Context

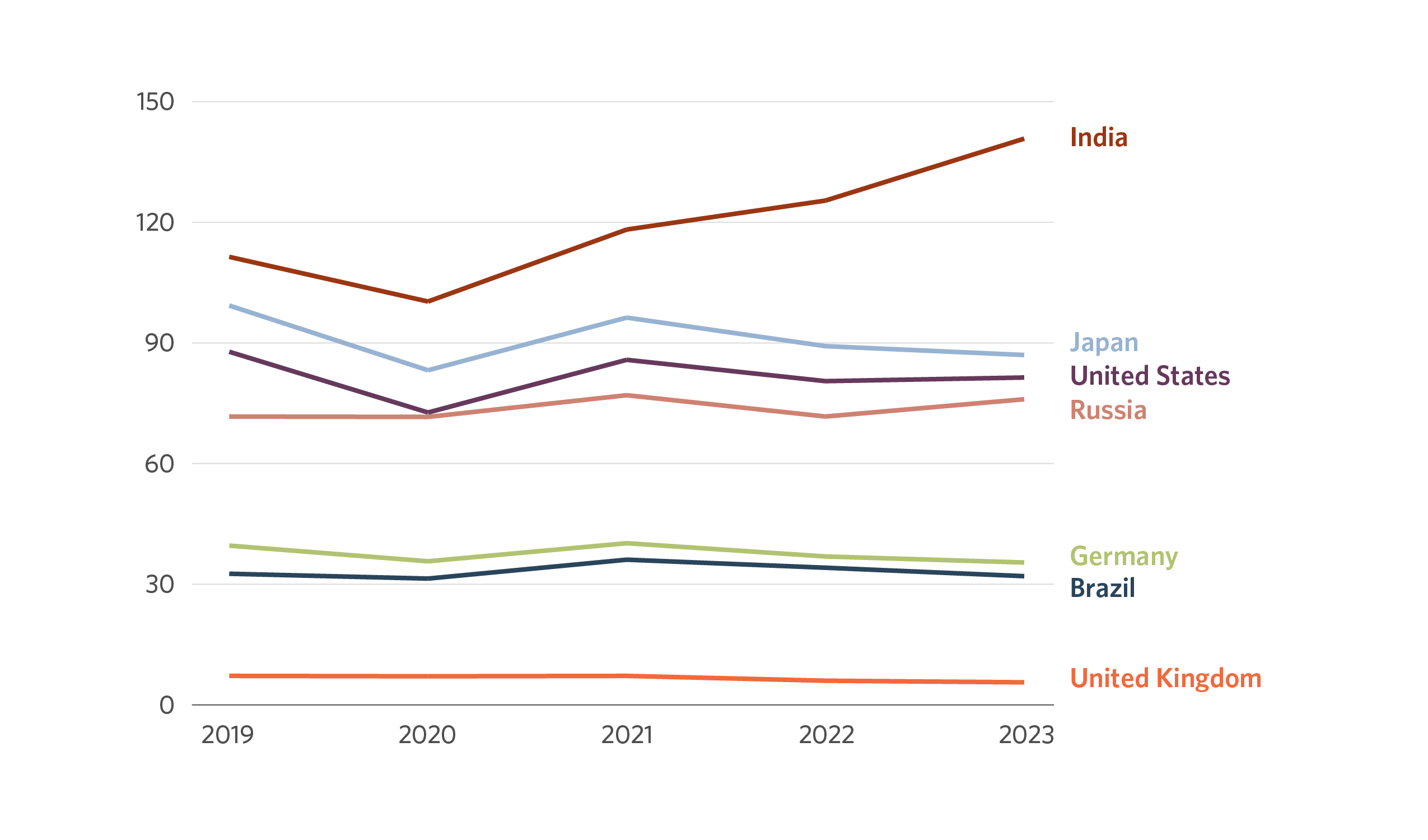

Metal consumption is a vital issue for financial development. Metal contributes considerably to creating sectors reminiscent of railways, building, vehicles, and so on. An analogous development sample exists between India’s gross home product and metal manufacturing[1]. Whereas the metal demand has plateaued in most superior economies, it’s rising with a CAGR of 4.79% in India.

Determine 1: Complete Crude Metal Manufacturing

Supply: World Metal Affiliation

The iron and metal (I&S) business, a hard-to-abate sector, is India’s largest industrial emitter, accounting for roughly 10-12% of the nation’s whole carbon emissions. Its hard-to-abate nature stems from two main components: reliance on carbon-intensive processes and the complexity of changing fossil-fuel-based power as feedstock.

