Earlier this week, Donald Trump signed a ‘Proclamation’ imposing a further 25 per cent tariff on all passenger automobiles (sedans, SUVs, crossovers, minivans, cargo vans) and lightweight vehicles that haven’t been inbuilt america.

The 25 per cent tariff additionally applies to key vehicle elements (engines, transmissions, powertrain elements, and electrical parts). (Observe: this protection could also be prolonged in future.)

The tariff on vehicles will enter into power on 3 April 2025. The tariff on vehicle elements will enter into power no later than 3 Might 2025.

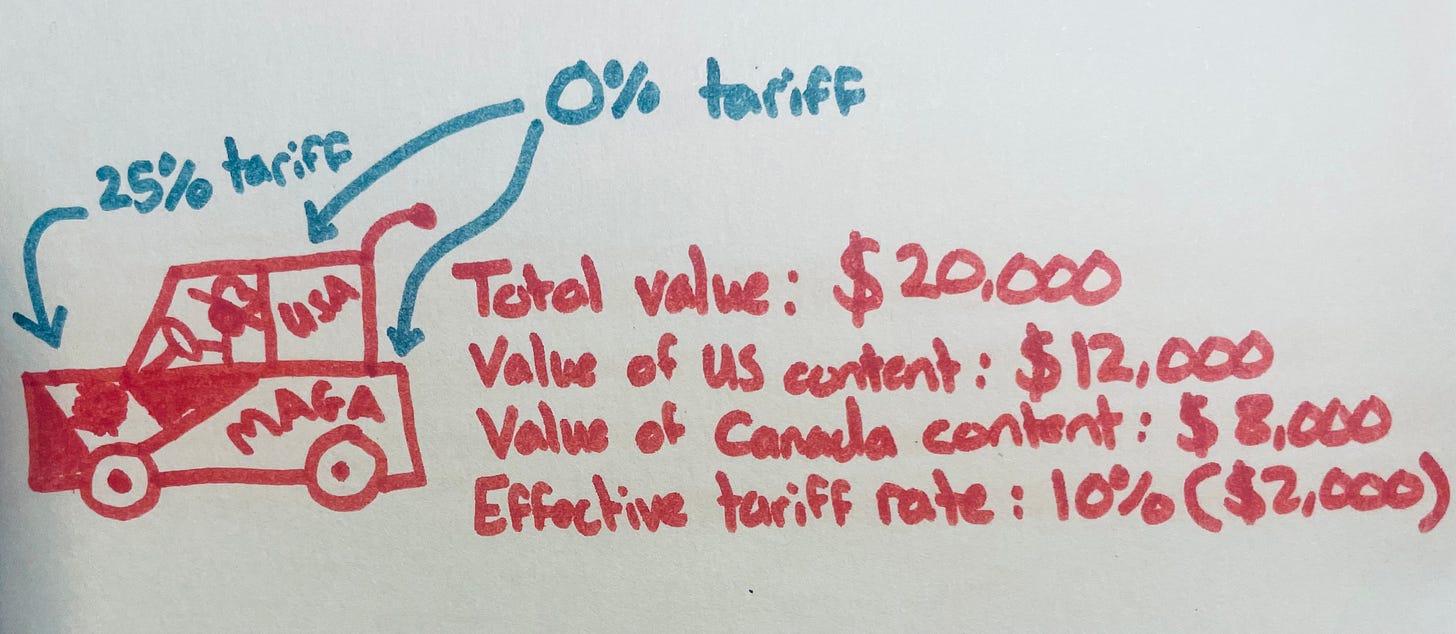

Nevertheless, whereas there aren’t any specific exemptions [as of yet] for automobiles exported to the US from Canada and Mexico, the tariff isn’t essentially 25 per cent.

It is because the proclamation stipulates that if an vehicle qualifies for preferential remedy below the US, Canada, Mexico free commerce settlement (USMCA), the tariff might solely apply to the non-US content material of the automobile.

That is all topic to the importer leaping by some administrative hoops and shall be calculated by subtracting the worth of the US content material in an vehicle from the whole worth of the auto.

The impression? Carmakers with a big North American footprint will face differential charges when exporting closing automobiles into the US from Mexico/Canada.

For instance, if we assume {that a} automotive imported from Mexico/Canada below USMCA has 40 per cent non-US content material, below the brand new protocol the efficient tariff fee on the entire automobile can be 10 per cent.

If, below an identical state of affairs, the automobile has 50 per cent non-US content material, the efficient tariff fee on the entire automobile can be 12.5 per cent. And so on.

