Latest Developments in Actual Property Growth (Spring 2025)By Frank MuracaRevealed April 11, 2025

This weblog put up is a part of a daily collection on current traits in non-public actual property financing. These posts are supposed to inform native governments about present circumstances dealing with non-public builders and actual property improvement initiatives of their communities. Lending for actual property improvement initiatives  Builders proceed to report challenges attributable to excessive rates of interest. For instance, in September 2023, an inexpensive housing developer in Wilmington requested $1.25 million in further hole funding from the town and county to assist cowl rising rate of interest prices. In response to one survey of the nation’s 30 main condominium builders performed by the Nationwide Multifamily Housing Council, over half of builders continued to report delays in development.[1] Of these surveyed, 68% responded that delays had been due to financial uncertainty and feasibility of the challenge. For example, Kane Realty – a industrial actual property improvement firm – reported final December that future progress on the mixed-use “Downtown South” challenge in Raleigh is contingent on “rates of interest happening”.  In March, the variety of condominium builders that reported delays because of the availability of financing continued to drop from 79% to 33%, reflecting that lenders are extra keen to lend than two years in the past. This pattern is supported by different knowledge exhibiting that banks are starting to loosen credit score requirements, making it simpler for builders to borrow for brand new development. Determine 3 exhibits survey response knowledge from the Federal Reserve’s Senior Mortgage Officer Opinion Survey (or SLOOS). Survey responses point out that simply 10% of banks are tightening requirements for industrial actual property loans used for development or land improvement, in comparison with over 70% in 2023.

