Faux, in case you can, that the final week didn’t occur (a tall order for the Stratechery demographic, I do know), and picture one other situation: China invades Taiwan. What occurs then?

I’m not a army skilled, however my assumption is that China would achieve success; the largest unknown variable could be time. If the U.S. doesn’t intervene the battle could be shorter; if the U.S. does the battle could be longer, and finally be determined in the way in which that wars are all the time determined: by way of industrial capability and logistics. China has a significant benefit in each areas given its relative manufacturing may and the very fact the battle would occur off their coast.

There are consultants who disagree; the Middle for Strategic & Worldwide Research ran a collection of wargames in 2023, and concluded that the U.S. and its allies would repel a Chinese language invasion, however at a heavy price to U.S. army forces and Taiwan typically. That, nonetheless, raises a extra pertinent level: with regards to the financial affect it hardly issues who wins or loses. In each circumstances China is successfully faraway from world provide chains, and Taiwan’s financial output — together with chips from TSMC and others — is destroyed.

It’s tough to overstate the extent to which each side of recent life rests on world provide chains, that are so lengthy and complicated that nobody can actually perceive the results of messing with them. It has, nonetheless, gotten simpler to know the complexity in recent times: first there was the bungled financial response to COVID, the place a temporal interruption in provide chains triggered worldwide provide shortages and contributed to world inflation; then there was final week, when the shock of blanket tariffs from the Trump administration led to a meltdown in worldwide inventory markets that appears to nonetheless be ongoing. A conflict over Taiwan, nonetheless, would put all of those to disgrace.

Commerce and China

Final November, within the wake of President Trump’s second election, I wrote A Likelihood to Construct: that title referenced the optimistic conclusion to a chunk that was, in case you learn intently, a fairly pessimistic abstract of the present commerce state of affairs, with a particular deal with tech. To summarize:

- The U.S. leveraged overseas assist, direct funding, and its shopper market to rebuild Europe and Japan after World Battle 2, and pegged currencies to the U.S. greenback (which was pegged to gold) to do it. This began the cycle of overseas international locations exporting to the U.S. and shopping for U.S. debt with the proceeds, though the U.S.’s relative dimension to the remainder of the world meant that the U.S. nonetheless ran a commerce surplus (the help and direct funding have been typically used to purchase U.S.-produced merchandise).

- By 1971 this method was about to break down below its personal weight, main the U.S. to de-peg from gold (i.e. depreciate the U.S. greenback) and dissolve the Bretton Woods system of forex controls. This led to a decade of ache — together with the oil shock of the Seventies — however what emerged had the same construction to the publish World Battle 2 system, simply with the U.S. greenback because the reserve forex, untethered from gold. This meant there was inelastic demand for U.S. treasuries, which principally made it unattainable for the U.S. to not run a deficit, both by way of commerce or the federal funds. Nonetheless, this was maintainable given the relative dimension of the U.S. financial system to its buying and selling companions.

- What modified within the final 25 years was the doorway of China into this method. China — clearly looking back, though maybe predictably for many who understood China traditionally, past its backwardness over the earlier two centuries — had much more capability than the system might bear. It’s not an accident that U.S. deficits — each by way of commerce and the federal funds — have exploded in keeping with Chinese language progress.

China is the skeleton key to grasp so many oddities in regards to the U.S.’s fiscal state of affairs over the past fifteen years specifically, particularly how it’s that the U.S.’s response to the Nice Recession didn’t result in inflation: Chinese language manufacturing was deflationary, and their ever-expanding commerce surpluses created an ever-expanding marketplace for U.S. debt, whether or not it’s held by the Chinese language nationwide authorities, provincial governments, state-owned enterprises, and many others. This inelastic demand additionally served to maintain the greenback artificially excessive, in defiance of the theoretical-expected response to long-running commerce deficits.

This, greater than the rest, is what has hollowed out U.S. manufacturing. The price of low cost shopper items and a seeming inexhaustible capability for U.S. debt was the shifting of ever extra manufacturing overseas. Sure, issues like decrease prices and completely different labor requirements performed a task, however it’s the construction of the world financial system that issues most; certainly, China’s labor prices are considerably larger than they was, however China’s manufacturing dominance is definitely accelerating.

