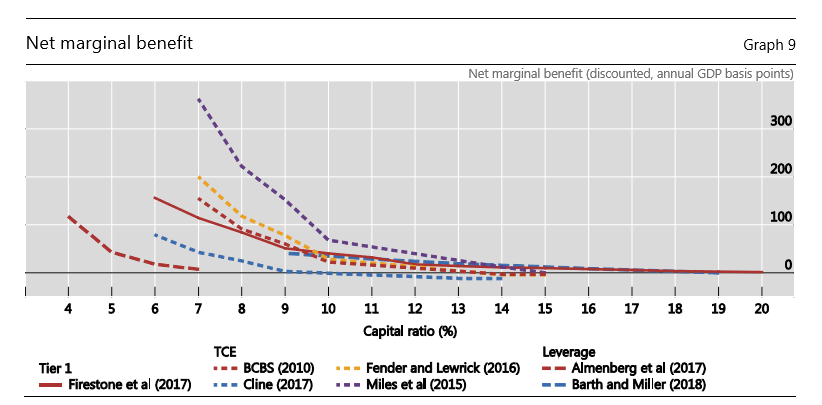

Reviewing some previous posts yesterday I additionally found this chart, taken from a 2019 working paper of the Basle Committee on Banking Supervision (which I wrote about right here)

I don’t need to fixate on the person numbers, however merely to reiterate the purpose that any wider financial positive factors from greater required minimal capital ratios abate fairly shortly as these necessities are elevated. Precise numbers which may emerge will rely closely on issues like assumed low cost charges (those utilized in these research are far beneath the usual low cost charges for us in New Zealand public coverage analysis), and the flexibility (or in any other case) of excessive capital ratios to save lots of us from monetary crises with extreme financial penalties (some extent fairly in rivalry in 2019, after I noticed that the numbers utilized by the Financial institution and their supporters have been grossly implausibly giant).

(Lastly, on this matter, it’s value remembering that capital buffers are very helpful to soak up losses, however that what issues much more – together with as regards actual financial losses and dislocations – is the standard of financial institution property, and thus financial institution lending requirements. A financial institution can have fairly giant capital buffers and but can nonetheless go off the rails fairly badly in a surprisingly brief house of time if lending requirements degrade and/or administration/Boards begin chasing lending alternatives which look superb and good within the warmth of a increase solely to show something however because the tide recedes. In all probability the most important actual financial losses don’t come up from a financial institution itself coming underneath stress, however from the gross misallocation of actual financial assets that may happen all too simply when undisciplined or excessively dangerous lending happens, and people prices are already baked in when the lending and related actual funding decisions are made, even when they solely turn into obvious when the shakeout occurs.)

Anyway, we’ll see what comes of the Financial institution’s evaluation. And if, as Hawkesby/Orr [previously]/Quigley declare, the Financial institution’s insurance policies are principally proper, whether or not they could make a compelling case to steer the general public, exterior commentators….and naturally the Minister of Finance who, I suppose, nonetheless has the specter of legislating up her sleeve.

Altering tack fully, right now marks 10 years since I left the Reserve Financial institution. As I famous on the time, that transfer was one thing of a double coincidence of desires: Graeme Wheeler actually wished me out, and I actually wished out, to be round as a home husband for our youngsters. It was an amazing transfer and I’ve not had the slightest remorse (certainly, one shudders on the thought that I would in any other case have been there when the Orr years began). Being out there for the youngsters, and serving to to allow my spouse to carry down busy jobs, will at all times rely as one of many blessings of my life (and some weeks in the past the youngest left for college).

Occasionally I take into consideration the place to subsequent. The weblog has been much less frequent in the previous couple of years (together with as a consequence of 2-3 years of pretty detached well being together with post-Covid, however now handed). Circumstances change and I’ve received busier. I’ve sometimes thought of shutting it down and doing different stuff – I had a top level view on my desk when the BPNG appointment got here via of a time-consuming challenge I’d nonetheless prefer to pursue. For now, numerous circumstances and concerns imply I’m going to attempt to self-discipline my public remark extra narrowly. There was an rising vary of issues I’d prefer to have written about however it wasn’t potential/acceptable. For this weblog that can imply primarily Reserve Financial institution issues, fiscal coverage, productiveness and never a lot else, which was the unique supposed focus. (And if a succesful, even glorious, Governor is appointed, constantly lifting the efficiency of the Financial institution, and its effectivity, openness and transparency, even perhaps Reserve Financial institution commentary will die away. There are a lot larger financial coverage challenges.)

