Apologies for sending this e-mail on the absolute worst time to e-mail anybody (Friday night), however I’ve been somewhat busy …

Earlier this week, however what looks like a lifetime in the past, Trump pulled the set off on new metal and aluminium tariffs.

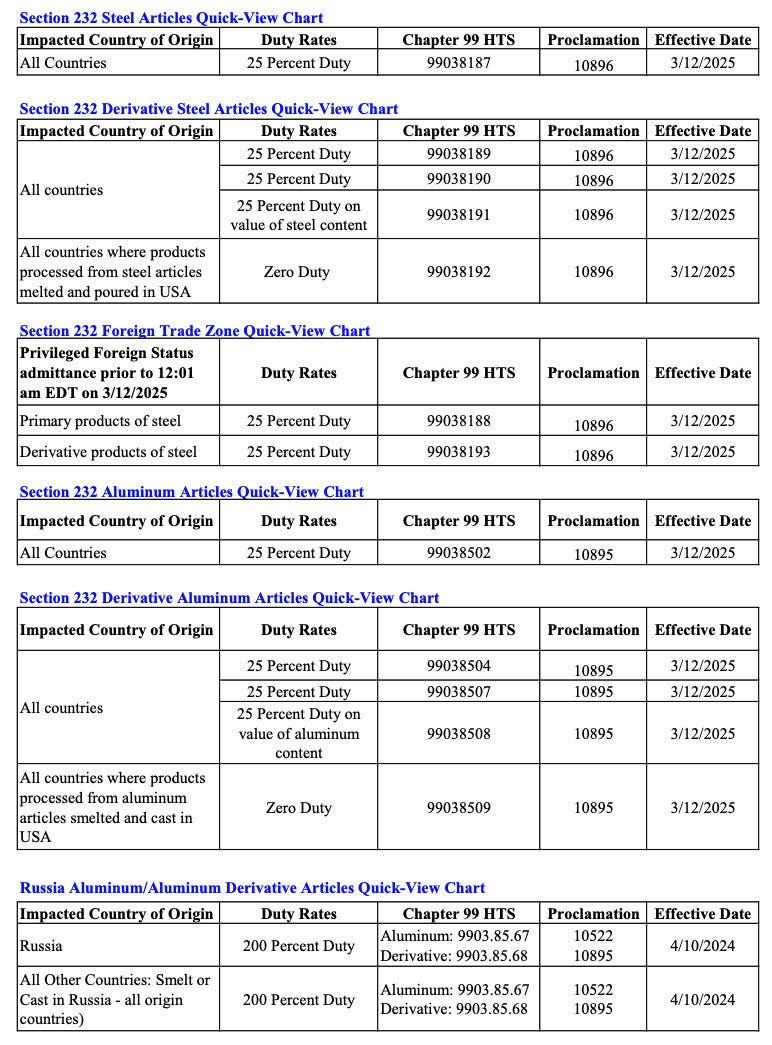

In abstract (thanks, EU explainer) …

The US measures applied on 12 March include three key parts:

Reinstating the June 2018 part 232 tariffs on metal and aluminium merchandise. These coated several types of semifinished and completed merchandise, resembling metal pipes, wire and tin foil.

Growing the tariffs imposed on aluminium from the unique 10% to 25%.

Extending the tariffs to different merchandise, notably:

Metal and aluminium merchandise, resembling family merchandise like cooking ware or window frames.

Merchandise which might be solely partly manufactured from metal or aluminium, resembling equipment, gymnasium gear, sure electrical home equipment or furnishings.

As well as, the US Secretary of Commerce will set up by 12 Might 2025 a system whereby the US will proceed to increase the listing of metal and aluminium derivatives merchandise topic to extra duties of as much as 25%.

