Whereas globally, FMCG/ client non-discretionary sectors are considered as defensive performs, in India, for over a decade, in addition they served as aggressive progress bets. Why not, when GDP was rising persistently in mid- to high-single digits pulling up tens of millions of individuals out of poverty and pushing them into the consumption class! On prime of this, a rising prosperous middle-class drove elevated demand. The theme performed out so nicely between 2010 and 2019 with Nifty FMCG index delivering 263 per cent, considerably outperforming Nifty 50 which delivered 128 per cent. HUL and Nestle India have been bumper hits throughout this era, returning 515 per cent and 288 per cent respectively.

However the final 5 years inform a completely totally different story with Nifty FMCG index returning simply 95 per cent, whereas Nifty 50 zoomed 159 per cent. Business leaders like HUL and Nestle India even underperformed the sectoral index, returning a meagre 0.5 per cent and 34.5 per cent throughout the identical interval.

Nonetheless, put up this underperformance, and amid international trade-war pushed uncertainties, views now are once more rising in favour of FMCG shares. However has there been a good reset within the valuation? What’s weighing on the sector, how are corporations responding and what does all of it imply for long-term buyers? Here’s a lowdown.

Consumption blues

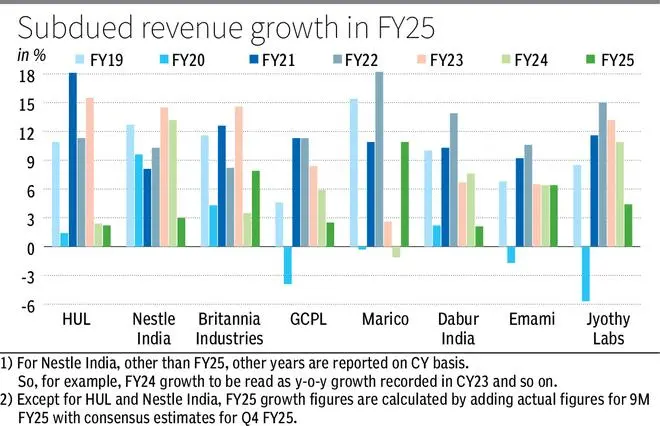

Nearly your entire FMCG pack forecasted a double-digit quantity progress for FY25, at the very least from H2 FY25, with a gradual restoration in rural, whereas city continues its progress trajectory. However what really performed out has been starkly totally different. Whereas rural markets, which have been a drag put up Covid, recovered from This fall FY24, city markets which carried the mantle till FY24 are underperforming now.

After many seasons of erratic monsoon post-Covid, 9M FY25 noticed inexperienced shoots with higher agricultural output. With the advance estimates of wheat manufacturing signalling a robust harvest and the present market costs at a premium to the minimal help value, the restoration within the rural markets appears set to proceed into FY26.

Nonetheless, city markets are seeing premiumisation as a key development with mass-market merchandise, which drive the majority of FMCG enterprise, underperforming. And apparently, many corporations noticed small packs flying off the cabinets quicker in Q3 FY25, which might be an indication of misery.

An alternate line of thought gaining floor is that whereas a slowdown is noticed within the progress trajectory of the listed giants, it’s not totally a results of cyclical financial slowdown and inflation lately. Corroboration comes from digital-first direct-to-consumer (D2C) manufacturers, with the correct formulations, persevering with to develop exponentially (albeit on a low base), regardless of being skewed in direction of the city premium.

There may be an inevitable structural shift going down within the distribution channels and the go-to-market methods. So, slowdown aside, altering dynamics, together with D2C gamers gaining market share, additionally have to be factored whereas contemplating investments within the sector.

Distribution conundrum

There have been instances when gamers within the business might flex their muscle mass stating their large community of distributors and kirana retailer retailers.

However disruption has come through fast commerce (q-commerce). Although e-commerce was already within the fray, the actual disruption was led to by q-commerce, being the actual various to the kirana shops, assembly your last-minute wants.

With the city distribution channels disrupted by q-commerce, the businesses have began consolidating their city outreach, specializing in ‘high-potential retailers’, whereas persevering with to develop their rural outreach. Firms at the moment are even tailoring SKUs by channel to spur progress.

HUL, then again, in a bid to strengthen normal commerce, has initiated a direct-to-kirana distribution technique in Mumbai geared toward quicker and dependable deliveries serving to retailers keep away from giant stock holdings.