A part of this is because of China’s choice over the previous couple of years to reply to the puncturing of its housing bubble by pushing sources into export-oriented industries; one other half is the unlucky actuality — under-appreciated by apostles of comparative benefit — that capabilities compound. I wrote in that Article:

The story to me appears simple: the large loser within the publish World Battle 2 reconfiguration I described above was the American employee; sure, we’ve all of these service jobs, however what we’ve a lot much less of are conventional manufacturing jobs. What occurred to chips within the Sixties occurred to manufacturing of every kind over the following a long time. Nations like China began with labor price benefits, and, over time, moved up studying curves that the U.S. dismantled; that’s how you find yourself with this from Walter Isaacson in his Steve Jobs biography a few dinner with then-President Obama:

When Jobs’s flip got here, he careworn the necessity for extra skilled engineers and steered that any overseas college students who earned an engineering diploma in the US needs to be given a visa to remain within the nation. Obama stated that might be carried out solely within the context of the “Dream Act,” which might enable unlawful aliens who arrived as minors and completed highschool to grow to be authorized residents — one thing that the Republicans had blocked. Jobs discovered this an annoying instance of how politics can result in paralysis. “The president could be very good, however he saved explaining to us explanation why issues can’t get carried out,” he recalled. “It infuriates me.”

Jobs went on to induce {that a} approach be discovered to coach extra American engineers. Apple had 700,000 manufacturing unit staff employed in China, he stated, and that was as a result of it wanted 30,000 engineers on-site to assist these staff. “You may’t discover that many in America to rent,” he stated. These manufacturing unit engineers didn’t must be PhDs or geniuses; they merely wanted to have primary engineering expertise for manufacturing. Tech faculties, group faculties, or commerce faculties might prepare them. “Should you might educate these engineers,” he stated, “we might transfer extra manufacturing crops right here.” The argument made a powerful impression on the president. Two or 3 times over the following month he advised his aides, “We’ve received to seek out methods to coach these 30,000 manufacturing engineers that Jobs advised us about.”

I feel that Jobs had cause-and-effect backwards: there are usually not 30,000 manufacturing engineers within the U.S. as a result of there are usually not 30,000 manufacturing engineering jobs to be crammed. That’s as a result of the construction of the world financial system — decisions made beginning with Bretton Woods specifically, and cemented by the elimination of tariffs over time — made them nonviable. Say what you’ll in regards to the viability or knowledge of Trump’s tariffs, the motivation — to undo eighty years of structural modifications — is fairly simple!

The opposite factor about Jobs’ reply is how finally self-serving it was. This isn’t to say it was improper: Apple couldn’t solely not manufacture an iPhone within the U.S. due to price, it can also’t accomplish that due to functionality; that functionality is downstream of an ecosystem that has developed in Asia and a protracted studying curve that China has traveled and that the U.S. has deserted. In the end, although, the profit to Apple has been profound: the corporate has the most effective provide chain on the earth, centered in China, that provides it the aptitude to construct computer systems on an unimaginable scale with most high quality for not that a lot cash in any respect.

That line about Trump’s motivation looms giant after the final week; the statement about Apple’s advantages seems to be far more precarious.

The Nixon Shock

There’s a fascinating historical past of the Nixon administration’s deliberations over closing the gold window, instituting worth controls, and imposing a ten% import tax — the actions that successfully ended Bretton Woods — on this 2011 Article in Bloomberg Businessweek. What’s fascinating is that the choice was made below intense financial strain, however the presentation was a PR masterpiece:

[Treasury Secretary John] Connally brilliantly packaged this system not as America abandoning its dedication to the gold normal however as America taking cost. He turned the greenback’s collapse, which might have appeared shameful, right into a second of hubris. The emphasis could be on righting America’s commerce steadiness, in addition to minor factors resembling a 5 % lower in overseas assist. An aide to William P. Rogers, the Secretary of State, referred to as and interjected, “You may’t lower overseas assist.” Connally stated, “Inform him if he doesn’t shut up we’ll make the cuts 15 %.” Shultz muzzled his disquiet over worth controls; even Burns joined ranks. The group feverishly debated whether or not Nixon ought to deal with the nation on Sunday night time, which might imply preempting the favored Gunsmoke. The general public relations side was paramount. Stein wrote later that the dialogue at Camp David assumed “the perspective of scriptwriters getting ready a TV particular.” Nobody pretended to know the way controls would work; the query was scarcely debated.

Addressing the nation on Sunday, Nixon blamed forex speculators and “unfair” alternate charges slightly than U.S. financial coverage. Politically, he hit the jackpot. Monday’s practically 33-point rise within the Dow was the largest ever to that time. Nixon’s “New Financial Coverage” drew raves from the press. “We unhesitatingly applaud the boldness with which the President has moved,” learn the New York Occasions editorial. Within the current period, America’s incapacity to restore its fiscal issues has tarnished its credibility and hampered its forex negotiations with China. The Nixon Shock confirmed the U.S. taking motion.

The top of Bretton Woods was in all probability inescapable, however it’s price declaring that the Nixon Shock was an financial catastrophe: the nation endured a decade of drastic inflation that was solely cured with sky-high rates of interest and a large recession (the architect of that remedy, Paul Volcker, was part of the group that instituted the Nixon Shock within the first place; Volcker got here to remorse it). In different phrases, the response of the market and the press was completely improper.