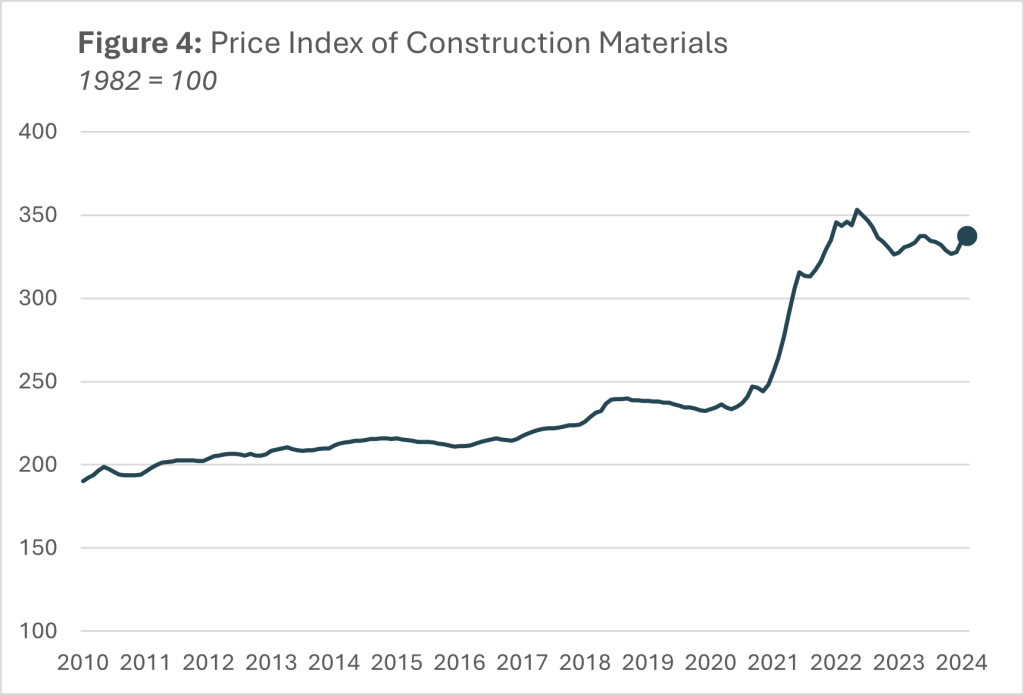

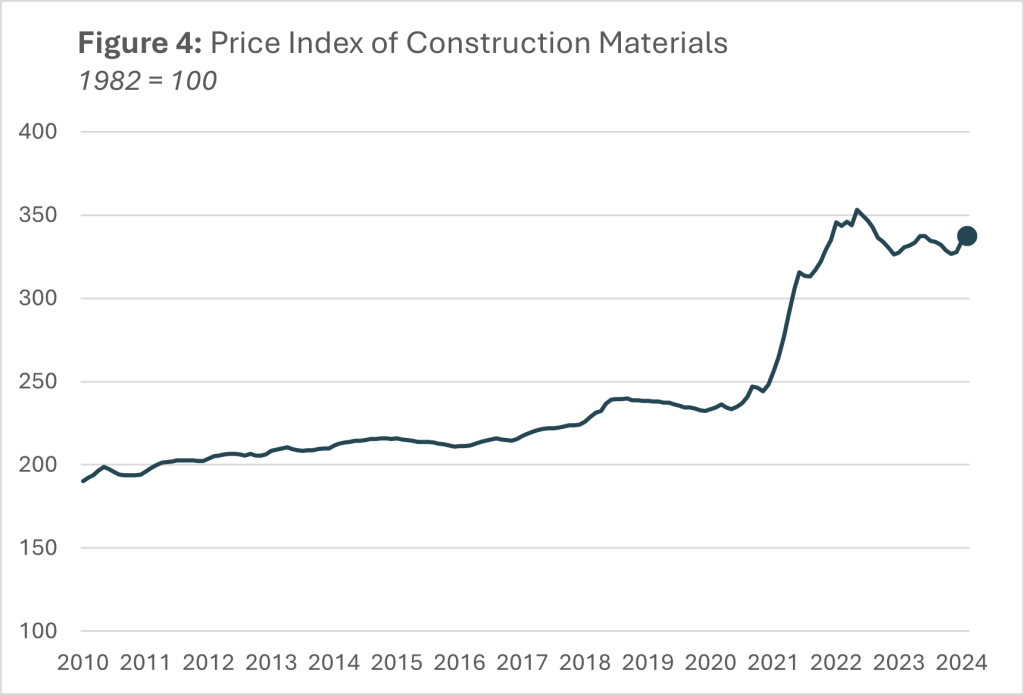

In response to one other survey performed by the Nationwide Multifamily Housing Council, 45% of CEOs of apartment-related corporations reported that now was a greater time to borrow for multifamily housing in comparison with simply 3% in July 2023. Modifications in development prices Along with the supply of lending, the price of constructing supplies continues to be between 30% and 45% increased than pre-COVID costs. In January 2023, one development firm official instructed WBTV, “COVID actually began actually inflating costs for development, for lots of various supplies and that was actually the beginning of it, and now inflation after that has saved costs form of excessive, so it’s been in all probability about 2-years now.” Even with current decreased inflation, constructions prices haven’t declined to pre-COVID ranges.[2] (Determine 4)  [1] Supply: Nationwide Multifamily Housing Council. Quarterly Survey of Residence Building & Growth Exercise (September 2023). https://www.nmhc.org/research-insight/nmhc-construction-survey/2025/quarterly-survey-of-apartment-construction-development-activity-march-2025/ [2] St. Louis FRED Financial Knowledge. Producer Value Index by Commodity: Particular Indexes: Building Supplies. https://fred.stlouisfed.org/collection/WPUSI012011

|

This weblog put up is a part of a daily collection on current traits in non-public actual property financing. These posts are supposed to inform native governments about present circumstances dealing with non-public builders and actual property improvement initiatives of their communities.

Lending for actual property improvement initiatives

To recap, as inflation rose in 2022, the Federal Reserve voted to extend rates of interest after a holding them at close to zero p.c in response to the COVID-19 financial disaster. As charges rose, lending for actual property improvement initiatives slowed down as initiatives grew to become tougher to finance. Even after rates of interest had been reduce once more in September 2024, actual property improvement lending has not returned to pre-2024 ranges. (Determine 1)

Builders proceed to report challenges attributable to excessive rates of interest. For instance, in September 2023, an inexpensive housing developer in Wilmington requested $1.25 million in further hole funding from the town and county to assist cowl rising rate of interest prices.

In response to one survey of the nation’s 30 main condominium builders performed by the Nationwide Multifamily Housing Council, over half of builders continued to report delays in development.[1] Of these surveyed, 68% responded that delays had been due to financial uncertainty and feasibility of the challenge. For example, Kane Realty – a industrial actual property improvement firm – reported final December that future progress on the mixed-use “Downtown South” challenge in Raleigh is contingent on “rates of interest happening”.

In March, the variety of condominium builders that reported delays because of the availability of financing continued to drop from 79% to 33%, reflecting that lenders are extra keen to lend than two years in the past.

This pattern is supported by different knowledge exhibiting that banks are starting to loosen credit score requirements, making it simpler for builders to borrow for brand new development. Determine 3 exhibits survey response knowledge from the Federal Reserve’s Senior Mortgage Officer Opinion Survey (or SLOOS). Survey responses point out that simply 10% of banks are tightening requirements for industrial actual property loans used for development or land improvement, in comparison with over 70% in 2023.

In response to one other survey performed by the Nationwide Multifamily Housing Council, 45% of CEOs of apartment-related corporations reported that now was a greater time to borrow for multifamily housing in comparison with simply 3% in July 2023.

Modifications in development prices

Along with the supply of lending, the price of constructing supplies continues to be between 30% and 45% increased than pre-COVID costs. In January 2023, one development firm official instructed WBTV, “COVID actually began actually inflating costs for development, for lots of various supplies and that was actually the beginning of it, and now inflation after that has saved costs form of excessive, so it’s been in all probability about 2-years now.” Even with current decreased inflation, constructions prices haven’t declined to pre-COVID ranges.[2] (Determine 4)

[1] Supply: Nationwide Multifamily Housing Council. Quarterly Survey of Residence Building & Growth Exercise (September 2023). https://www.nmhc.org/research-insight/nmhc-construction-survey/2025/quarterly-survey-of-apartment-construction-development-activity-march-2025/

[2] St. Louis FRED Financial Knowledge. Producer Value Index by Commodity: Particular Indexes: Building Supplies. https://fred.stlouisfed.org/collection/WPUSI012011

Creator(s)

Tagged Underneath

This weblog put up is revealed and posted on-line by the College of Authorities to deal with problems with curiosity to authorities officers. This weblog put up is for instructional and informational Copyright ©️ 2009 to current College of Authorities on the College of North Carolina. All rights reserved.

use and could also be used for these functions with out permission by offering acknowledgment of its supply. Use of this weblog put up for industrial functions is prohibited.

To browse an entire catalog of College of Authorities publications, please go to the College’s web site at www.sog.unc.edu or contact the Bookstore, College of

Authorities, CB# 3330 Knapp-Sanders Constructing, UNC Chapel Hill, Chapel Hill, NC 27599-3330; e-mail gross sales@sog.unc.edu; phone 919.966.4119; or fax

919.962.2707.

Copyright © 2009 to Current College of Authorities on the College of North Carolina.