Whereas normal commerce nonetheless contributes greater than half of the sector’s income presently, fashionable commerce channels (together with on-line channels) are main the expansion with wholesome double-digit, year-on-year good points.

Q-commerce has diluted the importance of a distribution community. Minimal investments in distribution networks meant that the main focus might be channelled in direction of new product improvement and promotions. A rising quality-consciousness amongst shoppers additional levelled the sphere and D2C manufacturers, with the correct formulation and a deal with ingredient composition, have managed to attain large. Incomes model loyalty, consequently, is tougher now than it ever has been. That is the place the sector giants are going through competitors from rising gamers.

Within the earlier construction, rising manufacturers have been stonewalled by the distribution community, however now they will compete higher. And the D2C/rising manufacturers have turned out to be the quiet, industrious ants to the elephant-esque legacy gamers.

To handle among the challenges right here, the business giants have warmed as much as acquisitions. With wholesome money technology yearly, the M&A playbook has at all times been integral to the incumbents. Buying rising D2C manufacturers, aside from including to the product portfolio, has additionally helped develop their digital presence.

HUL, seeking to develop its choices beneath the wonder and wellbeing (B&WB) section, purchased out The Minimalist in Q3 FY25. Emami, in the meantime, acquired The Man Firm and Brillare Sciences, working in the identical B&WB section. Marico, too, acquired 4 D2C corporations – Beardo, True Components, Simply Herbs and Plix.

Nonetheless, these acquisitions have been, as a rule, labored out at steep valuations and don’t materially add to the acquirers’ topline instantly. For instance, HUL’s acquisition of The Minimalist was valued at an costly 8.5 instances its FY24 income of ₹347 crore. But it surely solely provides round 0.6 per cent to HUL’s FY25 income.

The dimensions-up tempo can be a key monitorable right here.

Momentum test

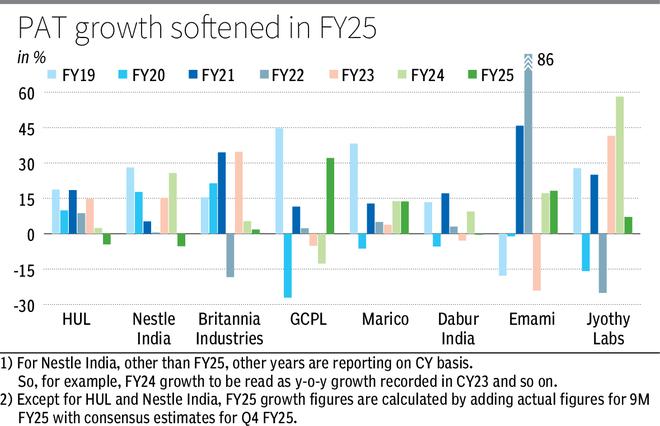

The current monetary efficiency of gamers, a part of the FMCG index and likewise beneath our protection, validate the evolving demand tendencies and shifts in margin dynamics throughout the sector.

Meals & Beverage

Each Britannia and Nestle India undertook value hikes to guard their margins on account of sustained inflation in enter prices. However having been late to cross on the rising enter costs, regardless of the quantity progress of round 6-8 per cent 12 months on 12 months throughout 9M FY25, Britannia’s income grew simply 4.6 per cent. Although marginally higher than FY24’s 3.5 per cent and FY20’s 4.3 per cent, it’s the slowest since FY03. EBITDA margin was down 100 foundation factors (bps). Nestle India, equally, discovered its EBITDA margin down 59 bps, whereas income grew simply 3 per cent (its lowest since FY16), leading to EBITDA being flat.

House & Private Care

Improved product combine helped Emami, Jyothy Labs and Godrej Shopper Merchandise (GCPL) with their revenue margins. The expansion and elevated penetration in high-margin liquid detergents additionally helped Jyothy Labs and GCPL with their profitability.

Consequently, Jyothy Labs and GCPL noticed their EBITDA margin enhance 10 bps and 40 bps 12 months on 12 months throughout 9M FY25. Emami, with improved offtake in its high-margin antiseptic cream and gels, noticed its EBITDA and PAT margins develop 50 bps and 110 bps throughout 9M FY25.

House and Private care section continued to be the biggest and quickest rising section for HUL and Dabur.