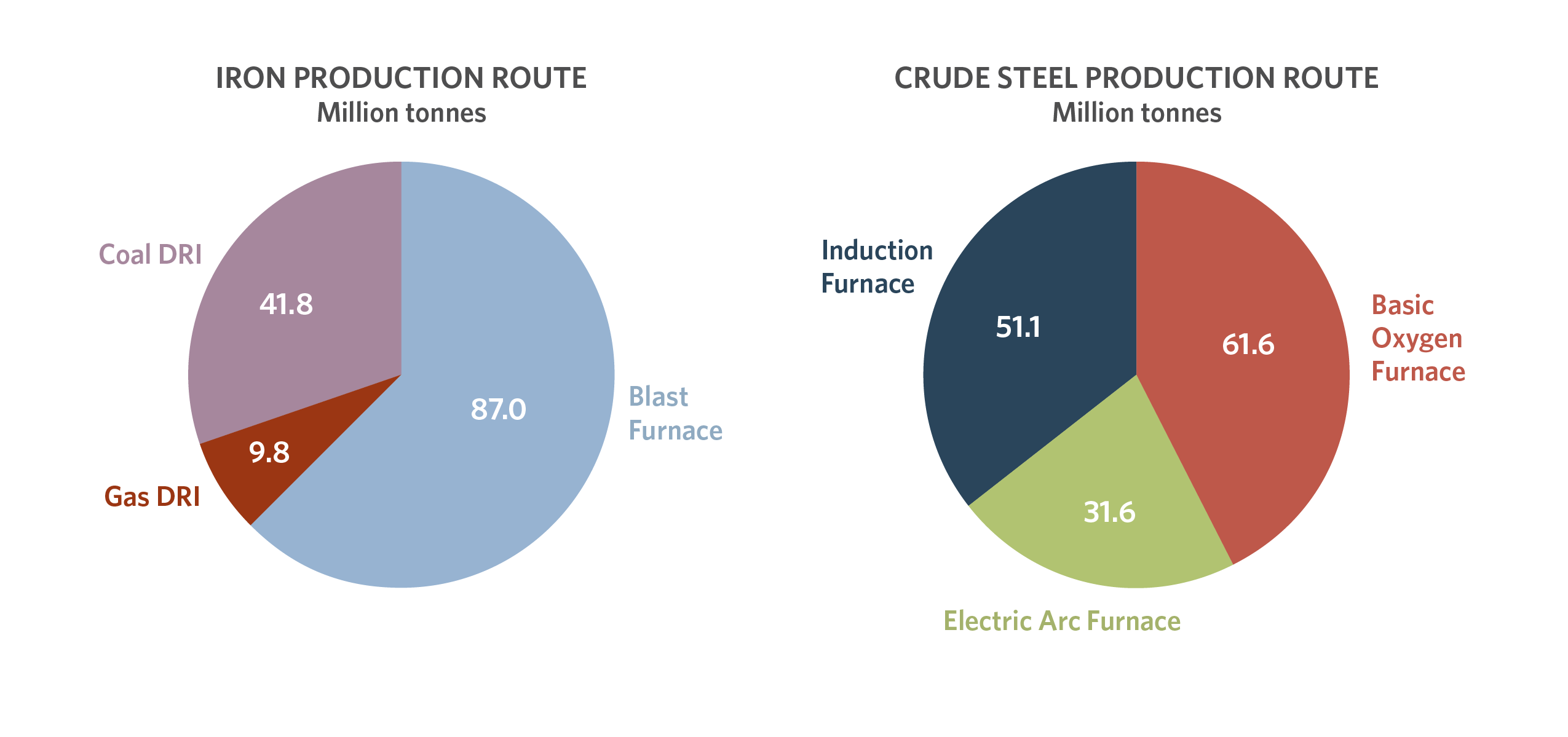

India’s metal sector includes two segments: the first sector, which incorporates massive built-in metal crops (ISPs), and the secondary sector, which includes smaller secondary metal producers (SSPs). They’ve totally different manufacturing routes: the first sector makes use of the Blast Furnace-Primary Oxygen Furnace (BF-BOF) steelmaking route, whereas the secondary sector largely depends on the Direct Lowered Iron-Electrical Arc Furnace (DRI-EAF)/ Direct Lowered Iron-Induction Furnace (DRI-IF) route.

Determine 2: Iron Manufacturing Route in Million Tonnes in India (FY23-24)

Determine 3: Crude Metal Manufacturing Route in Million Tonnes in India (FY23-24)

Supply: Ministry of Metal

Obstacles to decarbonization for the first and secondary sectors differ due to their technological variations and would require coverage assist tailor-made to their distinctive wants and challenges.

