Increasingly buying and selling in U.S. shares is coming from abroad. A few of these merchants are used to how buying and selling in futures, FX and different markets work, the place they provide buying and selling outdoors U.S. working hours, generally 24 hours a day.

Because the U.S. inventory market strikes nearer to buying and selling “across the clock,” there are some issues we want to consider.

To be honest, trades in U.S. shares can already happen after hours (particularly when there may be information). Though, the foundations for buying and selling are completely different – and numerous the investor protections just like the NBBO aren’t enforced.

There are various issues tied to buying and selling across the clock, corresponding to when does a day conclude and the subsequent buying and selling day begin. It doesn’t essentially must be midnight. Moreover, having a quick second to permit for the trade to course of issues like dividends and splits and different company actions – lots of which have an effect on costs – is important as we migrate our procedures to help across the clock markets.

For instance, if a inventory is doing a cut up, restrict costs and share portions might want to change. So, if an organization does a 10-for-1 inventory cut up:

- The worth ought to fall to 1/tenth of its prior worth, so the market cap (valuation) is similar after the cut up.

- The share portions to purchase and promote ought to enhance by 10x.

- That means the money required is similar as earlier than the cut up.

When can be a great time to do that?

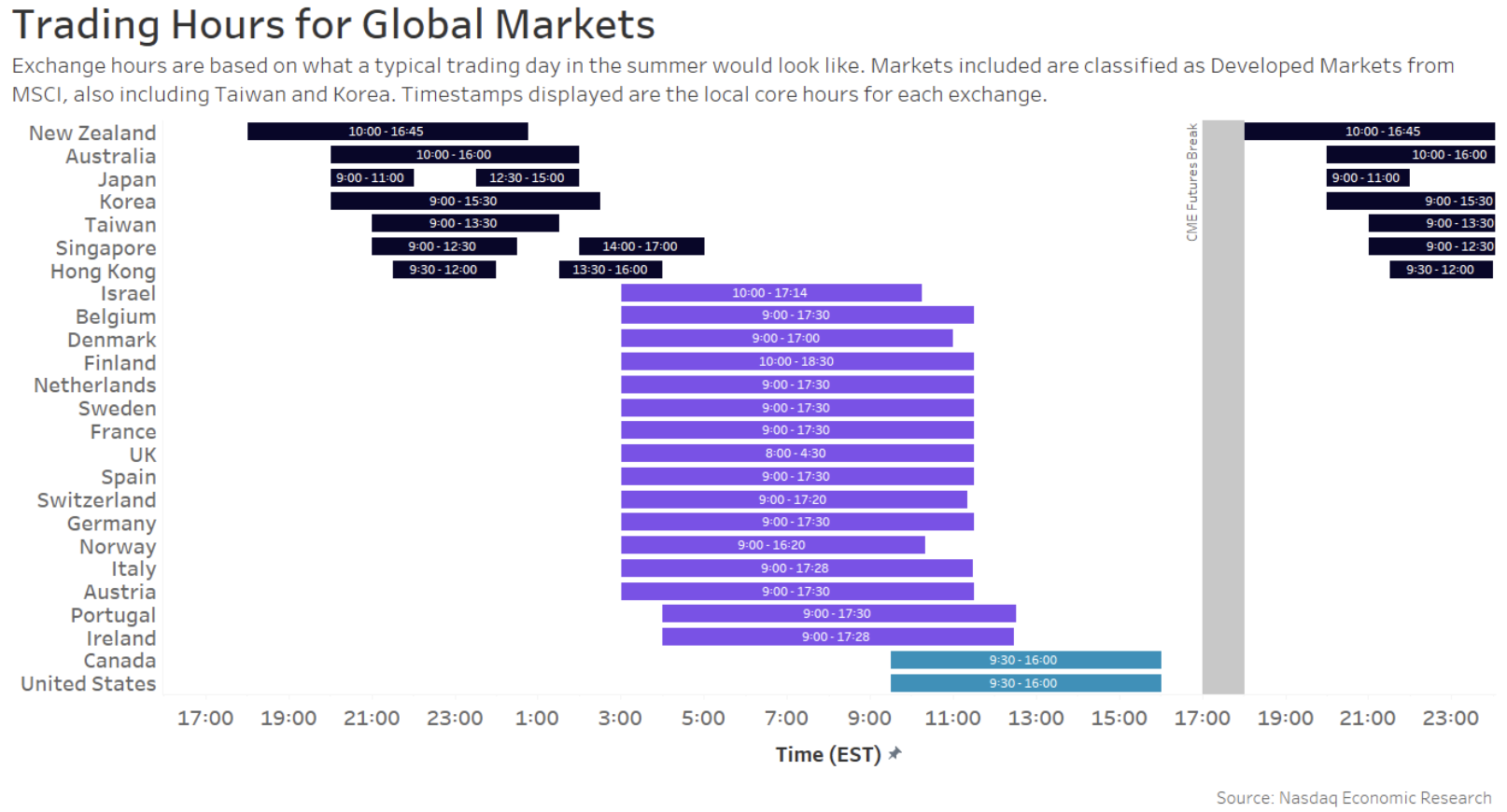

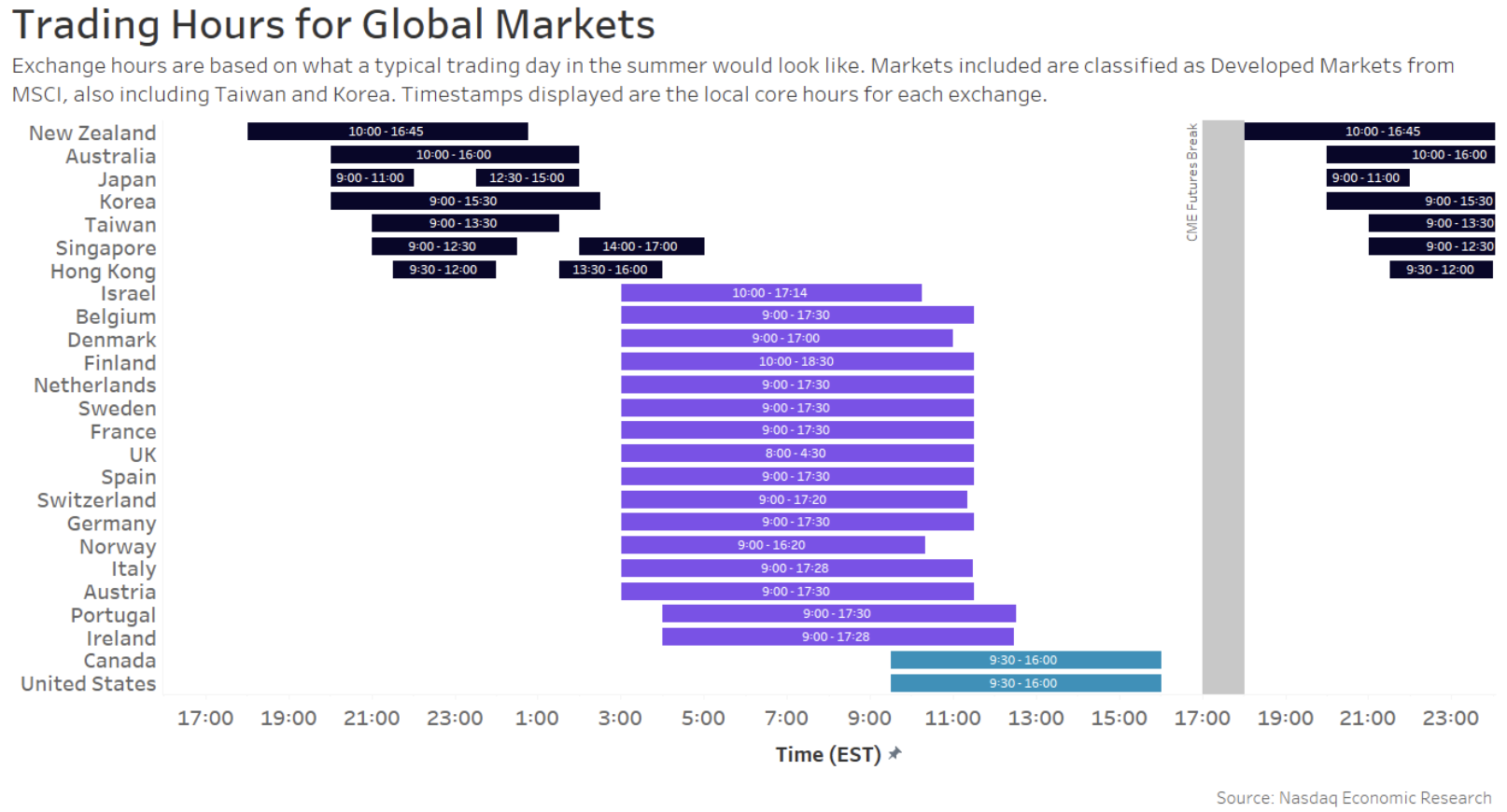

If we have a look at the completely different instances that every one the biggest inventory markets are “formally” open around the globe, midnight U.S. time won’t be essentially the most logical time to pause the market.

At midnight within the U.S., markets in international locations like Australia, Japan and Korea are already open. Meaning traders in these international locations are additionally awake and in a position to commerce (domestically).

Chart 1: Official inventory market hours for the bigger markets around the globe

Apparently, there’s a interval shortly after the U.S. shut the place no markets on this planet are open. Japan and Korean markets don’t open till 10 p.m. (New York time). Even CME’s Globex Futures market pauses every evening throughout this window, halting buying and selling from 5pm-6pm (New York time).