The query is that if what occurred this final week must be in comparison with the Nixon Shock, or contrasted? Actually the response is a distinction: everybody hates the “Liberation Day” tariffs, together with the market. Furthermore, the Trump administration’s rollout has been the very reverse of a PR masterpiece: nobody within the administration can appear to agree about what precisely the objective is, or what success seems to be like. I’m definitely not going to try to talk for an administration that may’t converse for itself, notably given Trump’s on-again-off-again method to tariffs over the previous couple of months.

What I do come again to, nonetheless, is what I opened with: there’s a situation inside the realm of potentialities that’s much more painful than something Trump proposed; is it higher to try to pressure into place a brand new financial system that, no less than in concept, reduces dependency on China and resuscitates U.S. manufacturing now, as an alternative of ready for the present system to break down by literal pressure? This does appear to be the administration’s objective: merely tariffing China is deadweight loss, resulting in rerouting and the basic downside of the greenback as reserve forex unaddressed; blanket tariffs, alternatively, are a legitimate, if extraordinarily blunt and inefficient, method to meaningfully restructure incentives.1

Furthermore, even when an invasion by no means occurs, is the present system sustainable, fiscally or societally? Trump’s political success is, in lots of respects, the clearest manifestation of what occurs in a system that pushes the features to the globalized prime whereas shopping for off the localized lots with low cost trinkets.

The Query of Kicking the Can

In the end, I truly assume there is a vital distinction between these draw back situations, and it explains why I feel that Trump’s method, whereas extra theoretically legitimate than it’s being given credit score for, is the improper one.

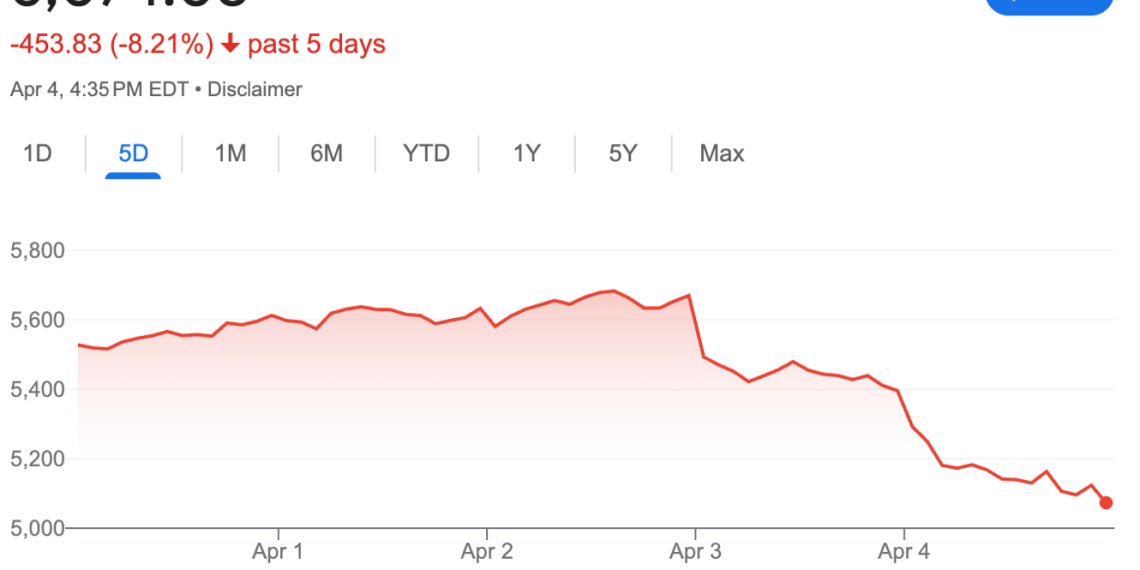

First, I’m skeptical that we’ve the abdomen for what could be essential to remake the worldwide financial order. I might need needed to spend just a few paragraphs explaining this level beforehand, however I feel a inventory market chart speaks for itself:

I’ll word, by the way in which, that these losses aren’t totally irrational or panic-driven: lowered commerce completely hurts U.S. multinationals; one level that’s being missed — no less than till what occurred in overseas inventory markets this morning — is that it hurts overseas firms much more. Nobody wins in a commerce conflict.

Second, the present financial system, flawed although we might now acknowledge it to be, is a posh system, constructed up over a long time; one must be very cautious in remaking advanced techniques in a top-down method. It’s one factor to diagnose issues; it’s a really completely different factor to unravel them. There’s a motive that new financial techniques often come up after main wars; it’s simpler to construct one thing new after the previous factor has been destroyed (and there’s the abdomen for it, as a result of there is no such thing as a different alternative).

