Estimating the potential influence of tariffs on imports requires you to make an assumption in regards to the so-called commerce elasticity.

For instance, if a ten% tariff improve is assumed to result in a 5% discount in imports, then the commerce elasticity is 0.5. If a ten% tariff improve results in a ten% discount in imports, the commerce elasticity is 1.0. If a ten% tariff improve results in a 20% discount in imports, the commerce elasticity is 2.0.

And many others.

Clearly, completely different merchandise have completely different elasticities. For instance, if the product is very easy to substitute both domestically or from elsewhere, then you definitely would anticipate the commerce elasticity to be excessive.

Alternatively, if the merchandise is important and you may solely get it from the one place you may have at all times imported it from then a tariff improve would have much less of an influence on imports, and the elasticity could be low.

Saying that, good individuals inform me {that a} affordable combination elasticity assumption is round 2.0.

Nonetheless, the precise stage, assuming it’s above 1.0, turns into moot as soon as tariffs rise hit 100% and over.

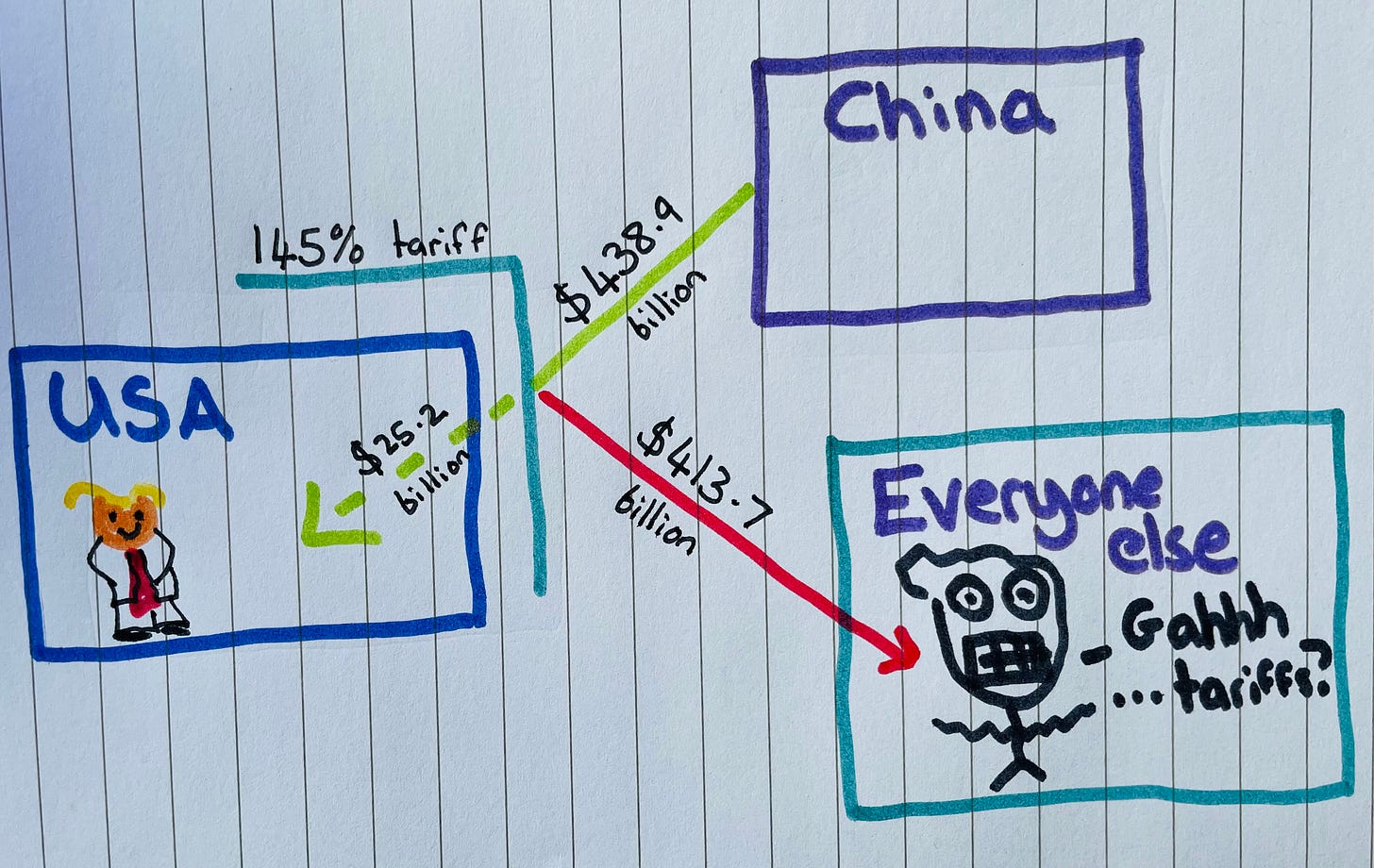

Let’s take, for instance, Trump’s new 145% tariff on China.

Should you assume an elasticity of 1.0, a 145% tariff will lead to US imports from China dropping to (sub) zero.

And assuming the US isn’t going to cease importing stuff from China completely, a tariff of 145% most likely means you’re left with an elasticity of round 0.65. That is unfathomably low/conservative, but it surely nonetheless ends in practically all imports being worn out.

Utilizing 2024 import numbers, and assuming a commerce elasticity of 0.65, this implies US items imports from China will fall from $438.9 billion to … $25.2 billion.

So yeah, beneath essentially the most conservative assumptions potential, at present tariff ranges, we’re speaking about China-US items commerce collapsing.

Which is totally wild.

Anyway, my follow-up query is: What occurs to the c$413 billion of Chinese language exports that may now not enter the US? The place do they go? What are the second-order penalties?

I believe there are two apparent solutions.

In response to being shut out of the US market, Chinese language exports both …

-

Get diverted away from the US and into different markets. On the one hand, this implies a lot of low-cost stuff for everybody else, on the opposite, producers in these markets will most likely freak out and foyer their very own governments for protecting tariffs. [Note: this is what happened in Trump 1.0 when he imposed the steel tariffs, and the EU and others, fearing a flood of cheap steel onto their markets, did the same.]

In image kind:

-

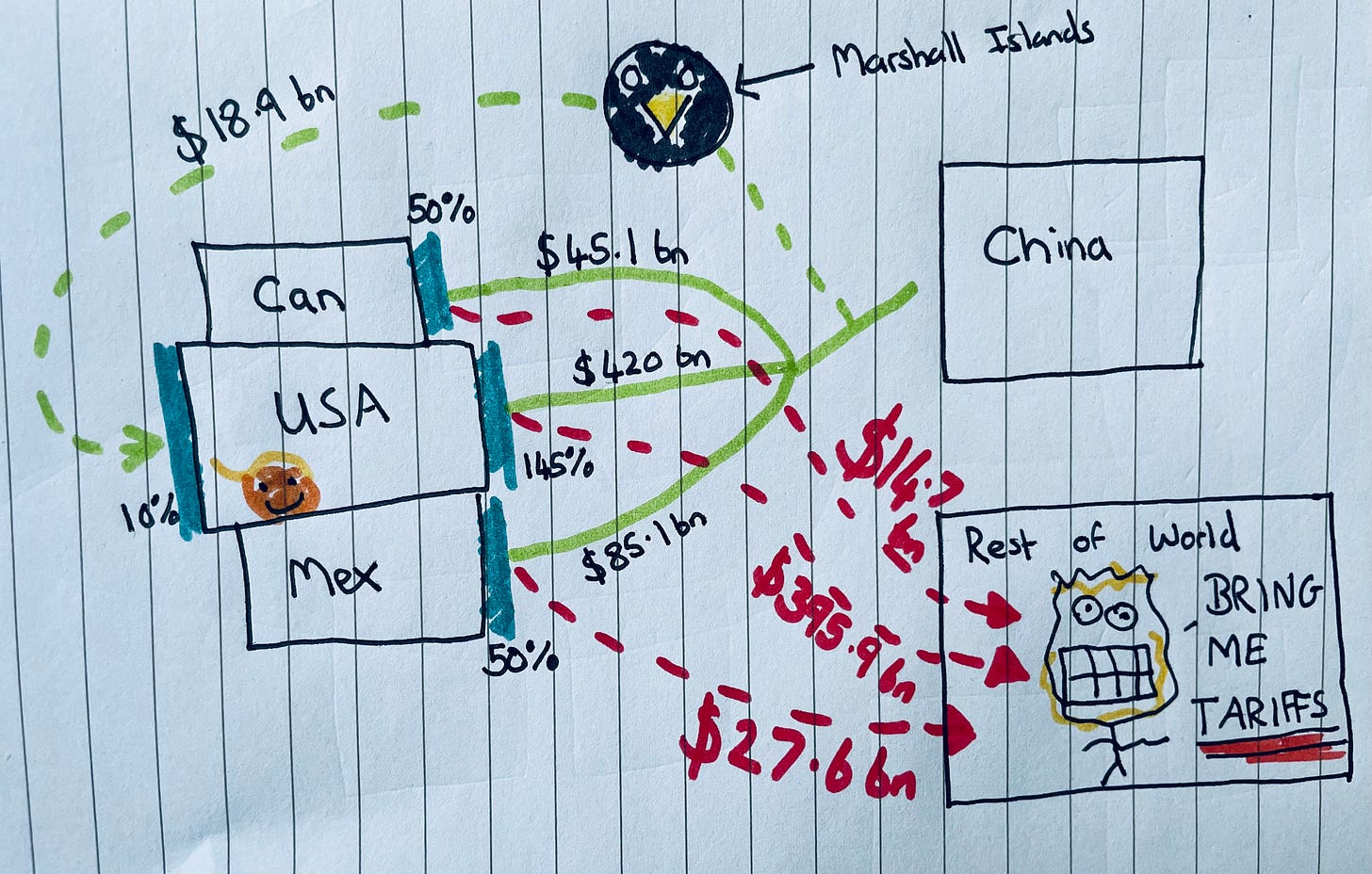

A few of the Chinese language exports may discover their means into the US by way of different markets, for instance Cambodia, Vietnam, Mexico, and the Heard and Macdonald islands. (Sure, that is my guidelines of origin-related concern that I are likely to badger on about … quite a bit.) To stop this from occurring, the US will most likely (and seemingly **is**) power different international locations to limit Chinese language commerce and funding as a situation of sustaining a decrease US tariff fee.

In follow, this suggests extra tariffs on China by others, extra commerce diversion, and extra subsequent strain on international locations to impose their very own tariffs to protect in opposition to Chinese language merchandise being diverted onto their market.

Right here it’s in a [much more complicated] image format, the place I assume that Canada and Mexico impose their very own tariffs on China too, however on the comparatively decrease fee of fifty% (however assume similar commerce elasticity [0.65], though it will undoubtedly be greater).

Can we assume the remainder of the world will take in circa $438 billion in diverted Chinese language exports with out kicking up a fuss?

I believe not.

All of that is to say that even when we assume the US-China tariffs (and I’ve simply mentioned the US facet of this immediately; China has imposed its personal retaliatory tariffs too) come right down to barely extra wise ranges, the remainder of the world goes to return beneath a lot of strain to introduce their very own tariffs each to guard home industries from diverted Chinese language competitors, and since the US is asking/forcing international locations to take action.

Have an ideal weekend!

Sam

P.S. If I’ve tousled a number of the sums … sorry. However you’re studying one thing written by a man who actually communicates utilizing felt tip pens. In order that’s kinda on you.