Industrial sectors like metal are more likely to endure a gradual transition as a result of they usually don’t have a financially viable ‘inexperienced various,’ i.e., they don’t have a commercially out there pathway to decarbonization absolutely aligned with the Paris Settlement. This hinders their capacity to entry the inexperienced financing marketplace for new initiatives by way of devices reminiscent of inexperienced bonds as they require capital allocation into demonstrable inexperienced applied sciences.

Contemplating this, Transition finance (TF) is rising as an necessary finance class that permits the move of finance in the direction of ‘transitional actions’ in hard-to-abate sectors reminiscent of metal.

Broadly, transitional actions confer with these actions which are necessary for emission discount within the hard-to-abate and energy-intensive sectors however can’t be categorised as inexperienced as a result of they don’t meet environmental standards reminiscent of zero or near-zero emissions. TF is crucial for investments in incremental decarbonization levers for present BF-BOF crops that step by step cut back the emission depth of the sector, thus paving the best way for the sluggish maturation of future zero-emissions applied sciences whereas guaranteeing incremental carbon abatement at this time.

Monetary devices are the essential enablers of finance flows to emission-intensive industries, which are sometimes locked out of the inexperienced finance market as a result of they don’t have demonstrable inexperienced applied sciences. TF devices are broadly categorized into 4 segments:

| Instrument: | KPI-linked | Use-of-proceeds | Hybrid | Conventional |

| Instance: | Sustainability-linked loans (SLLs), Sustainability-linked bonds (SLBs) | Transition loans, Transition bonds | Sustainability-linked inexperienced bonds (SLGBs)[2] | Public/non-public fairness, conventional loans/bonds |

Devices beneath the umbrella of TF is probably not restricted to these labeled as ‘transition.’ Now we have noticed solutions that any instrument could also be categorized as a TF instrument if it incentivizes an entity-wide transformation to decrease emission depth[3]. These could embody devices reminiscent of sustainability-linked bonds (SLBs) and sustainability-linked loans (SLLs).

There are not any universally accepted pointers for devices labeled as ‘transition,’ their capital allocation necessities, and penalty mechanisms (if any). Based mostly on the commentary of devices issued thus far, they are often categorized as use-of-proceeds with none penalty mechanism.

The secondary metal sector has a viable near-term decarbonization pathway due to its increased use of scrap metal, technologically possible low-emission feedstock (DRI by way of pure gasoline/hydrogen), and an electrified manufacturing course of.

Due to this fact, the first sector is a greater candidate for TF as there are not any commercially viable ‘inexperienced’ applied sciences, however there are applied sciences that may present incremental emission reductions at this time. The capital raised by way of TF devices might be leveraged for gradual main sector transition in two important methods:

- Integration of finest out there applied sciences (BATs): A large scope exists for adopting BATs within the BF-BOF crops, enabling improved power effectivity and restoration. BATs reminiscent of Pulverized Coal Injection (PCI), Coke-DRY-Quenching (CDQ), and Prime Strain Restoration Turbine (TRT) have a destructive price of CO2 abatement and are subsequently economically viable for CO2 mitigation. Cumulatively, chosen BATs can ship as much as 15% discount in emissions for the BF-BOF route (CPI, 2023[ZF6] ).

- Partial [ZF7] CCU/S-based BF-BOF crops: TF proceeds can be utilized to arrange CCU/S models for the BF-BOF-based ISPs that may seize the flue gases launched from the flue stack, a significant contributor to the CO2 emissions in steelmaking. Though the CO2 abatement potential for this intervention is excessive, the know-how isn’t commercially mature, and the price of abatement stays unviable at $50-60/tCO2 (CPI, 2024). However, the price of abatement is predicted to fall within the coming many years due to technological innovation, coverage and financing assist, and value discount within the set-up of CCU/S models, making this a very good candidate for TF. The potential of changing the captured CO2 into value-added downstream merchandise is beneath investigation by CPI, which might enhance the viability of this selection.

Based on tracked information as much as 2023, the Indian metal sector had about 195 MTPA of metal manufacturing capability within the pipeline awaiting monetary closure. Two-thirds of the brand new capability is predicted to be added by way of the BF-BOF route. If the crops beneath growth can entry TF, it could assist them obtain their emission depth targets/objectives by integrating emission discount applied sciences of their proposed crops. Due to this fact, TF might be pivotal in enabling the gradual transition of the first sector’s present and deliberate crops by bridging the hole till commercially viable low-carbon applied sciences emerge.