In infographic type [note: thank you to those on Bluesky who critiqued an earlier version of this masterpiece]:

If this broad method sounds eerily acquainted, that’s as a result of it’s.

A few weeks in the past, I wrote about how the US is making use of tariffs to the metal and aluminium content material of downstream merchandise, comparable to sports activities tools.

… it seems that the 25 per cent tariff can, in some situations, apply completely to the metal/aluminium content material of a product reasonably than the product’s whole worth.

See this US Customs and Border Safety Steerage (emphasis added):

Reporting Directions for Duties Primarily based on Metal Content material

For brand spanking new metal derivatives exterior of Chapter 73, the 25 % responsibility is to be reported with HTS 9903.81.91 primarily based upon the worth of the metal content material.

If the worth of the metal content material is identical because the entered worth or is unknown, the responsibility have to be reported below HTS 9903.81.91 primarily based on your complete entered worth, and report on just one entry abstract line.

If the worth of the metal content material is lower than the entered worth of the imported article, the great have to be reported on two traces. The primary line will signify the non-steel content material, whereas the second line will signify the metal content material.

Because of this if the price of your imported spinoff product is $100, however the metal content material is just valued at $25, the last word tariff can be 25% of $25 reasonably than 25% of $100. Assuming you will be bothered to do all of the paperwork that’s.

I then wrote [emphasis added], which, in any case this, appears to be like more and more believable:

Anyhow, this method makes me marvel if we’d see one thing comparable elsewhere.

For instance, what if you happen to had been tariffed primarily based on the Chinese language worth of your imported product?

For instance, a European EV battery would usually be topic to a 3.4% US tariff. However what if the European EV battery’s China-originating cells (topic to a 25% tariff), account for 70% of the worth?

Assuming the battery prices $1000, you could possibly think about a scenario by which the US began asking importers to pay a 3.4% tariff on the EU worth and a 25% tariff on the China content material. [Assuming the alternative is to pay the full China tariff.]

This could end in a complete tariff value of ($300*0.034)+($700*0.25)] $185.2 reasonably than [$1000*0.034] $34.

It will even be MASSIVELY sophisticated and dear for companies. This makes me suppose it’s precisely the kind of factor this US administration may attempt to do.

Whoops.

Anyhow, one closing level:

The proclamation confirms that these tariffs are along with present tariffs and duties. Just about the entire Trump interventions up to now have stipulated this, however for some purpose it goes largely unremarked on.

This implies, for instance, that the precise tariff utilized to gentle vehicles imported from, say, the EU can be 50 per cent — the prevailing 25 per cent rooster tax plus the brand new 25 per cent tariff.

This additionally means that you would be able to play a enjoyable recreation referred to as “let’s add up all of the tariffs to get a extremely massive quantity”.

For instance, Chinese language electrical automobiles already face an MFN tariff of two.5 per cent, a Biden-era extra 100 per cent tariff, the brand new China-specific 20 per cent tariff, the chance of a brand new Venezuela-related secondary 25 per cent tariff (extra beneath), and now the brand new 25 per cent auto tariff. If my calculator is serving me appropriately, this implies a possible whole tariff of 172.5 per cent.

In meme type:

One of many commonplace Trump assumptions has been that he’ll threaten nations with tariffs if these nations don’t assist him in his worldwide endevours.

For instance, I wrote this for FT Alphaville final November:

I assume the dialog with numerous nations, together with these scoring beneath 0 on the MAGA index, will go one thing like this: “In addition to shopping for extra stuff from us, if you wish to keep away from the common tariff you’ll want to impose excessive tariffs on Chinese language imports”.

It will create a dilemma for the UK, EU and others. Assuming that China would retaliate to any blanket tariffs, nations will compelled to decide on between the US blanket tariff and the Chinese language retaliatory tariffs. In observe it in all probability received’t be fairly so binary, and nations might attempt to placate Trump with commitments to impose tariffs they had been contemplating anyway.

For instance, the EU has already imposed anti-subsidy tariffs on Chinese language electrical automobiles, in addition to numerous commerce defence tariffs masking merchandise comparable to metal, bikes, graphite, biodiesel and others, so might attempt to placate him by initiating new investigations into merchandise comparable to EV batteries, photo voltaic, and wind generators.

Effectively, it seems that this was the truth is the vanilla model and actually Trump can be “fairly so binary”.

