There’s a new breed of monetary investor – or dis-investor, maybe – that targets publicly traded firms with allegedly incriminating stories, whereas taking brief vendor positions on the corporate.

This new breed of short-seller funding agency is nearly at all times an nameless group with out recognized ties to funds or traders.

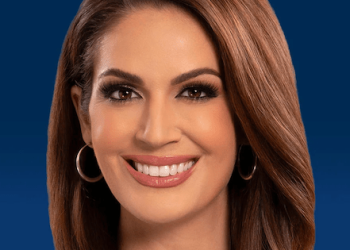

Upright Analytics is exclusive within the area, although. Proprietor and standout brief vendor Lauren Balik is an precise one that places her title behind her assertions.

Most of those different short-seller companies, comparable to Culper or an on-line account that goes by “The Buddha,” are fronts for hedge funds, Balik mentioned.

Whether or not they work in the dead of night of night time or the sunshine of day, these brief sellers are focusing on the identical factor.

“I’m at all times in search of when the narrative goes to crumble,” Balik instructed AdExchanger. “Every time the narrative falls aside, or can crumble, is the place I’m trying to strike.”

Tech firms usually obtain very gentle scrutiny relating to their backside line and in-the-weeds financials, in the event that they show progress. “This isn’t like Kraft Heinz,” she mentioned. These massive firms undergo the wringer with monetary opinions.

The short-seller area

Hedge funds are keen on shadowy content material and analysis companies as a result of they could be a approach to get data on firms. These short-seller accounts or companies infiltrate closed engineering and entrepreneurs’ boards on-line to find nonpublic data about SaaS pricing modifications, worker numbers and every other element they’ll a couple of potential brief sale or funding.

For Balik, any report or brief place with Upright she’s written has come from her personal cash and analysis, though she has finished consulting and analysis work for hedge funds.

Regardless, the development of short-seller funds with hybrid media and content material arms has not been variety to advert tech and mar tech.

In 2017, Gotham Metropolis Analysis leveled tough allegations towards Criteo, claiming greater than half of its impressions went to bots and faux or low-quality websites, in addition to the advert company conglomerate MDC Companions. Final week, one other short-seller agency, known as Culper Analysis, revealed a scathing report on Zeta International. That adopted a collection of stories by Balik concerning her personal brief place on Zeta starting final month.

“I’m at all times taking a look at issues within the digital cost area and advert tech area,” Balik mentioned.

And the timing of those short-seller strikes just isn’t coincidental.

When Criteo got here underneath hearth, it was in late 2017, about six months earlier than GDPR enforcement started in Could 2018.

The Zeta shorts are additionally being timed for subsequent February, when Zeta should reconcile its revenues by breaking out its political revenue. This was an order by the SEC as a consequence of Zeta’s earlier lumpy income progress round political elections.

One among Balik’s key rationales for shorting Zeta is that it has misrepresented progress this 12 months. Somewhat than report political and advocacy income, because it has beforehand categorized income, Zeta this 12 months has been reporting solely political candidate spend, which doesn’t rely the tremendous PACs, advocacy teams, partiers themselves and different massive spenders.

Balik and others have timed their activist brief positions for subsequent February, after they imagine traders will decrease expectations, if greater than they count on of Zeta’s income this 12 months truly disappears with the election cycle.

What’s subsequent for Upright?

Solely about one in 10 of Balik’s brief positions ever flip into full-fledged stories, she mentioned.

“By the point I’m writing about it, I’m already in deep,” she mentioned.

However which means there’s at all times extra to brief. Particularly since Balik is ready to pounce on some anticipated IPOs.

Klarna, the Swedish buy-now-pay-later firm, is poised to IPO – and to attract a short-seller marketing campaign. Balik mentioned Klarna is “a complete rip-off” and “a very tousled firm.”

The market and different extra standard fairness analysts appear excessive on AppLovin proper now, she mentioned. “I feel that’s a bunch of baloney. We’ll see what occurs with them.”

Being a bit shady or overhyped might not be sufficient to attract Balik into a brief sale. There additionally should be a possibility to knock main market cap off the enterprise, thus profiting considerably from the brief sale, which earns extra the additional an organization drops. She earnings on 75% of her brief positions, she mentioned.