Issues appear to be at a reasonably low ebb in and across the Reserve Financial institution. There was, particularly, the mysterious, sudden, and as-yet unexplained resignation of the Governor (we’ve had 4 Governors for the reason that Financial institution was given its operational autonomy 35 years in the past, and solely two have accomplished their phrases and left in a traditional approach, which have to be some form of undesirable superior nation report). Having slimmed down the bloated variety of Orr’s deputies by one final yr, one other of them quietly resigned and left final month on (apparently) brief discover and no particular job to go to. Of those that stay, two are (at greatest) ethically challenged and one is solely unqualified for the job she holds.

After which there’s the thriller as to why a brief Governor (particularly offered for within the Act) has not but been appointed, despite the fact that it’s now 4 weeks since Orr tossed his toys and walked out (formally ending on 31 March, however now not current). I wrote about this briefly on Monday morning when it emerged (in The Publish) that regardless of what the Minister and Financial institution had led us to imagine on the day Orr resigned (efficient 31 March), there wouldn’t be a brief Governor in place from 1 April. The Financial institution’s spokesperson, quoted within the Publish article on Monday so badly misinterpret the related provisions of the Act that the Financial institution appeared to really feel it essential to subject a launch yesterday, which added nothing however not less than didn’t muddy the water additional. The Financial institution’s Board has to (lastly) make a advice of an individual to function non permanent Governor by 28 April, however even as soon as she will get such a nomination the Minister of Finance can take as lengthy (or brief) as she likes to make an appointment (or, presumably, knock again a advice and ship the Board away to make one other).

Affordable folks would have assumed that inside a number of days of Orr saying his resignation (and storming off), the Board would have met and made a advice. With greater than three weeks discover (not less than on paper) having been given there was actually no excuse for not even having a advice on the Minister’s desk by the top of March. We’re left to marvel why. Maybe Hawkesby didn’t need the job? Maybe the Board doesn’t believe in him to do even the fill-in position? Maybe the Minister had indicated that she didn’t need him? We don’t know, and neither do worldwide markets who (like the remainder of us) have been taken off-guard by Orr’s resignation. It actually isn’t an excellent look. And if for some cause Hawkesby isn’t an possibility (and there are very slim pickings among the many different 2nd tier managers), maybe they may twist the arm of former Deputy Governor Grant Spencer and convey him again for a second stint filling in between Governors (solely it could be authorized this time)?

The unsatisfactory image was compounded just a bit in a while Monday morning when Hawkesby and the Board chair Neil Quigley fronted as much as the Finance and Expenditure Committee to announce that they have been in any case going to have a evaluation of financial institution capital necessities (their opening statements are right here). This had all been organized with the Minister of Finance, who put out a simultaneous assertion welcoming the evaluation, and confirmed by the Financial institution’s Board at a gathering final week (which the outgoing – however nonetheless in workplace, and thus nonetheless a Board member – Governor didn’t attend).

[UPDATE: Meant to mention that Hawkesby did himself no favours – if he aspires to be seen as anything other than Orr’s man – when he opened his FEC statement this way (emphasis added)

“I’d like to begin by acknowledging our Governor, Adrian Orr, who over 7 years would have attended FEC hearings more than 50 times and always been engaging. We are looking forward to continuing that relationship.”

Orr actively misled FEC repeatedly, and the frostiness of his encounters with any questioning FEC members has been repeatedly commented on. ]

Recall that, rightly or wrongly (I believe wrongly), Parliament has given policymaking powers on such issues to the Financial institution (and particularly to the underqualified Board). Recall too that only a few weeks in the past the Minister of Finance had indicated that she was looking for recommendation on methods to compel the Financial institution to vary coverage. Presumably the Board – and maybe administration – studying which approach the political winds have been blowing merely caved and organized Monday’s FEC look and announcement, slightly than threat dropping their powers. They have been, in any case, in a weak place: so far as we all know the Financial institution’s Funding Settlement for the subsequent 5 years has not but been authorised (the Minister has talked of coming cuts), there wasn’t a everlasting Governor in place, and even the appointment of a brief Governor gave the impression to be hanging in some form of limbo.