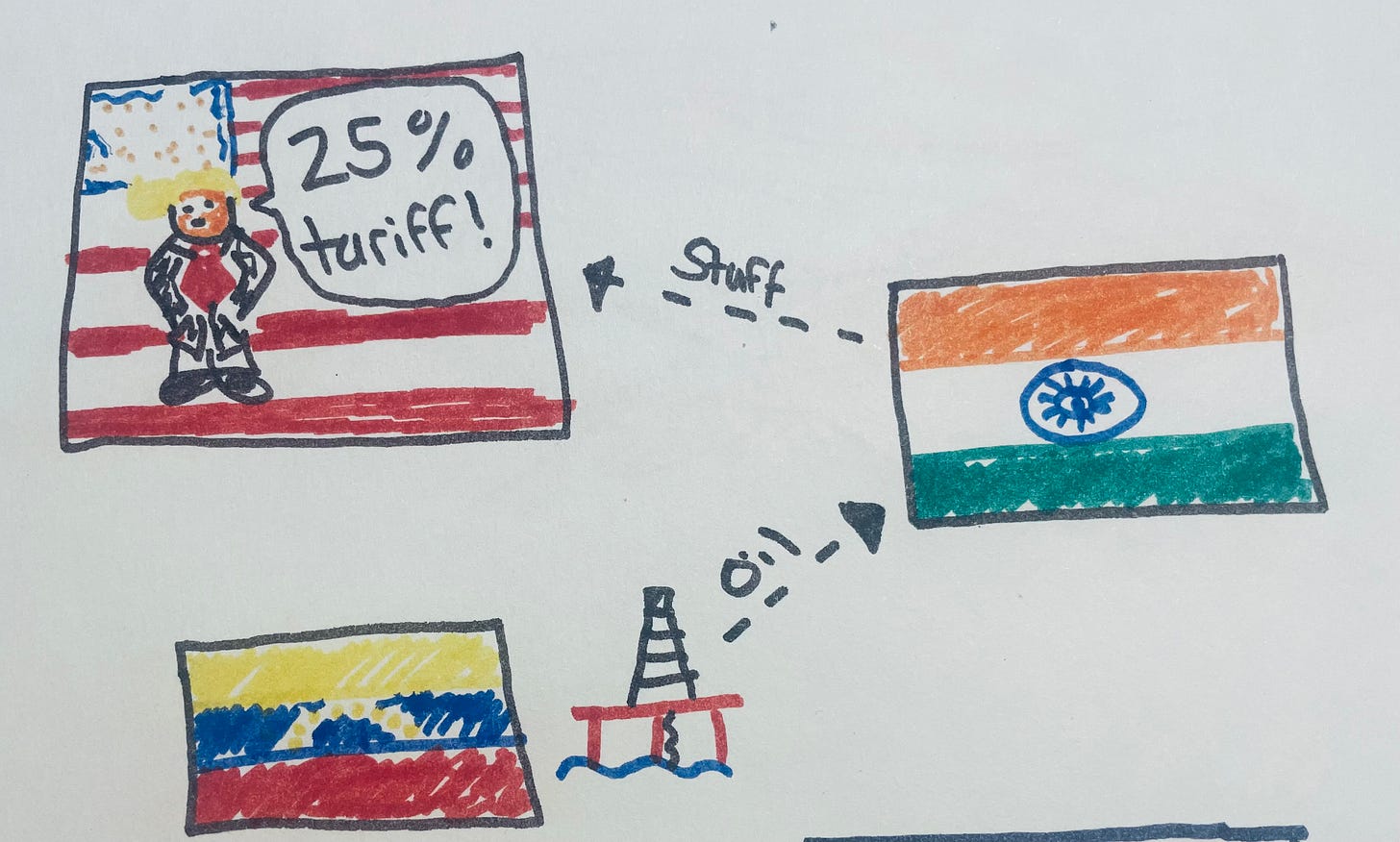

By which I imply he has signed an govt order granting the US Secretary of State the facility to impose a 25 per cent tariff on any nation that imports oil from Venezuela.

In Infographic type:

And … on the idea you actually need to destroy one other nation’s economic system by coercive means … it’s kinda intelligent?

However the place does it finish?

A 25 per cent tariff if you happen to proceed to purchase Chinese language Electrical Automobiles?

A 25 per cent tariff if you happen to proceed to purchase French cheese?

A 25 per cent tariff if you happen to proceed to purchase Greenlandic fish?

A 25 per cent tariff if you happen to proceed to purchase Taiwanese semiconductors?

Hmmm.

Oh, Trump’s additionally mentioned he’s going to use extra tariffs to imported Canadian lumber and lumber derivatives for nationwide safety causes. I believe it’s because he’s afraid of Mark Carney’s … struggle cupboard.

Have day!

Sam