Prepping slides for macro, discovered these fascinating correlations.

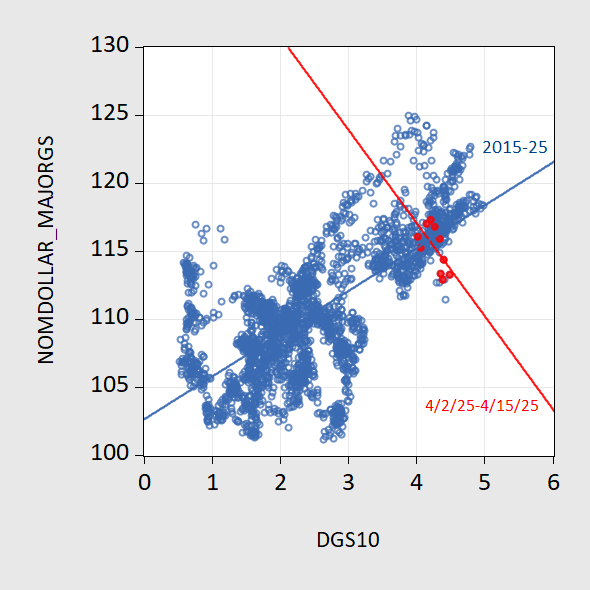

First, how the power of the greenback correlates with the Treasury 10 12 months yield, day by day 2015-23 April 2025.

Determine 1: Nominal greenback index vs. basket of main nation currencies (blue circles), and OLS match (blue line), and observations for 4/2/2025-4/15/2025 (pink circles). Supply: Fed and Treasury by way of FRED, and writer’s calculations.

Within the two weeks round Liberation Day, Treasury 10 12 months yields rose because the greenback fell (pink circles in Determine 1).

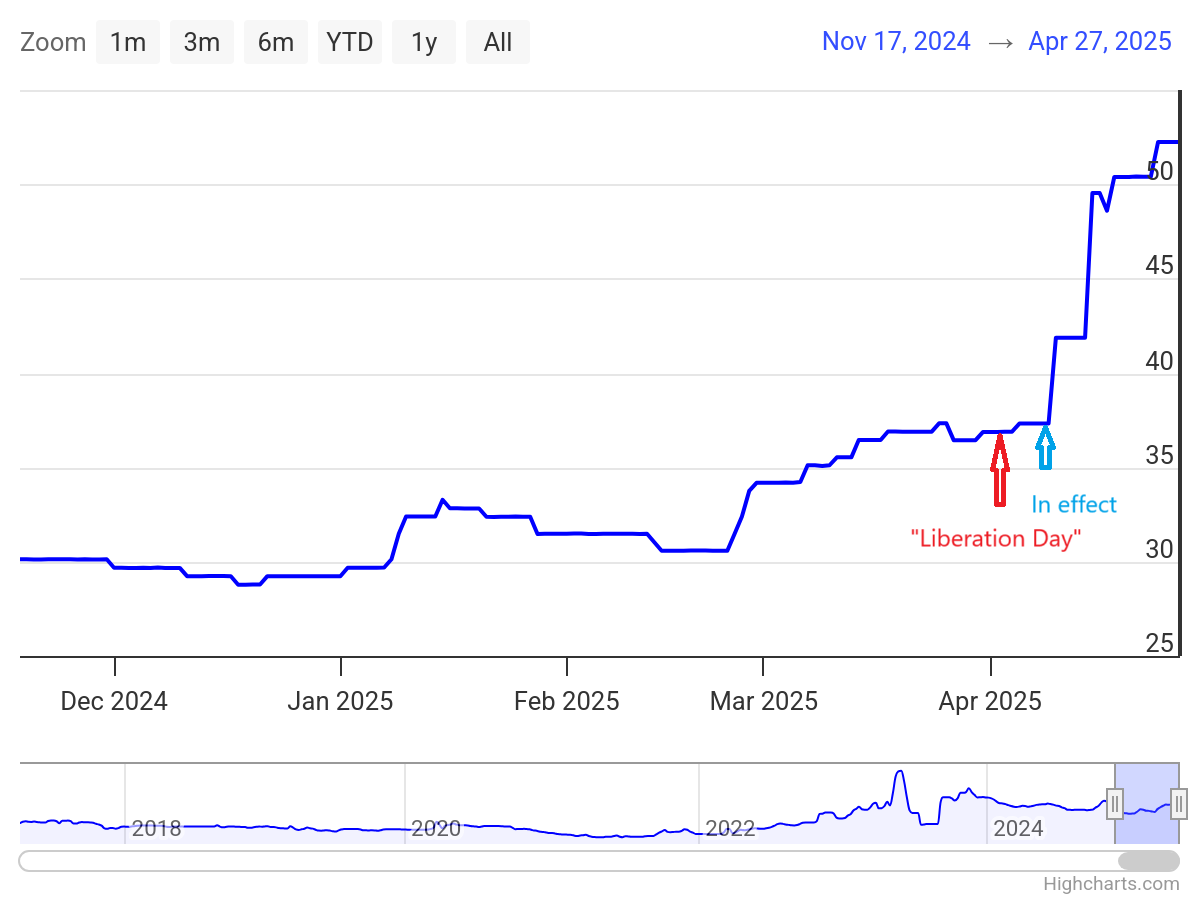

One apparent place to search for a loss in credibility is in credit score scores; nevertheless, these are notoriously sticky. I checked out credit score default swap spreads, and was shocked, as I assumed solely in rising market economies in disaster did I see noticeable actions — resembling these since April 2, “Liberation Day”.

Credit score default swap spreads on 5 12 months Treasuries. Supply: worldgovernmentbonds.com, annotated by writer.

Giant actions solely within the context of the US. To cite:

As of the most recent replace on 27 Apr 2025 13:45 GMT+0, the United States 5 Years Credit score Default Swap (CDS) worth stands at 52.25 foundation factors. This CDS worth interprets to an implied likelihood of default of 0.87%, primarily based on a presumed restoration charge of 40%.

All I can say is, thanks Trump!