Entity-level transition plans are the cornerstone of commercial transition to decrease emissions. A possible, benchmarked, and bold transition plan is a essential enabler for firms to entry transition finance. It’s essential to make sure that transition plans are reasonable, keep away from superficial or deceptive claims, and cling to core transition finance ideas. This entails benchmarking towards acknowledged requirements and finest practices and guaranteeing alignment with science-based targets for attaining net-zero emissions.

In our work, we now have established a framework for assessing the credibility of transition plans primarily based on steerage supplied by Local weather Bonds Initiative (CBI), the Organisation for Financial Co-operation and Growth (OECD), and the Affiliation of Southeast Asian Nations (ASEAN).

Some Indian metal firms have disclosed their transition plans. JSW Metal is a frontrunner on this regard, and we now have assessed their plan towards our framework.

Desk 1: Evaluation Framework

| Component | Steering | JSW Metal Restricted |

| Internet-zero emissions objective | Science-based goal is in line with the 1.5° C goal of the Paris Settlement, with no to low overshoot and, as a minimum, effectively beneath 2° C. | For part I, the wager is on power effectivity, materials circularity, renewable power, operational effectivity, and so on. Section II bets on lowering the price of inexperienced hydrogen and CCU/S. Whereas the sustainability report talks about partnerships & alternatives, there isn’t a particular roadmap for adoption or securing funding for applied sciences past 2030. |

| Interim targets (phasing) | The online-zero goal 12 months is 2050. The targets for phases I and II have been derived from the IEA iron and metal know-how roadmap revealed in 2020, which is in line with the 1.5° C situation. | The long-term transition objective includes interim (quick, medium, and long-term) quantifiable and time-bound targets. Embrace a proof of methodologies, assumptions used, and benchmarking undertaken. |

| Know-how choice | Any science-based pathways/roadmap is in line with the objectives of the Paris Settlement. | There isn’t a readability on the usage of offsets. Contemplating the plan suggests an emission depth of 0.996 tCO2/TCS in 2050, offsets and CCUS will play a vital position in attaining internet zero. |

| Protection: scope 1, 2, and three | Scope 1 & 2 on the minimal. Embrace Scope 3, the place materials and exclusion are to be defined and justified. | JSW Metal can be net-neutral in carbon emissions for all operations beneath direct management. There isn’t a particular point out of the inclusion or exclusion of scope III emissions. |

| Use of carbon credit & offsets | It shouldn’t be used as a substitute for lowering emissions or delaying mitigation motion. Ideally, there needs to be not more than 10 % abatement. | The monetary plan particulars the transition’s implications, the financing necessities for executing the transition plan, and how one can obtain such financing. |

| Financing | The monetary plan particulars the implications of the transition, the financing necessities for the execution of the transition plan, and how one can obtain such financing. | JSW has raised two SLBs linked to its 2030 emission-intensity discount goal; nonetheless, its sustainability report doesn’t chart a path for elevating or deploying funds past 2030. |

| Avoiding carbon lock-in | Establish present belongings and new investments prone to resulting in carbon lock-in. Develop a method and course of for the accountable retirement of high-emitting belongings. | No point out. |

| Do No Vital Hurt (DNSH) | Keep away from hurt to different sustainability targets (e.g., biodiversity) on the exercise and entity stage. | No point out. |

| Governance | Outline processes and duties for normal monitoring and reporting progress aligned with disclosure requirements (e.g., IFRS S1 and S2), well timed revisions of targets, and up to date plans. | The governance framework is in place with the Board of Administrators at Apex. |

| Third-party verification | Third-party verification of credibility of transition plans and actions for effectiveness, completeness, and efficiency towards benchmarks. | No point out. |

| Simply transition issues | Assess and account for hostile environmental and social impacts, together with on the labor pressure and communities, from the transition within the transition plan. A method for mitigating such impacts is to be included within the plan. | No point out. |

Supply: CPI Evaluation

A reputable transition plan is essential for metal firms to chart their manner ahead to internet zero and safe transition finance to speed up decarbonization. It’s advisable for different Indian metal firms to discover and undertake comparable methods.

This weblog serves as an introduction to our work on transition finance for the Indian I&S sector. Keep tuned for the upcoming launch of our dialogue paper on February 25th and a full-fledged report on the subject later within the 12 months.

[1] The Indian Metal Trade: Progress, Challenges, and Digital Disruption

[2] Inexperienced sustainability-linked bonds: Attending to the guts of accountability and impression in sustainable financing

[3] Transition Finance: Investigating the State of Play – A Stocktake of Rising Approaches and Monetary Devices