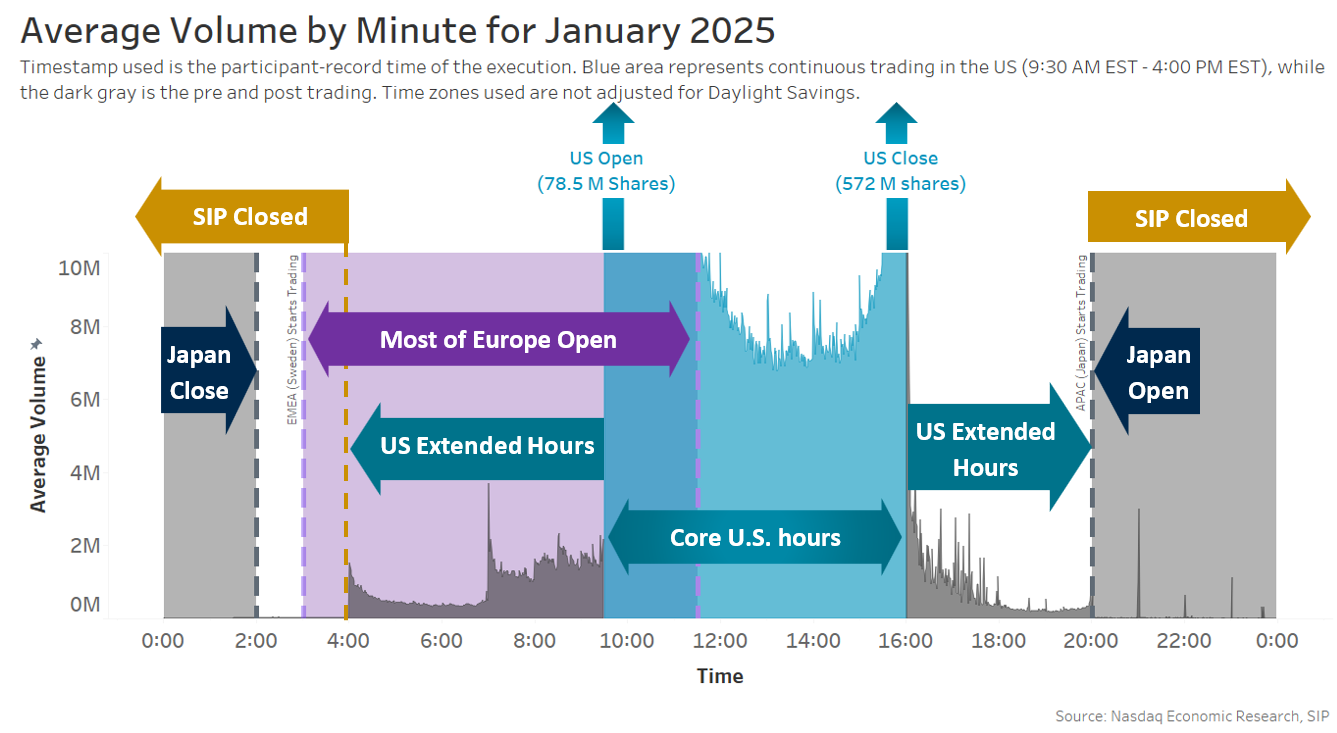

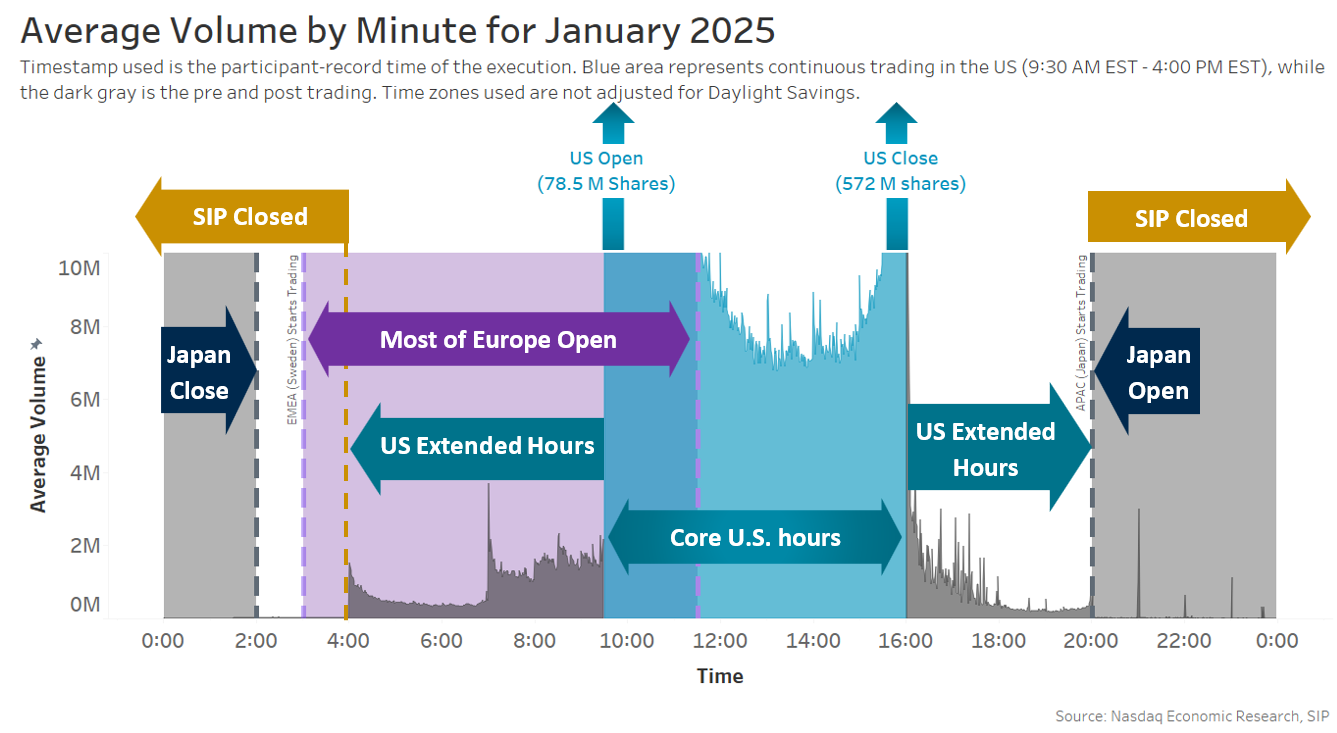

After we have a look at inventory buying and selling exercise, primarily based on time stamps reported to the SIP (Chart 2), we see that the interval from 4 p.m. till 6 p.m. remains to be fairly busy, and residual buying and selling seems elevated proper as much as 8 p.m., which is when the SIP itself formally pauses for the evening, reopening at 4 a.m.