The varied tariffs are neatly summarised on this desk:

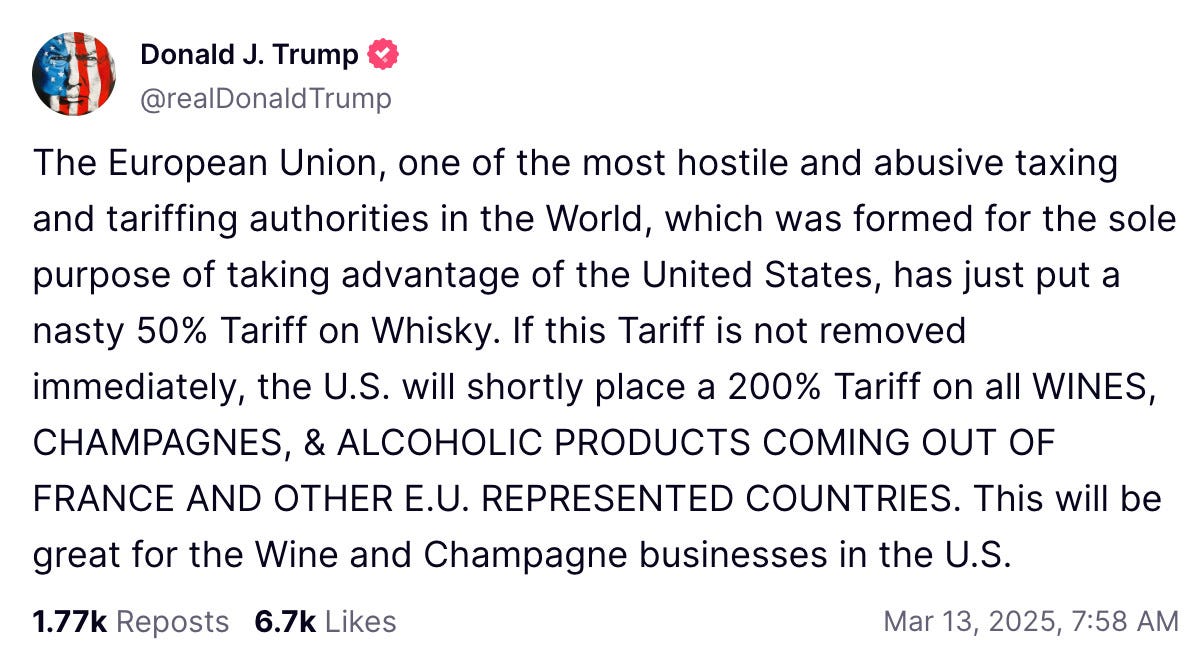

Clearly the media focus rapidly moved onto the EU’s introduced retaliation after which this Reality Social submit by the poster-in-chief:

Nonetheless, I need to discuss concerning the authentic measures , notably the extension of the metal/aluminium tariffs to downstream spinoff merchandise resembling, for instance, baseball bats.

As a result of it seems that the 25 per cent tariff can, in some situations, apply completely to the metal/aluminium content material of a product somewhat than the product’s whole worth.

See this US Customs and Border Safety Steerage (emphasis added):

Reporting Directions for Duties Primarily based on Metal Content material

For brand spanking new metal derivatives outdoors of Chapter 73, the 25 % responsibility is to be reported with HTS 9903.81.91 based mostly upon the worth of the metal content material.

If the worth of the metal content material is identical because the entered worth or is unknown, the responsibility should be reported beneath HTS 9903.81.91 based mostly on the whole entered worth, and report on just one entry abstract line.

If the worth of the metal content material is lower than the entered worth of the imported article, the great should be reported on two strains. The primary line will characterize the non-steel content material, whereas the second line will characterize the metal content material.

Because of this if the price of your imported spinoff product is $100, however the metal content material is just valued at $25, the last word tariff could be 25% of $25 somewhat than 25% of $100. Assuming you may be bothered to do all of the paperwork that’s.

Anyhow, this method makes me surprise if we’d see one thing related elsewhere.

For instance, what when you have been tariffed based mostly on the Chinese language worth of your imported product?

For instance, a European EV battery would usually be topic to a 3.4% US tariff. However what if the European EV battery’s China-originating cells (topic to a 25% tariff), account for 70% of the worth?

Assuming the battery prices $1000, you would think about a scenario during which the US began asking importers to pay a 3.4% tariff on the EU worth and a 25% tariff on the China content material. [Assuming the alternative is to pay the full China tariff.]

This may end in a complete tariff value of ($300*0.034)+($700*0.25)] $185.2 somewhat than [$1000*0.034] $34.