“I guess particularly on firms actually taking it,” she mentioned, as in taking a beating.

“That’s the place my differentiator is.”

There’s a new breed of monetary investor – or dis-investor, maybe – that targets publicly traded firms with allegedly incriminating stories, whereas taking brief vendor positions on the corporate.

This new breed of short-seller funding agency is nearly at all times an nameless group with out recognized ties to funds or traders.

Upright Analytics is exclusive within the area, although. Proprietor and standout brief vendor Lauren Balik is an precise one that places her title behind her assertions.

Most of those different short-seller companies, comparable to Culper or an on-line account that goes by “The Buddha,” are fronts for hedge funds, Balik mentioned.

Whether or not they work in the dead of night of night time or the sunshine of day, these brief sellers are focusing on the identical factor.

“I’m at all times in search of when the narrative goes to crumble,” Balik instructed AdExchanger. “Every time the narrative falls aside, or can crumble, is the place I’m trying to strike.”

Tech firms usually obtain very gentle scrutiny relating to their backside line and in-the-weeds financials, in the event that they show progress. “This isn’t like Kraft Heinz,” she mentioned. These massive firms undergo the wringer with monetary opinions.

The short-seller area

Hedge funds are keen on shadowy content material and analysis companies as a result of they could be a approach to get data on firms. These short-seller accounts or companies infiltrate closed engineering and entrepreneurs’ boards on-line to find nonpublic data about SaaS pricing modifications, worker numbers and every other element they’ll a couple of potential brief sale or funding.

For Balik, any report or brief place with Upright she’s written has come from her personal cash and analysis, though she has finished consulting and analysis work for hedge funds.

Regardless, the development of short-seller funds with hybrid media and content material arms has not been variety to advert tech and mar tech.

In 2017, Gotham Metropolis Analysis leveled tough allegations towards Criteo, claiming greater than half of its impressions went to bots and faux or low-quality websites, in addition to the advert company conglomerate MDC Companions. Final week, one other short-seller agency, known as Culper Analysis, revealed a scathing report on Zeta International. That adopted a collection of stories by Balik concerning her personal brief place on Zeta starting final month.

“I’m at all times taking a look at issues within the digital cost area and advert tech area,” Balik mentioned.

And the timing of those short-seller strikes just isn’t coincidental.

When Criteo got here underneath hearth, it was in late 2017, about six months earlier than GDPR enforcement started in Could 2018.

The Zeta shorts are additionally being timed for subsequent February, when Zeta should reconcile its revenues by breaking out its political revenue. This was an order by the SEC as a consequence of Zeta’s earlier lumpy income progress round political elections.

One among Balik’s key rationales for shorting Zeta is that it has misrepresented progress this 12 months. Somewhat than report political and advocacy income, because it has beforehand categorized income, Zeta this 12 months has been reporting solely political candidate spend, which doesn’t rely the tremendous PACs, advocacy teams, partiers themselves and different massive spenders.

Balik and others have timed their activist brief positions for subsequent February, after they imagine traders will decrease expectations, if greater than they count on of Zeta’s income this 12 months truly disappears with the election cycle.

What’s subsequent for Upright?

Solely about one in 10 of Balik’s brief positions ever flip into full-fledged stories, she mentioned.

“By the point I’m writing about it, I’m already in deep,” she mentioned.

However which means there’s at all times extra to brief. Particularly since Balik is ready to pounce on some anticipated IPOs.

Klarna, the Swedish buy-now-pay-later firm, is poised to IPO – and to attract a short-seller marketing campaign. Balik mentioned Klarna is “a complete rip-off” and “a very tousled firm.”

The market and different extra standard fairness analysts appear excessive on AppLovin proper now, she mentioned. “I feel that’s a bunch of baloney. We’ll see what occurs with them.”

Being a bit shady or overhyped might not be sufficient to attract Balik into a brief sale. There additionally should be a possibility to knock main market cap off the enterprise, thus profiting considerably from the brief sale, which earns extra the additional an organization drops. She earnings on 75% of her brief positions, she mentioned.

“I guess particularly on firms actually taking it,” she mentioned, as in taking a beating.

“That’s the place my differentiator is.”