Nevertheless, when the SIP reopens, there are trades reported from the interval when the SIP was closed, though they’re much decrease than when the SIP is open and have a tendency to cluster across the top-of-each-hour.

Chart 2: Volumes proven by commerce timestamps on the SIP throughout a mean 24-hour day

Possibly by midnight (U.S. time) tomorrow ought to have already got began

Though it may appear pure to us within the U.S. to cease the day round midnight, it is essential to keep in mind that that is about worldwide traders.

Taking a look at instances the place worldwide buying and selling is likely to be extra energetic, it’d make sense to pause markets earlier within the night and begin tomorrow’s buying and selling earlier than the clock formally strikes midnight.

It is simply one of many issues we want to consider altering!

Increasingly buying and selling in U.S. shares is coming from abroad. A few of these merchants are used to how buying and selling in futures, FX and different markets work, the place they provide buying and selling outdoors U.S. working hours, generally 24 hours a day.

Because the U.S. inventory market strikes nearer to buying and selling “across the clock,” there are some issues we want to consider.

To be honest, trades in U.S. shares can already happen after hours (particularly when there may be information). Though, the foundations for buying and selling are completely different – and numerous the investor protections just like the NBBO aren’t enforced.

There are various issues tied to buying and selling across the clock, corresponding to when does a day conclude and the subsequent buying and selling day begin. It doesn’t essentially must be midnight. Moreover, having a quick second to permit for the trade to course of issues like dividends and splits and different company actions – lots of which have an effect on costs – is important as we migrate our procedures to help across the clock markets.

For instance, if a inventory is doing a cut up, restrict costs and share portions might want to change. So, if an organization does a 10-for-1 inventory cut up:

- The worth ought to fall to 1/tenth of its prior worth, so the market cap (valuation) is similar after the cut up.

- The share portions to purchase and promote ought to enhance by 10x.

- That means the money required is similar as earlier than the cut up.

When can be a great time to do that?

If we have a look at the completely different instances that every one the biggest inventory markets are “formally” open around the globe, midnight U.S. time won’t be essentially the most logical time to pause the market.

At midnight within the U.S., markets in international locations like Australia, Japan and Korea are already open. Meaning traders in these international locations are additionally awake and in a position to commerce (domestically).

Chart 1: Official inventory market hours for the bigger markets around the globe

Apparently, there’s a interval shortly after the U.S. shut the place no markets on this planet are open. Japan and Korean markets don’t open till 10 p.m. (New York time). Even CME’s Globex Futures market pauses every evening throughout this window, halting buying and selling from 5pm-6pm (New York time).

After we have a look at inventory buying and selling exercise, primarily based on time stamps reported to the SIP (Chart 2), we see that the interval from 4 p.m. till 6 p.m. remains to be fairly busy, and residual buying and selling seems elevated proper as much as 8 p.m., which is when the SIP itself formally pauses for the evening, reopening at 4 a.m.

Nevertheless, when the SIP reopens, there are trades reported from the interval when the SIP was closed, though they’re much decrease than when the SIP is open and have a tendency to cluster across the top-of-each-hour.

Chart 2: Volumes proven by commerce timestamps on the SIP throughout a mean 24-hour day

Possibly by midnight (U.S. time) tomorrow ought to have already got began

Though it may appear pure to us within the U.S. to cease the day round midnight, it is essential to keep in mind that that is about worldwide traders.

Taking a look at instances the place worldwide buying and selling is likely to be extra energetic, it’d make sense to pause markets earlier within the night and begin tomorrow’s buying and selling earlier than the clock formally strikes midnight.

It is simply one of many issues we want to consider altering!