It will even be MASSIVELY sophisticated and dear for corporations. This makes me suppose it’s precisely the kind of factor this US administration would possibly attempt to do.

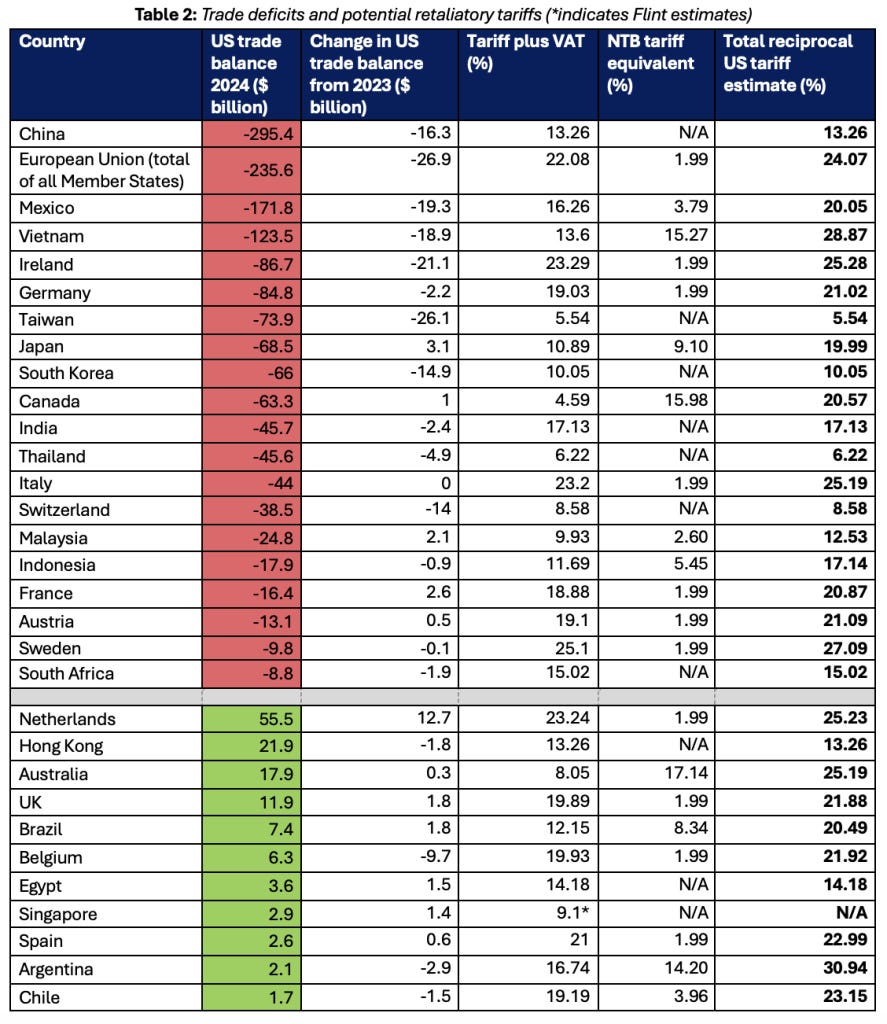

My wonderful Flint colleagues have produced some evaluation taking a look at which international locations are most uncovered to Trump’s obsession with reciprocity and produced some differential US tariff estimates to go together with it.

Test it out HERE.