HUL’s EBITDA margins have been down 21 bps for FY25, whereas that of Marico and Dabur additionally dropped 70 bps and 74 bps throughout 9M FY25, owing to inflation in costs of palm oil, copra and fruit concentrates respectively, their key uncooked supplies.

Outlook

In macro phrases, the urban-rural hole in month-to-month per capita consumption expenditure is all the way down to 70 per cent in 2023-24 from 84 per cent in 2011-12, signalling regular rural consumption progress. For the city markets, an increase in disposable revenue, because of tax cuts and panel for the eighth pay fee (anticipated to come back into impact from H2 FY26) to be appointed within the subsequent two-three months, alongside a softening inflation is theoretically a optimistic set-up.

Softening uncooked materials costs, notably copra and palm oil, ought to assist enhance profitability going forward. Additionally, value hike measures nonetheless underway, persevering with till Q1 FY26, hints at value progress for FY26. However sustained improve in promoting and promotion bills, to drive quantity progress, will proceed, limiting the enlargement in revenue margins. The main target continues to be on volume-driven progress and demand setting is predicted to enhance ranging from Q2 FY26.

The business will proceed to develop, however the tempo at which it comes is the million-dollar-question. For the close to time period, altering dynamics within the distribution channels may have an effect, however in the long run, premiumisation is predicted to proceed being the driving issue with a deal with the product portfolio. Below-penetrated classes resembling physique wash liquids, useful dietary drinks, family pesticides, oral care and hair care merchandise might drive quicker progress for Emami, Jyothy Labs, GCPL and Marico.

Valuation

The Nifty FMCG index has corrected from a peak PE of 52.8 instances in January 2024 to 44.3 instances now. However it’s nonetheless at a premium to its five-year common of 42.6 instances. The pre-Covid five-year common PE is at a a lot decrease 40.2 instances, signalling that the correction is perhaps underdone.

In the beginning of 2010, the Nifty FMCG index was valued at 30 instances its earnings. The last decade that adopted (2010-19) noticed earnings develop at a 13.6 per cent CAGR, whereas the index grew at a considerably greater CAGR of 17.1 per cent, stretching the valuation to 40 instances its earnings, as on the finish of 2019. Whereas a burgeoning middle-income group drove enterprise and earnings progress, the valuation re-rating was pushed by low international rates of interest and liquidity gush. Moreover, investor confidence in consistency of earnings progress with most corporations within the sector thought to be high quality shares, backed by a robust monitor report of execution and sound company governance added gas. Additionally, the capex cycle taking successful as a result of financial institution clean-up throughout the decade meant that client non-discretionary performs have been comparatively higher bets.

However now among the above components have taken successful. Latest years have proven that quantity and earnings progress is probably not constant, and international liquidity has considerably tightened. Zero or ultra-low rates of interest in developed markets meant that an FMCG inventory priced at 75 instances its earnings might even be enticing for a international investor. This isn’t the case anymore, with risk-free authorities bonds in developed markets giving enticing yields relative to high-PE FMCG shares. So the levers for premium valuation are waning.

HUL, at 48.8 instances its FY26 earnings, regardless of its market management and a reduction to its five-year common, may see additional deterioration with reduce in margin steering by 100 bps to 22-23 per cent for FY26. Its common quantity progress from FY20 stands at 3 per cent, half that of the 7 per cent progress recorded throughout FY11-19. Dabur, with challenges in pushing gross sales by means of normal commerce may additionally see a troublesome FY26, and buying and selling at round 42 instances its FY26 earnings, margin to security appears minimal.

Nestle India continues to be the most costly, buying and selling at 68.7 instances. Marico, buying and selling at 50.6 instances its FY26 earnings, remains to be at a 14 per cent premium to its five-year common, leaving little room to err. Equally, Britannia is buying and selling at an 11 per cent premium to its five-year common and GCPL at a premium of 19 per cent.

Emami and Jyothy Labs are comparatively cheaper, buying and selling at 29 instances and 31.8 instances their FY26 earnings respectively. Per our current suggestions, buyers can contemplate accumulating in these counters.

Excessive valuation multiples at all times work in opposition to share appreciation except progress is constant. All hinges on quantity progress restoration for the business. And at this juncture, valuation is probably the most crucial issue for buyers to search out funding alternatives on this sector. Therefore, tempered expectations and selective stock-picking needs to be the best way to go.

Revealed on April 26, 2025