It’s at all times potential that the Financial institution itself (particularly now minus Orr – who final yr was vociferously defending present coverage and, as so usually, attacking any critics) thought {that a} evaluation was (substantively) well timed and acceptable, however it seems to be loads like bowing to political stress, at some extent of explicit weak spot. In an unbiased company. And, frankly, since I imagine that massive coverage calls needs to be made by elected politicians, I’d slightly the federal government had truly legislated to shift big-picture prudential policymaking powers again to the Minister of Finance, whereas retaining a significant position for a better-performing Reserve Financial institution to advise and to implement (primarily the mannequin in most different areas of presidency policymaking).

There are additionally numerous questions on the place to from right here with the evaluation. The suggestion from Quigley is that the evaluation might be accomplished by the top of the yr, however whereas choices are lastly a matter for the Financial institution’s Board, it does invite the query of what position (if any) the brand new everlasting Governor is to have (not less than whether it is anybody apart from Hawkesby). By regulation, the non permanent Governor can (finally) be appointed for six months, extendable for one more three. Even when the Board will get on and advertises for a everlasting Governor this month, at greatest it is going to be a number of months earlier than a brand new Governor is on board (eg there was roughly six months between Don Brash resigning and Alan Bollard beginning work). With a non-expert Board wouldn’t one usually anticipate the Governor to be taking the lead in formulating the recommendation on which the Board would lastly make choices? Or is the brand new particular person to be introduced with a fait accompli?

After which after all, there are questions concerning the nature of the evaluation itself. Is it purely look theatre (“we have to appear like we’re doing one thing”) or is it genuinely a case of an open-minded reassessment? There’s discuss of consulting banks earlier than any adjustments are made, however what concerning the wider group of specialists and commentators (a lot of whom submitted on the 2019 coverage proposals/choices)? And for all of the discuss of commissioning “worldwide specialists”, absolutely solely essentially the most naive would take that at face worth. You select your skilled in line with your pursuits (eg a distinct group if one wished folks seemingly largely to reaffirm your priors than for those who have been genuinely opening issues up). I reread yesterday my submit concerning the “worldwide specialists” Orr had commissioned in 2019, and the slightly restricted (and conveniently-supportive, having been chosen for a objective) contribution they made. These earlier specialists have been barred from speaking to anybody in New Zealand apart from the handful the Financial institution authorised. Will it’s any totally different this time?

And though again in 2019 the regulation was such that the selections have been nonetheless these of Orr alone (the Board then had a distinct position), Quigley was additionally the Board chair then and has had Orr’s again proper all through his time in workplace – apparently serving the Governor’s pursuits greater than the general public’s curiosity. His personal questionable relationship with the details on numerous events has additionally been documented right here on numerous events. Apparently Quigley introduced fairly properly at FEC on Monday, however so what? When he isn’t underneath stress – and FEC was extra attuned to welcome the evaluation than ask very looking questions – he’s a clean operator (when he’s underneath stress, properly…..see his press convention on the afternoon Orr resigned).

My very own view, again in 2019, was that even the ultimate Orr place – which pulled again from the preliminary proposals – went additional than was actually warranted. However one of many issues I’d be in search of as a part of the Financial institution’s evaluation this yr – and as a check of seriousness and openmindedness – is a rigorous and clear comparability of the New Zealand capital necessities (for giant and for small banks) with these of different nations. The Reserve Financial institution made no atttempt no matter to offer these types of comparisons in 2018/19.

One would possibly consider nations like Norway, Sweden, Denmark, Australia and Canada, however maybe additionally superior nations the place the majority of the banking system is made up of subsidiaries of much-larger overseas banks (for instance, the Baltics). To do that correctly isn’t a superficial train of evaluating headline capital ratios. One wants to take a look at issues just like the composition of stability sheets (in a fairly granular approach), threat weights on particular person kinds of exposures (standardised and IRB) and so forth. One would possibly, in precept, take the enterprise construction of a number of New Zealand banks and really apply the foundations in different nations to see how a lot capital they’d be required to have on these guidelines, relative to the foundations right here.