Third, there are a variety of different issues the Trump administration might be doing, notably by way of relieving regulation, making certain equal alternative all through the financial system, and many others. It looks like a missed alternative to be burning political capital on deficit discount and commerce rebalancing when there are main pro-growth alternatives nonetheless out there. This appears notably pertinent given the rise of AI, which has very excessive variance by way of potential outcomes.

Make no mistake, the structural issues going through U.S. manufacturing specifically are very actual, and the China-Taiwan systemic threat is just going to extend. As an alternative of adjusting the system to ameliorate the chance, nonetheless you would merely deal with the chance immediately; I feel the easiest way to try this is to undo the chip controls and tie China much more tightly into the present system typically, and to Taiwan particularly. Sure, that is kicking the can down the street, however path dependency is a much more highly effective pressure than we regularly understand.

To return to the Nixon Shock, I feel one motive why it was a PR success is as a result of the disaster was inescapable; I’m wondering if one motive why “liberation day” is a PR catastrophe is as a result of there’s nonetheless extra street to kick the can down.

Tech and Tariffs

So what of tech firms, and the advantages that firms like Apple have gotten from Asia typically and China particularly?

First, it’s price articulating this profit in full. Steve Jobs, in his first tenure at Apple, was deeply dedicated to manufacturing, together with constructing a futuristic manufacturing unit in Fremont for the Mac; that merely price the corporate tens of millions — his try to do the identical for NeXT all however drove the corporate out of enterprise. What Apple wanted — and ultimately present in China, below Tim Prepare dinner — was scalability: Apple would focus its integration chops on getting the product proper, and belief contract producers to attain the pliability of assembly demand. This, extra broadly, is a vital addition to the aptitude dialogue above: manufacturing has modified from being some extent of integration with a product to being a horizontal scalable providers providing; growing the customer support chops mandatory for such a enterprise could be a big cultural problem for a brand new U.S. manufacturing base, a la Intel’s struggles to grow to be a foundry.

To that finish, one advantage of a conflict over Taiwan is that it could be so horrible for tech firms that there actually isn’t a lot profit in planning for it; the hedging price — which might entail constructing out these scalable horizontal service suppliers, which for financial causes should serve a couple of firm or product — could be so astronomical that it in all probability wouldn’t be economical to do something apart from deepen the established order, notably on condition that the established order incorporates robust incentives for all events, together with China, to keep away from catastrophe.

These tariffs, nonetheless, are far more difficult, as a result of they exist (for now in any case), whereas a conflict doesn’t. Apple, which has so adroitly balanced the connection with each the U.S. and Chinese language governments, is clearly probably the most impacted: you may quibble with the Wall Avenue Journal’s estimates on the tariff affect on an iPhone, however it definitely is directionally appropriate that Apple will in all probability face little alternative however to considerably increase costs. That has the direct downside of resulting in fewer gross sales (even when iPhone demand might be pretty inelastic), and the secondary downside of lowering the marketplace for Apple’s providers enterprise, its main supply of progress.

There’s an much more disappointing knock-on impact: Apple’s providers enterprise just isn’t topic to tariffs, which is to say it’s going to grow to be much more essential to Apple’s backside line; that decreases the chance that Apple transforms its relationship with builders, which I feel is its most promising alternative with AI.

The entire advertising-based companies — Meta, Google, and Amazon — will even be negatively impacted. Numerous low cost merchandise means plenty of promoting (and plenty of merchandise on Amazon particularly), a lot of which might disappear; might this imply a return of app set up promoting, if e-commerce promoting decreases, decreasing costs general? All three firms additionally supply {hardware} from China, each on the market to customers and for his or her information facilities. It’s Microsoft and its previous formulation of software program and distribution which may be probably the most shielded. After all it wants information heart {hardware} as properly, and dearer PCs means much less Home windows income, however the world of bits has by no means appeared extra enticing relative to atoms.

The issue for all of them, nonetheless, is similar downside confronted by the financial system typically: extra grist within the wheels of the financial system means decrease velocity, and decrease velocity is dangerous for tech firms specifically. These are entities who’re predicated on Aggregating unfathomable ranges of demand as a way to achieve leverage on huge up-front prices; now demand will gradual whilst the prices rise. Furthermore, their regulatory threat will seemingly enhance: a technique for entities like European international locations to retaliate shall be to easily ramp up the fines, or determine a method to tax software program providers, additional slowing velocity; the worst case situation could be a devoted effort to interrupt away from U.S. tech fully. I feel that is unlikely, however extra seemingly than it was per week in the past.

So what of my optimistic spin final November, after I referred to as my tariff preview A Likelihood to Construct? Properly, my skepticism is holding with the pessimism embedded in that piece: it’s loads simpler to construct from scratch than to retrofit one thing that exists; that applies to firms simply as a lot as international locations and financial orders. I’ll be cheering for the startups that seize this chance; I’m sympathetic to the incumbents assured prices with very unsure rewards.