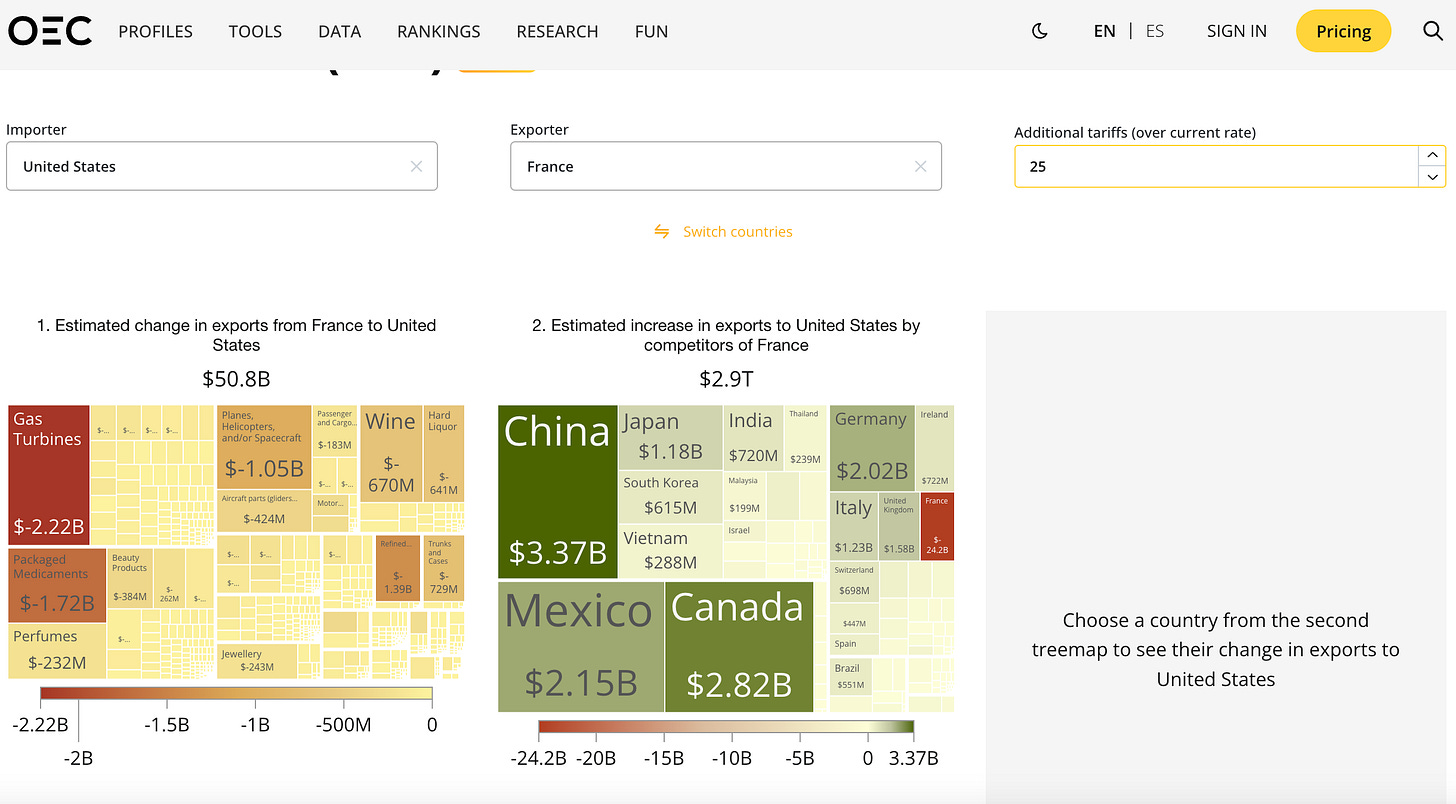

The OEC has a enjoyable/terrifying new software, which lets you estimate the influence of bilateral tariff will increase on a rustic’s commerce with one other nation. No thought why they’ve made this now. [/s]

Right here, for instance, is what occurs if the US applies a further 25% tariff on France:

For these of you hoping the US Congress would possibly step in to curb a few of Trump’s tariff disruption, sorry.

Former US ITC nominee Haile Craig has a really helpful submit on LinkedIn explaining how/why Congress simply voted to restrict its powers over Trump’s commerce coverage.

At this time the Home voted 216-214 to vary its guidelines and switch off expedited procedures for disapproving President Trump’s tariffs on Canada, Mexico, and China. This tremendously reduces the possibilities that the Home will maintain a ground vote to nullify any of these tariffs.

For the commerce and process nerds, here is the way it works:

Present regulation permits Congress to vote to disapprove (i.e., terminate) a nationwide emergency declared by a President utilizing “privileged” procedures within the Home and Senate. Such disapproval resolutions can be found to Congress each six months in the course of an emergency. After a disapproval decision is launched, it usually should be discharged from committee inside 15 days and obtain a ground vote inside 3 days thereafter. See 50 U.S.C. 1622.

A giant caveat is that … [Continue reading HERE]

Greatest,

Sam