If the present Reserve Financial institution coverage, and scheduled additional will increase in minimal required capital, ended up just about within the pack, relative to the scenario in different superior nations, it is likely to be thought of the top of the matter. There won’t be something very optimum about what these different nations have chosen to do, however the case for any revision to the New Zealand guidelines could be that a lot tougher to maintain than if (for instance) the total New Zealand necessities imposed a lot greater capital necessities on a lot the identical form of portfolios. There isn’t a compelling cause to imagine that the publicity to essentially severe antagonistic shocks is any higher in New Zealand than in different superior economies, so absent a compelling argument that the remainder of the world is simply “too lax”, being someplace across the median of different nations is likely to be an inexpensive benchmark for New Zealand authorities (in a world of inevitable nice uncertainty). (By the way, there could be no level in having necessities decrease than these utilized by APRA, since their necessities would set a ground for the Australian banking teams as an entire – there was too little point out of the APRA group necessities within the latest New Zealand debate).

Reviewing some previous posts yesterday I additionally found this chart, taken from a 2019 working paper of the Basle Committee on Banking Supervision (which I wrote about right here)

I don’t need to fixate on the person numbers, however merely to reiterate the purpose that any wider financial positive factors from greater required minimal capital ratios abate fairly shortly as these necessities are elevated. Precise numbers which may emerge will rely closely on issues like assumed low cost charges (those utilized in these research are far beneath the usual low cost charges for us in New Zealand public coverage analysis), and the flexibility (or in any other case) of excessive capital ratios to save lots of us from monetary crises with extreme financial penalties (some extent fairly in rivalry in 2019, after I noticed that the numbers utilized by the Financial institution and their supporters have been grossly implausibly giant).

(Lastly, on this matter, it’s value remembering that capital buffers are very helpful to soak up losses, however that what issues much more – together with as regards actual financial losses and dislocations – is the standard of financial institution property, and thus financial institution lending requirements. A financial institution can have fairly giant capital buffers and but can nonetheless go off the rails fairly badly in a surprisingly brief house of time if lending requirements degrade and/or administration/Boards begin chasing lending alternatives which look superb and good within the warmth of a increase solely to show something however because the tide recedes. In all probability the most important actual financial losses don’t come up from a financial institution itself coming underneath stress, however from the gross misallocation of actual financial assets that may happen all too simply when undisciplined or excessively dangerous lending happens, and people prices are already baked in when the lending and related actual funding decisions are made, even when they solely turn into obvious when the shakeout occurs.)

Anyway, we’ll see what comes of the Financial institution’s evaluation. And if, as Hawkesby/Orr [previously]/Quigley declare, the Financial institution’s insurance policies are principally proper, whether or not they could make a compelling case to steer the general public, exterior commentators….and naturally the Minister of Finance who, I suppose, nonetheless has the specter of legislating up her sleeve.

Altering tack fully, right now marks 10 years since I left the Reserve Financial institution. As I famous on the time, that transfer was one thing of a double coincidence of desires: Graeme Wheeler actually wished me out, and I actually wished out, to be round as a home husband for our youngsters. It was an amazing transfer and I’ve not had the slightest remorse (certainly, one shudders on the thought that I would in any other case have been there when the Orr years began). Being out there for the youngsters, and serving to to allow my spouse to carry down busy jobs, will at all times rely as one of many blessings of my life (and some weeks in the past the youngest left for college).

Occasionally I take into consideration the place to subsequent. The weblog has been much less frequent in the previous couple of years (together with as a consequence of 2-3 years of pretty detached well being together with post-Covid, however now handed). Circumstances change and I’ve received busier. I’ve sometimes thought of shutting it down and doing different stuff – I had a top level view on my desk when the BPNG appointment got here via of a time-consuming challenge I’d nonetheless prefer to pursue. For now, numerous circumstances and concerns imply I’m going to attempt to self-discipline my public remark extra narrowly. There was an rising vary of issues I’d prefer to have written about however it wasn’t potential/acceptable. For this weblog that can imply primarily Reserve Financial institution issues, fiscal coverage, productiveness and never a lot else, which was the unique supposed focus. (And if a succesful, even glorious, Governor is appointed, constantly lifting the efficiency of the Financial institution, and its effectivity, openness and transparency, even perhaps Reserve Financial institution commentary will die away. There are a lot larger financial coverage challenges.)