Profitable of hand dealer buying and selling inventory trade graph cash, world financial, dealer investor,graph cash of block chain inventory market cryptocurrency promoting and purchase with worth chart knowledge graph istock photograph for BL

| Photograph Credit score:

Thitima Uthaiburom

The week earlier than final, US 10-year bonds witnessed the worst week since 2001, with yields spiking 50 foundation factors over the week to 4.5 per cent. Although yields cooled over the week passed by, a brand new drama surfaced with a brewing feud between President Trump and Fed Chair Powell.

Whereas the Trump administration is decided to convey yields on long-term bonds down, the Fed’s choice to attend and watch given tariff-led upside dangers to inflation is taking part in a brick wall. Final week, Trump mentioned he couldn’t wait to have Powell’s workplace terminated, whereas on the identical time Powell’s chairmanship is legally well-guarded. The impasse is a basic case of when an unstoppable drive meets an immovable object.

The ‘elephant within the room’ right here is the US authorities’s large debt pile of $36.2 trillion. The nation has been on a spending spree for the reason that world monetary disaster, which accelerated when the Covid pandemic hit.

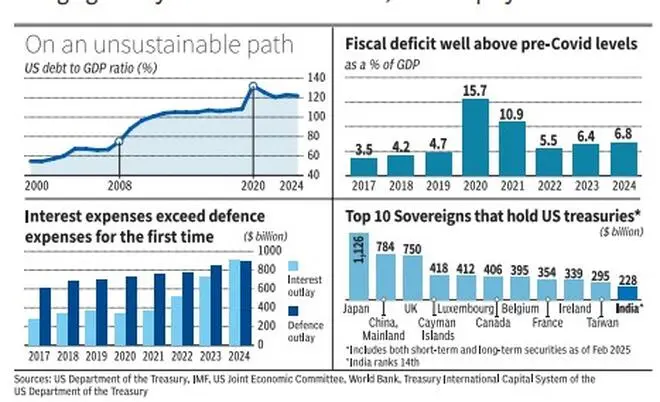

In the present day, the US’ debt to GDP stands at a major 122 per cent (December 2024). Bond yields capturing up can burn a gap by the Federal Authorities’s funds, thus explaining Trump and his administration’s fixation on bond yields. Actually, it was the bond tantrum from the sooner week that pushed Trump to swiftly go sluggish on reciprocal tariffs.

Three components

The debt-related issues for Trump administration stem from three components.

First is the refinancing drawback. The earlier administration ducked the rate of interest strain by issuing short-term payments as a substitute of long-term bonds. Whereas the method was unsustainable for lengthy, it’s the present administration’s drawback to now refinance them with long-term bonds and can add additional strain on yields.

Two, is the difficulty of the US authorities’s dependancy to spending, which after all Trump is making an attempt to handle with DOGE. Whereas the US fiscal deficit cooled to five.5 per cent of GDP in 2022 (calendar yr) after having skyrocketed to fifteen.7 per cent of GDP in 2020 resulting from Covid stimulus, the ratio has now inched again to six.8 per cent. Even worse, curiosity outlay of the Federal Authorities for 2024 surpassed the nationwide defence outlay for the primary time within the nation’s historical past. This reminds of Ferguson’s regulation – ‘any nice energy that spends extra on debt servicing than on defence, dangers ceasing to be an excellent energy’.

The third issue is one that’s self-inflicted. The coverage of the Trump administration, going backwards and forwards, makes an attempt to upend world provide chains and will tarnish the safe-haven standing of US Treasury securities and the worldwide reserve foreign money standing of the greenback. That is the place commerce battle blows up into capital wars. Though there isn’t any sturdy various to the US greenback but, world central banks may flip to different currencies or gold much more. Every week in the past, speculations have been rife within the bond market that China may retaliate by dumping its holdings of US bonds. This was one of many key causes for the yield to go up the week earlier than final, though the precise cause for the tantrum remains to be being investigated.

US debt, an fairness woe

A long time earlier, Richard Nixon’s Treasury Secretary famously mentioned: “the greenback is our foreign money, nevertheless it’s your drawback”.

Equally, this debt pile of the US and excessive yields aren’t solely an issue for the US, however one for fairness traders throughout the globe. First, the insurance policies that the Trump administration is making an attempt to implement may end in a stagflation within the US, a interval of recession pushed by inflated costs.

High funding bankers have forecast a 50 per cent/60 per cent likelihood of a recession. In a globalised financial setting, this implies a slowdown in world GDP. This mixed with excessive US bond yields, used as benchmark to cost danger property throughout the globe, could be a double whammy for fairness traders.

Buyers internationally, together with in India, should regulate the US bond market.

Revealed on April 19, 2025